Blockchain Transaction Cost Comparison Calculator

Compare Blockchain Transaction Costs

Calculate how much you'd pay to process transactions across different blockchains. Enter your transaction volume to see cost differences.

Why This Matters

For enterprise applications like supply chain tracking, IoT data verification, or contract compliance, transaction costs can make or break your implementation.

Taraxa's $0.0003 per transaction cost means you could save thousands of dollars compared to Ethereum's $1.50+ fees for the same volume.

Cost Comparison Results

Enter transaction volume and click 'Calculate Costs' to see comparison

Most crypto coins are built for trading, speculation, or flashy NFTs. Taraxa (TARA) is different. It doesn’t want to be the next meme coin or the fastest DeFi platform. It’s trying to solve a quiet, messy, real-world problem: how do you prove a handshake deal happened? If you’ve ever worked in supply chains, logistics, or small business operations, you know that a lot of transactions never make it onto paper - they’re just verbal agreements, WhatsApp messages, or Excel sheets. Taraxa’s goal is to make those invisible deals verifiable, tamper-proof, and automated - without needing a bank or lawyer.

What Makes Taraxa’s Blockchain Unique?

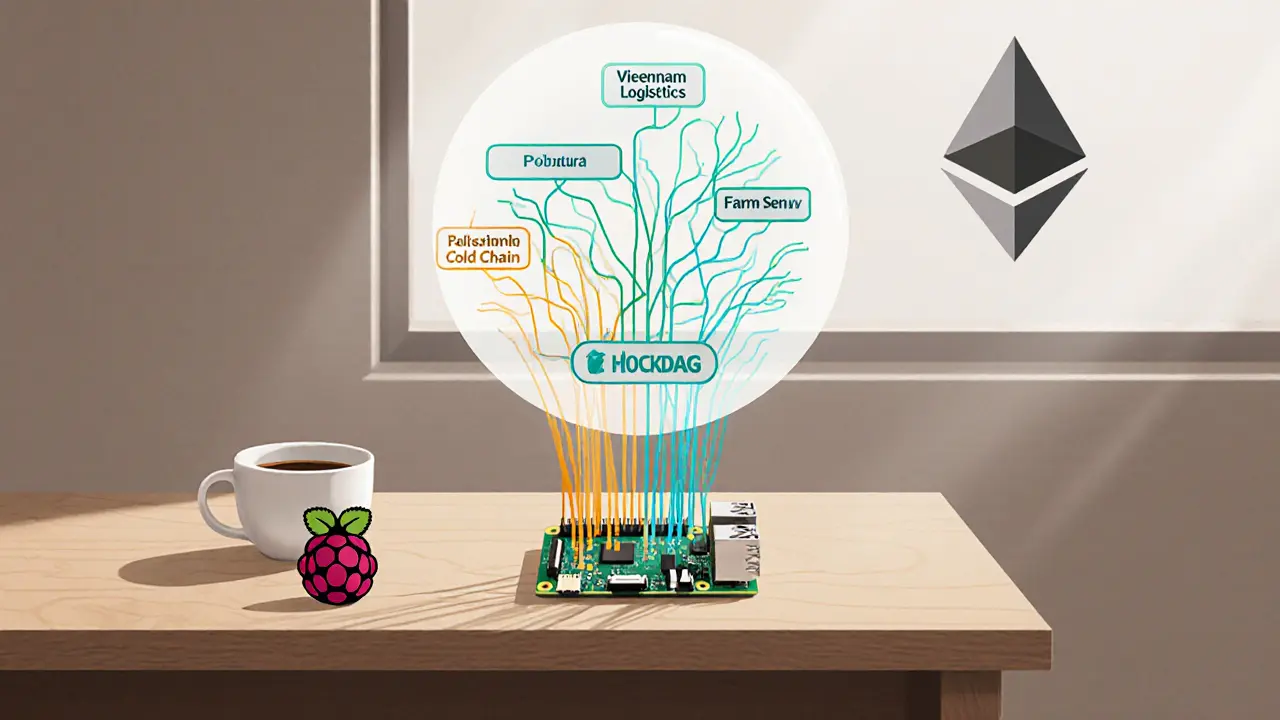

Taraxa runs on a blockDAG - a Directed Acyclic Graph. That’s a mouthful, but here’s what it means in plain terms: instead of building blocks one after another like Bitcoin or Ethereum, Taraxa lets multiple blocks be created and confirmed at the same time. Think of it like a highway with multiple lanes instead of a single toll booth. This lets Taraxa process over 5,000 transactions per second (TPS) with finality in under 3.7 seconds. Compare that to Ethereum, which struggles to hit 30 TPS and takes minutes to confirm. Even Solana, often praised for speed, rarely hits its theoretical 65,000 TPS in real-world use. Taraxa delivers consistent, reliable throughput without sacrificing decentralization.It’s also EVM-compatible. If you’ve ever built or used an Ethereum dApp - whether it’s a token, a DeFi protocol, or a smart contract - you can drop it onto Taraxa with almost no changes. Developers report migration taking just 2 to 8 hours. That’s a huge advantage for teams tired of high gas fees and slow networks. On Taraxa, transaction fees average less than a tenth of a cent. On Ethereum, even on a quiet day, you’re paying $1.50 or more.

The TARA Token: Not a Speculative Asset, But a Utility Tool

The TARA token isn’t designed to be a store of value. It’s a utility token - the fuel that keeps the network running. You need TARA to pay for transactions, to stake as a validator, and to access services on the platform. There are exactly 10.9 billion TARA tokens in existence. No more will ever be created. That fixed supply gives it a predictable inflation model, unlike many coins that keep printing new tokens.Right now, TARA trades around $0.0006279 (as of June 2025), with a market cap of roughly $3.5 million. That’s tiny compared to Ethereum’s $240 billion or even Polygon’s $5.3 billion. But that’s not the point. Taraxa isn’t trying to beat Ethereum in market cap. It’s trying to beat it in practicality for enterprise use.

Staking TARA is accessible. You only need 2,500 TARA (about $1.56 at current prices) to run a validator node. That’s a far cry from Ethereum’s 32 ETH - which costs over $100,000. You can even run a node on a Raspberry Pi. This low barrier means more people can participate, which helps decentralize the network. Validators currently earn around 12.7% APY, based on 90 days of mainnet data.

Who’s Actually Using Taraxa?

You won’t find Taraxa powering DeFi farms or NFT marketplaces. That’s not its target. Instead, it’s focused on industries where trust is built through paper trails - or lack thereof.- Supply chain tracking: A small logistics company in Vietnam uses Taraxa to log when goods are handed off between drivers. Each transfer is recorded on-chain, timestamped, and signed. No more disputes over who received what.

- IoT data verification: Sensors on farm equipment record soil moisture levels. Taraxa stores that data immutably, so insurers can verify claims without sending auditors to the field.

- Contract compliance: A food distributor in Poland uses Taraxa to prove that cold-chain temperature requirements were met during transport. The data is automatically verified by the blockchain.

As of Q3 2025, Taraxa has three verified enterprise pilots. That’s not a lot - but it’s more than most Layer-1 blockchains have in real-world use cases. The problem? There’s almost no public documentation about these partnerships. Taraxa’s website claims “multiple enterprise implementations,” but only three are listed, and none show detailed case studies. That lack of transparency makes it hard for businesses to trust the platform.

How Does Taraxa Compare to Other Blockchains?

| Feature | Taraxa | Ethereum | Solana | Polygon |

|---|---|---|---|---|

| Transactions per second (TPS) | 5,000+ | 15-30 | 65,000 (theoretical) | 7,000 |

| Finality time | Under 3.7 seconds | 1-5 minutes | 1-2 seconds | 2-4 seconds |

| Average transaction fee | $0.0003 | $1.50-$15 | $0.0001-$0.01 | $0.001-$0.01 |

| Consensus mechanism | Proof-of-Stake (blockDAG) | Proof-of-Stake | Proof-of-History + PoS | Proof-of-Stake |

| Validator hardware requirement | 4GB RAM, Raspberry Pi capable | 32 ETH (~$102,400) | High-end server | Low to medium |

| Ecosystem size (dApps) | Dozens | Thousands | Hundreds | Thousands |

| Primary use case | Enterprise audit trails | DeFi, NFTs, general smart contracts | High-speed trading, DeFi | Ethereum scaling, DeFi |

Taraxa wins on transaction cost and validator accessibility. It loses badly on ecosystem size. There are only about 50 active dApps on Taraxa compared to thousands on Ethereum and Polygon. That means fewer tools, fewer wallets, and fewer developers. If you’re looking to build a DeFi protocol or launch an NFT collection, Taraxa isn’t the place. But if you need to log 10,000 supply chain handoffs a day with zero fraud risk, it’s one of the few blockchains built for that.

Challenges and Risks

Taraxa’s biggest problem isn’t technology - it’s adoption. Even with superior speed and low fees, it’s stuck in the early stage. Here’s why:- Minimal developer activity: GitHub shows only 12 active contributors to the core codebase in the last 30 days. Ethereum has over 3,000.

- Limited wallet support: Most users report they can’t use MetaMask or Trust Wallet directly. You need Taraxa’s own wallet or a custom integration.

- Poor documentation for enterprises: Developers say the docs are fine for basic use, but when you need to integrate with ERP systems or legacy databases, the guides fall apart.

- Low trading volume: Daily volume is around $148,000 - down 37% from last quarter. That’s not a sign of strong investor confidence.

Trustpilot reviews show a 3.8/5 average, but 73% of negative reviews cite wallet issues. That’s a major roadblock. If users can’t easily send or receive TARA, adoption stalls.

What’s Next for Taraxa?

The roadmap is ambitious. Taraxa plans to boost throughput to 50,000 TPS by mid-2026 using hardware acceleration and deeper blockDAG optimizations. They’re also improving cross-chain messaging with Ethereum and Polygon - which could let users move assets between networks seamlessly.But the real test is enterprise adoption. If Taraxa lands just two or three big contracts - say, with a global shipping company or a major food retailer - its value could jump 5x, according to Delphi Digital. But if no major brands adopt it by 2026, it risks becoming another “promising tech” that fades into obscurity.

Right now, Taraxa is like a high-end factory built in the middle of nowhere. The machines are brilliant. The output is flawless. But no one’s delivering raw materials to the door.

Is TARA Worth Buying?

If you’re looking for a crypto to flip for quick gains, skip TARA. It’s not going to moon overnight. The market cap is too small, the volume too low, and the community too quiet.But if you’re an enterprise user - a logistics manager, a supply chain auditor, or a developer building for real-world systems - Taraxa is worth testing. The cost to try it is near zero. You can deploy a dApp in hours, pay pennies per transaction, and run a validator for under $2. If your business deals with informal, undocumented transactions, Taraxa might be the only blockchain that actually solves your problem.

It’s not the flashiest coin. It’s not the biggest. But for a very specific set of needs, it’s one of the few that makes sense.

What is Taraxa (TARA) used for?

Taraxa (TARA) is used to create a tamper-proof, verifiable record of informal business transactions - like handshake deals, supply chain handoffs, or IoT sensor data. Its blockchain helps companies prove that agreements happened without relying on paper trails or third-party auditors. The TARA token pays for transactions and secures the network through staking.

How fast is Taraxa compared to Ethereum?

Taraxa processes over 5,000 transactions per second with finality in under 3.7 seconds. Ethereum handles only 15-30 TPS and takes minutes to confirm transactions. Taraxa’s blockDAG architecture allows parallel processing, making it significantly faster for high-volume, low-value transactions.

Can I stake TARA tokens?

Yes. You can stake TARA to become a validator node. The minimum requirement is 2,500 TARA (about $1.56 at current prices). Validators earn around 12.7% APY and can run nodes on low-cost hardware like a Raspberry Pi, making it one of the most accessible staking networks.

Is Taraxa compatible with Ethereum wallets?

Taraxa is EVM-compatible, meaning Ethereum dApps can run on it with minimal changes. However, mainstream wallets like MetaMask don’t natively support TARA yet. Users must use Taraxa’s official wallet or add the network manually via custom RPC settings, which many find confusing.

Why is Taraxa’s market cap so low?

Taraxa’s market cap is low because it’s not focused on speculative trading or DeFi. Its target users are enterprises, not retail investors. With only dozens of dApps, minimal exchange listings, and low trading volume, there’s little demand from traders. Its value lies in utility, not speculation - which takes longer to build.

Where can I buy TARA coin?

TARA is available on smaller exchanges like Gate.io, Bitget, and MEXC. It’s not listed on major platforms like Coinbase or Binance. Always check the exchange’s reputation and ensure you’re using a secure wallet to store your tokens.

Comments (6)

- Ivanna Faith

- November 29, 2025 AT 12:59 PM

Okay but let’s be real - Taraxa is the crypto equivalent of a Swiss Army knife that only opens bottles. 🤷♀️ Everyone’s chasing moonshots and here’s this quiet little thing solving supply chain paperwork like it’s 1998. I’m low-key impressed. Not gonna get rich off it, but if I ran a logistics company? I’d be all over this.

Also, Raspberry Pi validator? That’s either genius or a hacker’s dream. Either way, I’m here for it.

- Akash Kumar Yadav

- November 30, 2025 AT 10:04 AM

India is building real infrastructure while you guys are busy gambling on meme coins. Taraxa? Finally someone gets it - blockchain isn’t about flipping tokens, it’s about fixing broken systems. Our farmers need this. Our shipping lanes need this. And no, you don’t need 100k ETH to participate. This is how the future works - simple, cheap, and for the people. Stop comparing it to Ethereum like it’s a failure because it’s not trying to be a casino.

- Bhoomika Agarwal

- December 1, 2025 AT 18:15 PM

Oh wow. A blockchain that doesn’t scream ‘BUY NOW OR DIE’? Shocking. 🙃

So let me get this straight - you’re telling me there’s a crypto that doesn’t need a PhD in DeFi to use, costs less than your morning coffee, and actually solves a problem nobody else cares about?

Bro. I think I just found the most underrated tech since the fax machine got replaced. Also, 2,500 TARA to stake? That’s less than the price of a bad TikTok ad. This is either genius or a trap. Either way, I’m watching.

- Katherine Alva

- December 2, 2025 AT 12:03 PM

There’s something deeply poetic about a technology built for the invisible labor of the world - the handshake deals, the WhatsApp confirmations, the unlogged deliveries.

Taraxa doesn’t want to be the future of finance. It wants to be the quiet witness to the everyday economy that’s been ignored for decades.

It’s not flashy. It doesn’t need to be. Some of the most powerful things in life aren’t loud. They’re just there - reliable, unobtrusive, and real. 🌱

- Nelia Mcquiston

- December 3, 2025 AT 17:19 PM

I’ve been reading about Taraxa for weeks now. I’m not a trader. I’m a supply chain analyst. And honestly? I’ve never seen anything this practical. The fact that you can run a node on a Raspberry Pi? That’s democratizing blockchain in a way Ethereum never did.

Yes, the ecosystem is tiny. Yes, the wallet situation is trash. But if they fix the docs and make MetaMask integration a priority? This could be the quiet revolution we’ve been waiting for. No hype. Just utility. And that’s rare.

- Mark Stoehr

- December 4, 2025 AT 15:21 PM

This is why crypto is dead. Everyone’s too scared to make a real coin anymore so they make some ‘enterprise solution’ that sounds like a PowerPoint slide from a middle manager. 5000 TPS? Big whoop. No one uses it. Wallets don’t work. No one talks about it. Market cap is less than my rent.

It’s not a blockchain. It’s a graveyard for delusional founders. And don’t even get me started on ‘stake on a pi’ - that’s not decentralization, that’s a security nightmare. Skip it.

Post-Comment

Categories

Popular Articles