There’s no shortage of crypto exchanges out there, but when you hear about NeutroSwap, you might wonder: is this just another obscure token project, or is there something real behind it? The truth is, NeutroSwap isn’t a full-service exchange like Binance or Coinbase. It’s a decentralized exchange built around one token: NEUTRO. If you’re looking to trade NEUTRO, this is where you’ll likely do it. But if you’re expecting a wide range of coins, low fees, or customer support, you’re going to be disappointed.

What Exactly Is NeutroSwap?

NeutroSwap is a decentralized exchange (DEX) built on the Binance Smart Chain. It’s not a company with offices, a support team, or a mobile app. It’s code. Specifically, it’s a smart contract that lets users swap NEUTRO tokens for BNB, BUSD, or other tokens listed on the platform. There’s no sign-up, no KYC, no password recovery. You connect your wallet-MetaMask, Trust Wallet, or something similar-and trade directly.The only thing NeutroSwap is known for is being the most popular place to trade NEUTRO. CoinGecko lists it as the top DEX for this token. That’s it. No trading pairs beyond a handful of stablecoins and BNB. No margin trading. No staking. No NFT marketplace. Just swaps.

How Does Trading on NeutroSwap Work?

If you’ve used Uniswap or PancakeSwap before, you already know how this works. Here’s the step-by-step:- Open your crypto wallet (MetaMask is the most common).

- Make sure you have BNB in your wallet to pay for gas fees.

- Go to the NeutroSwap website-make sure it’s the real one. Scams are common with small DEXs.

- Connect your wallet by clicking the ‘Connect Wallet’ button.

- Select NEUTRO as the token you want to trade and pick what you want to swap it for (usually BNB or BUSD).

- Set your slippage tolerance. Because NEUTRO has low liquidity, you might need to set it to 8-12% to avoid failed trades.

- Click ‘Swap’ and confirm the transaction in your wallet.

That’s it. No waiting. No approvals. No middleman. But here’s the catch: because NeutroSwap is a small DEX, liquidity is thin. You might find that trading more than a few hundred dollars’ worth of NEUTRO causes big price swings. A $500 trade could move the price 10% in one direction. That’s not a bug-it’s a feature of low-liquidity tokens.

Is NeutroSwap Safe?

Safety on a DEX like this comes down to two things: the smart contract and your own actions.There’s no public audit report for NeutroSwap’s smart contract. No CertiK, no Hacken, no PeckShield. That’s a red flag. If you’re trading large amounts, you’re essentially trusting code that no independent security firm has checked. There have been no public reports of exploits or hacks so far, but absence of evidence isn’t evidence of absence.

Second, you’re responsible for everything. If you send NEUTRO to the wrong address, it’s gone forever. If you visit a fake NeutroSwap site (and there are many), your wallet could be drained. Always double-check the URL. Bookmark the real site. Never click links from Twitter or Telegram.

What Are the Fees?

NeutroSwap charges a 0.3% trading fee on every swap. That’s standard for most DEXs. But here’s what most people forget: you also pay gas fees on Binance Smart Chain. Those can range from $0.10 to $2 per transaction, depending on network congestion.Unlike centralized exchanges, there’s no fee schedule with tiers. No VIP discounts. No fee waivers. You pay the same whether you trade $10 or $10,000. And if your trade fails because of slippage, you still pay the gas fee. No refunds.

What Tokens Can You Trade?

Don’t expect variety. NeutroSwap supports a handful of tokens:- NEUTRO (the native token)

- BNB (Binance Coin)

- BUSD (Binance USD)

- WBNB (Wrapped BNB)

- Maybe one or two other tokens added by liquidity providers

That’s it. No Bitcoin. No Ethereum. No Solana. No altcoins with real market cap. If you want to trade anything besides NEUTRO and BNB/BUSD, you’ll need to use another exchange first, then bring it over to NeutroSwap.

Who Is This For?

NeutroSwap isn’t for beginners. It’s not for people who want to buy crypto with a credit card. It’s not for those who need help when something goes wrong.This is for experienced DeFi users who:

- Own NEUTRO tokens and want to trade them quickly

- Understand how wallets and gas fees work

- Know how to check contract addresses and verify websites

- Are comfortable with high slippage and price volatility

If you’re new to crypto, stick with Coinbase or Kraken. If you’re holding NEUTRO and want to cash out, NeutroSwap might be your only option-but proceed with caution.

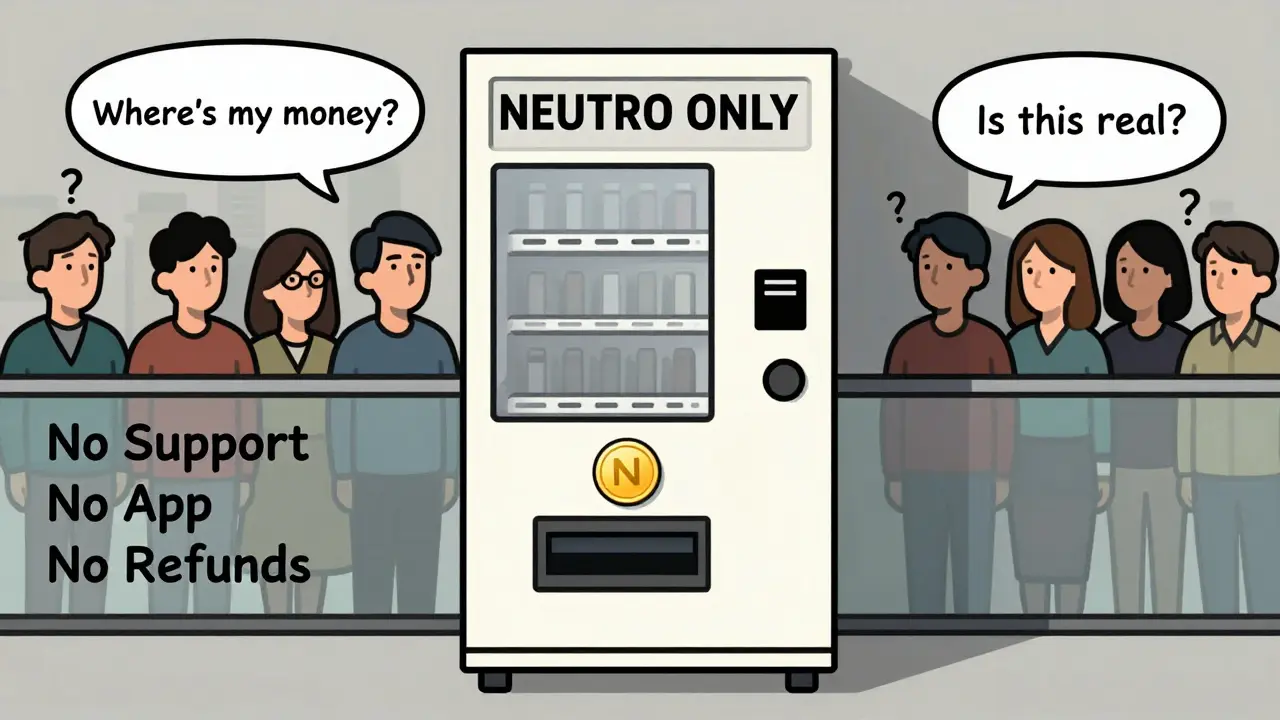

What’s Missing?

For a platform that’s labeled an ‘exchange,’ NeutroSwap leaves out almost everything you’d expect:- No mobile app

- No customer support email or chat

- No educational resources

- No fiat on-ramps

- No staking or yield farming

- No API for traders

- No historical price charts beyond basic DEX tools

It’s not a full exchange. It’s a token swap tool. Think of it like a vending machine for NEUTRO. You can buy one, you can sell one, but you can’t ask for help if it jams.

How Does It Compare to Other DEXs?

| Feature | NeutroSwap | PancakeSwap | Uniswap | |--------|------------|-------------|---------| | Supported Tokens | 5-10 | 10,000+ | 10,000+ | | Liquidity | Very Low | High | Very High | | Gas Fees | BSC (low) | BSC (low) | Ethereum (high) | | Audits | None | Yes | Yes | | Mobile App | No | Yes | Yes | | Customer Support | None | Limited | None | | Fiat On-Ramp | No | No | No | | Best For | NEUTRO traders | General BSC trading | General ETH trading |PancakeSwap and Uniswap are far more mature. They have audits, higher liquidity, and more tools. But if your only goal is trading NEUTRO, NeutroSwap is the only place that lets you do it directly.

Final Verdict

NeutroSwap isn’t a crypto exchange in the traditional sense. It’s a narrow, unregulated, low-liquidity DEX built for one purpose: trading NEUTRO tokens. If you’re holding NEUTRO and need to swap it for BNB or BUSD, you’ll likely have to use it. But don’t expect anything else.There’s no safety net. No backup plan. No customer service. Just code. And if that code fails, or if you get phished, there’s no one to call.

Use NeutroSwap only if you fully understand the risks. Trade small amounts. Double-check everything. And never invest more than you’re willing to lose.

Is NeutroSwap a scam?

NeutroSwap isn’t officially labeled a scam, but it has all the warning signs of a high-risk project. There’s no public audit, no team behind it, no customer support, and no track record. It’s a DEX built around a single token with little liquidity. Many small DEXs like this are abandoned after the initial hype fades. Treat it like a gamble, not an investment.

Can I buy NEUTRO with USD on NeutroSwap?

No. NeutroSwap only accepts crypto tokens like BNB and BUSD. To buy NEUTRO, you first need to purchase BNB or BUSD on a centralized exchange like Coinbase or Kraken, then transfer it to your wallet and connect to NeutroSwap. There’s no direct fiat on-ramp.

Is NeutroSwap available on mobile?

No, NeutroSwap has no official mobile app. You can access it through your phone’s browser using MetaMask or Trust Wallet, but the experience is clunky and risky. There’s no official app to download from the App Store or Google Play. Any app claiming to be NeutroSwap is fake.

What’s the trading volume on NeutroSwap?

NeutroSwap’s daily trading volume is typically under $100,000, often much less. For comparison, PancakeSwap does over $100 million daily. Low volume means large price swings on small trades and difficulty exiting positions without slippage. It’s not a liquid market.

Can I stake NEUTRO on NeutroSwap?

No, NeutroSwap does not offer staking, liquidity pools, or yield farming. It’s purely a token swap platform. If you see anyone promoting staking rewards for NEUTRO on NeutroSwap, it’s a scam. The only way to earn from NEUTRO is by trading it or holding it in hopes of price appreciation.

Comments (10)

- Rajappa Manohar

- December 29, 2025 AT 17:24 PM

NeutroSwap? More like NeutroScam. Just connect your wallet and pray. No audits, no support, just a smart contract and a dream.

- prashant choudhari

- December 30, 2025 AT 07:16 AM

Low liquidity means you’re trading with ghosts. One big sell and your NEUTRO turns into digital confetti. Stay small or stay away.

- Daniel Verreault

- December 31, 2025 AT 04:04 AM

Bro this is peak DeFi chaos. You got zero safety net but the slippage? Oh man you gotta crank it to 12% or your tx just vanishes like my last paycheck. And don’t even get me started on the fake sites - I saw one that looked legit with a .io domain and everything. My wallet nearly got drained. Always verify the contract address. Always. Trust no one. Not even your own eyes.

- Antonio Snoddy

- December 31, 2025 AT 22:03 PM

NeutroSwap is the digital equivalent of a back-alley poker game where everyone’s bluffing and the dealer’s a ghost. You think you’re trading tokens but really you’re just feeding entropy. The smart contract doesn’t care if you’re rich or broke - it just executes. No mercy. No second chances. And yet… here we are. Drawn in by the siren song of decentralization. We don’t need banks. We don’t need trust. We just need gas and a prayer. Is that freedom? Or just beautifully packaged nihilism? I’ve lost more on this than I’ve made - but I still check the chart every morning. There’s something hypnotic about watching value evaporate in real time.

- Jacky Baltes

- January 2, 2026 AT 02:48 AM

There’s a quiet dignity in simplicity. NeutroSwap doesn’t pretend to be more than it is. No bells. No whistles. No false promises. It’s a tool. A very dangerous tool, yes - but tools aren’t evil. People misuse them. The real question isn’t whether NeutroSwap is safe. It’s whether we, as users, are responsible enough to use it. We demand audits and support because we’ve been conditioned to outsource our risk. But in DeFi, the only audit that matters is the one you run in your head before you click confirm.

- Gavin Hill

- January 3, 2026 AT 02:08 AM

Low volume means low risk right? I mean if nobody’s trading it how bad can it be? I put in 50 bucks and the price moved 30% in 2 minutes. That’s not volatility that’s a magic trick. I think I just invented a new crypto term: ghost liquidity

- SUMIT RAI

- January 3, 2026 AT 06:10 AM

NeutroSwap is literally a vending machine for a token that doesn’t exist outside of this one site 😂💀

- Abhisekh Chakraborty

- January 3, 2026 AT 15:33 PM

Bro I bought NEUTRO last week and now I’m broke and emotionally drained. I thought I was investing but I was just feeding the machine. The only thing growing here is my regret. I’m gonna sell everything and buy Bitcoin. At least that’s got a community that doesn’t want me dead.

- Ryan Husain

- January 4, 2026 AT 06:41 AM

While the risks are substantial and the infrastructure minimal, it is worth noting that NeutroSwap fulfills a specific niche within the decentralized finance ecosystem. For users who possess NEUTRO tokens and require immediate, non-custodial exchange capabilities, the platform offers a functionally adequate solution. The absence of customer support, audits, or liquidity depth should not be interpreted as malice, but rather as a reflection of its experimental, community-driven nature. One might argue that this represents the raw essence of DeFi - unfiltered, unmediated, and unforgiving. Proceed with awareness, not fear.

- Willis Shane

- January 4, 2026 AT 21:43 PM

After reviewing the technical and operational deficiencies of NeutroSwap, I must conclude that this platform presents an unacceptable level of systemic risk to retail participants. The absence of third-party audits, the negligible liquidity pool, and the complete lack of institutional oversight render this not merely a high-risk endeavor, but a structural failure of due diligence. Any individual who engages with this protocol without a full understanding of irreversible transaction finality and smart contract vulnerability is not a trader - they are a liability to themselves. I strongly advise against any form of participation.