Crypto Trading: What It Is, How It Works, and What You Need to Know

When you trade crypto trading, the act of buying and selling digital currencies to profit from price movements, often using decentralized or centralized platforms. Also known as digital asset trading, it’s not just about watching charts—it’s about understanding where the market moves, who controls it, and how to protect your money.

Most people start crypto trading because they see quick gains, but the real challenge is staying safe. cryptocurrency exchanges, platforms where you buy, sell, or swap digital assets, often with varying levels of security and regulation. Also known as crypto platforms, they range from giants like CoinDCX to risky no-KYC sites that vanish overnight. India banned unregistered ones like Binance and KuCoin. FTX Turkey collapsed because it operated without a license. And platforms like MochiSwap or Libre Swap? They have no team, no audits, and almost no trading volume. If you’re trading, you’re trusting someone else with your funds—and not all of them have your back.

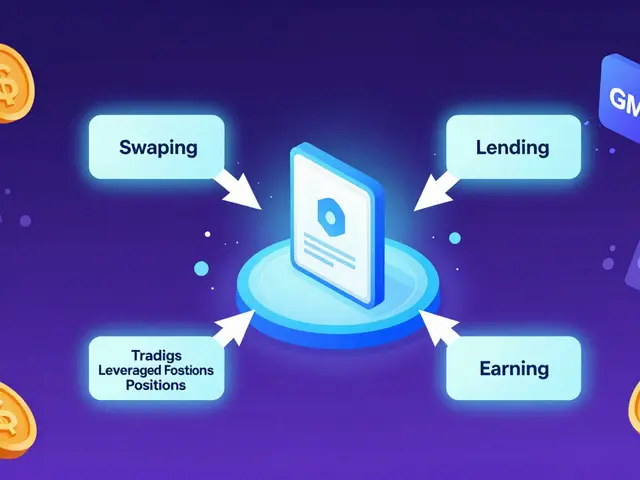

DeFi, a system of financial tools built on blockchain that removes banks and middlemen, letting users lend, borrow, and trade directly. Also known as decentralized finance, it’s where things get powerful—and dangerous. Think THORChain letting you swap BTC for ETH without wrapping, or Venus BNB earning interest when you deposit BNB. But DeFi isn’t magic. Cross-chain bridges get hacked. Governance tokens like AERO or RUNE look valuable but are often controlled by a few whales. And airdrops? Most are scams. KCAKE? Doesn’t exist. CELT? Never had a public drop. You can’t trust hype—you need to check who’s behind it, what the contract says, and if anyone’s actually using it.

Security isn’t optional. North Korea stole over $3 billion in crypto to fund weapons. Blockchain can speed up insurance claims, but it also makes theft traceable—so if you lose your keys, you lose everything. Tax rules are clear: avoiding taxes legally is smart. Evading them is a felony. And if you’re using leverage, you’re playing with fire. One bad trade can wipe you out.

What you’ll find here isn’t guesswork. It’s real cases: why Arbidex failed, how UAE’s regulatory shift opened doors, what happens when a token like LifeTime vanishes overnight, and how blockchain is changing supply chains—not just prices. These aren’t theory pieces. They’re post-mortems, checklists, and warnings from people who’ve seen it go wrong. Whether you’re trading on Base Chain, checking airdrop eligibility, or trying to avoid a rug pull, the answers are here—no fluff, no hype, just what you need to know before you click buy.

How to Use a Decentralized Exchange: A Simple Step-by-Step Guide

Learn how to use a decentralized exchange like Uniswap with MetaMask. Step-by-step guide on swapping crypto, avoiding gas fee traps, and staying safe without a middleman.

NeutroSwap Crypto Exchange Review: What You Need to Know Before Trading NEUTRO

NeutroSwap is a decentralized exchange built solely for trading NEUTRO tokens. No fiat, no app, no support-just a low-liquidity DEX with no audit. Only for experienced users willing to take big risks.

Biswap v2 Crypto Exchange Review: Fees, Features, and Real Performance in 2025

Biswap v2 is a low-fee decentralized exchange on BNB Chain offering swaps, staking, yield farming, and 100x leverage. With a deflationary BSW token and no KYC, it's ideal for experienced DeFi users seeking high rewards - but carries significant risk.

Alien Base v3 Crypto Exchange Review: Is It Worth Using on Base Chain?

Alien Base v3 is a Base Chain DEX with a clean interface and ALB token farming, but low liquidity makes it risky for large trades. Best for small-scale DeFi users, not serious traders.

Uniswap v2 on Base: A Simple, Reliable Crypto Exchange for Everyday Traders

Uniswap v2 on Base offers a simple, low-cost way to trade crypto without intermediaries. With low fees, wide token support, and no KYC, it’s ideal for self-custody traders - but requires crypto knowledge and carries risks.

Categories

Popular Articles