Governance Voting Power Calculator

Calculate Your Influence

Enter your token holdings to see your voting power in a DAO and how participation rates impact governance control.

Your Voting Power

Active VotingYour Voting Power

0%

Total Supply

0 tokens

Based on your holdings and participation rate:

Your vote is worth 0% of total voting power.

To pass a proposal, you'd need:

A 99% majority to guarantee your vote matters.

Why This Matters

Most governance proposals pass with less than 10% of token holders voting. This means a small group controls the outcome, even if you're holding significant tokens.

With only 5% participation (the average), you'd need over 19 times your current holdings to make a difference.

If you're holding less than 1% of total supply, your vote might not matter even if you participate. This is why participation matters more than holdings for small holders.

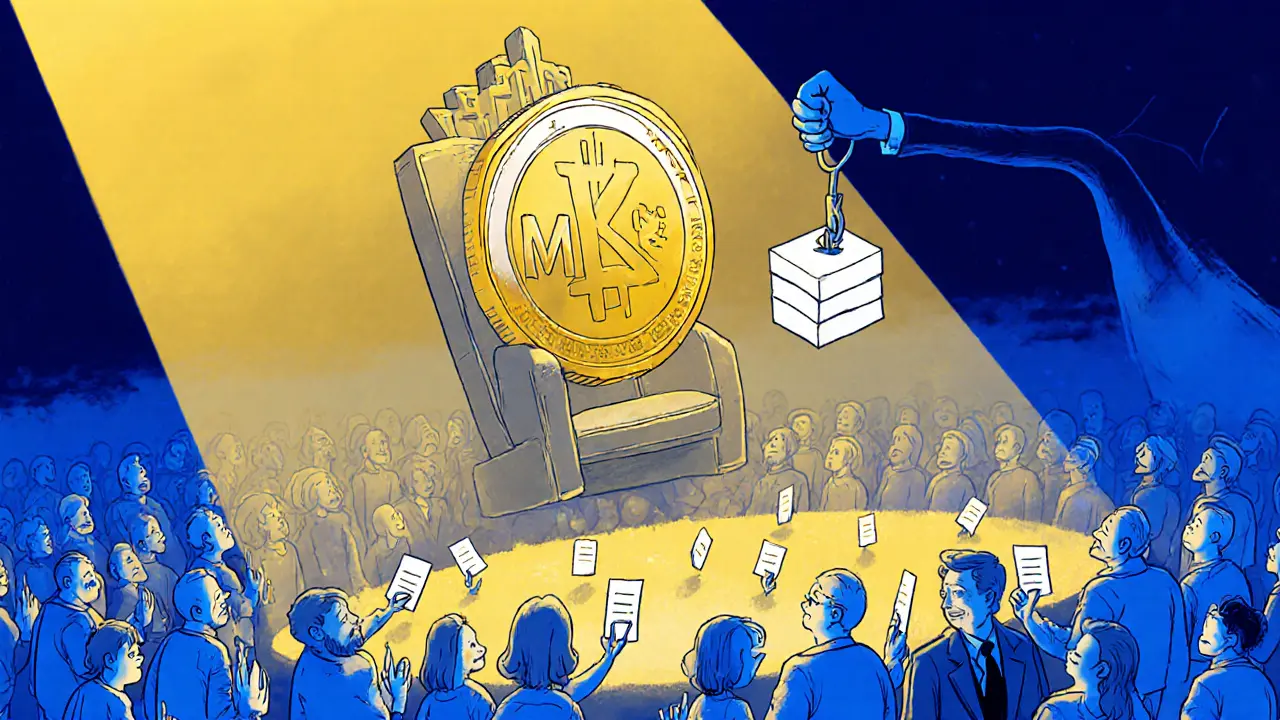

When you hold a governance token, you’re not just owning a piece of crypto-you’re holding a vote. That vote can decide whether a protocol raises fees, changes its interest rates, allocates millions in treasury funds, or even kicks out a core developer. This is the real power behind tokens like MakerDAO’s MKR is a governance token that controls the economic rules of the DAI stablecoin system, including debt ceilings, collateral types, and risk parameters. Also known as MKR token, it was first introduced in 2017 and has since enabled thousands of holders to directly shape one of the largest decentralized finance protocols. But here’s the problem: most people don’t understand how that vote translates into actual value. And if you’re holding governance tokens without knowing how they work, you might be sitting on paper wealth with no real control-or worse, you’re being outvoted by whales who don’t care about your opinion.

How Governance Tokens Actually Work

Governance tokens aren’t like Bitcoin or Ethereum. They don’t exist to be spent or stored as digital gold. Their entire purpose is to give holders a say in how a protocol evolves. Every major decision in a DAO-from changing the way liquidity rewards are distributed to approving a new partnership-goes through a voting process. The number of votes you get is directly tied to how many tokens you hold. If you own 1% of the total supply, you get 1% of the voting power.

This isn’t democracy. It’s plutocracy. The more tokens you have, the louder your voice. That’s why MakerDAO’s MKR holders can vote to adjust the stability fee for DAI loans, or why Uniswap’s UNI holders decided to launch a $100 million liquidity mining program. These aren’t theoretical votes-they change real money flows.

Smart contracts make sure the votes are executed exactly as decided. No middleman. No delays. Once a proposal passes, the code automatically updates. That’s the beauty of it. But it also means if you don’t pay attention, someone else could vote to drain the treasury-or worse, change the rules in a way that devalues your holdings.

Why Governance Tokens Are Hard to Value

Here’s the biggest confusion: governance tokens have no clear way to generate income. Unlike staking tokens that earn interest or yield tokens that collect fees, governance tokens don’t pay dividends. Their price rises or falls based on speculation-whether people think the protocol will grow, not whether they’re actively using their voting rights.

Take the case of AAVE. Its governance token, AAVE, saw its price spike when the community voted to expand into new markets. But it also crashed when users felt excluded from key decisions. The value wasn’t in the token itself-it was in the perception of control. That’s fragile.

Experts point out that most governance tokens are priced like lottery tickets. People buy them hoping the protocol will succeed, not because they plan to vote. But if only 5% of token holders participate in every vote, who’s really running the show? Often, it’s a handful of wallets that control 30%, 40%, or even 60% of the supply. That’s not decentralization. That’s centralization with a blockchain coat of paint.

Who Really Controls Governance?

Small holders are often left out. Imagine you own 0.1% of a governance token. You get one vote out of a thousand. You spend hours reading proposals, watching community calls, and researching the technical implications. Then you vote. But the whale wallets-some holding millions of tokens-vote together and crush your opinion. The proposal passes. You’re left wondering why you bothered.

This is called governance fatigue. Many users stop voting because it feels pointless. Others don’t vote because they don’t understand the proposals. A 2024 study of 12 major DAOs found that over 70% of governance proposals passed with less than 10% of total token supply participating. That means a tiny fraction of holders were making decisions that affected millions in value.

Some protocols are trying to fix this. Quadratic voting, for example, gives more weight to smaller holders by making each additional vote more expensive. If you want to cast 10 votes, it doesn’t cost you 10 tokens-it costs you 55 (1+2+3+4+5+6+7+8+9+10). That makes it harder for whales to dominate. Other projects are experimenting with revenue-sharing: if you vote, you get a share of protocol fees. That turns voting from a chore into an opportunity.

Real-World Examples of Governance in Action

MakerDAO’s MKR token is the most mature example. Holders vote on everything from which assets can be used as collateral for DAI loans to how much interest borrowers pay. In 2023, they voted to include real-world assets like U.S. Treasury bonds as collateral-a move that expanded the system’s capacity by billions of dollars. That decision didn’t come from a CEO. It came from hundreds of individual token holders.

Uniswap’s UNI token has been used to fund developer grants, launch new trading pairs, and even pay for marketing campaigns. In 2024, a proposal to allocate $20 million to incentivize liquidity on new chains passed with 92% approval. But it only got 3% of total supply voting. That’s a problem.

Then there’s Compound, which used its COMP token to reward early users with airdrops. Those users then voted on how to distribute future rewards. The system worked-but only because early adopters had enough skin in the game to care. Most new projects can’t replicate that.

The Future of Governance Tokens

The next wave of governance tokens won’t just be about voting. They’ll be about earning. New models are emerging where holding the token isn’t enough-you have to participate to get rewarded. Some protocols now tie token rewards directly to voting activity. Others use reputation systems: the more you vote, the more influence you gain over time, even if you don’t hold many tokens.

AI is starting to help too. Tools like Snapshot and Aragon now offer summary bots that break down complex proposals into plain language. Some DAOs are even using AI to predict voting outcomes based on past behavior. That helps small holders make smarter decisions without needing a degree in blockchain engineering.

And then there’s cross-protocol governance. Imagine a single vote that affects not just one DAO, but multiple interconnected protocols. That’s already being tested in the DeFi layer, where governance tokens from different projects can coordinate on shared standards-like how to handle oracle data or manage liquidations across protocols.

What You Should Do With Your Governance Tokens

If you’re holding governance tokens, here’s what actually matters:

- Don’t assume your vote doesn’t matter. Even small holders can swing votes if others are apathetic.

- Read proposals before voting. Skip the hype. Look at the code changes, treasury impact, and risk exposure.

- Join community calls. Most DAOs host weekly Discord or Telegram meetings where proposals are debated.

- Use tools like Snapshot, Tally, or DAOhaus to track voting activity and see who’s influencing decisions.

- If the protocol offers rewards for voting-vote. It’s the only way to turn governance into real value.

Governance tokens are powerful-but only if you use them. Holding them passively is like owning a key to a house you never enter. The door is open. The power is yours. But if you don’t walk through it, someone else will.

Are governance tokens the same as regular crypto tokens?

No. Regular crypto tokens like Bitcoin or Ethereum are primarily used as digital money or stores of value. Governance tokens are designed for decision-making. They give holders voting rights in a decentralized organization. You can’t spend them at a store, but you can vote on whether the protocol should change its rules, allocate funds, or partner with other projects.

Can I make money just by holding governance tokens?

Not directly. Holding a governance token doesn’t pay interest or fees. Any profit comes from price appreciation, which is speculative. Some protocols now offer rewards for voting, but that’s not guaranteed. If you’re buying governance tokens hoping for passive income, you’re likely misunderstanding their purpose.

Why do whales dominate governance votes?

Because voting power is proportional to token holdings. If someone owns 10% of all tokens, they get 10% of the votes. Many whales bought large amounts early, and their holdings give them outsized influence. Even if 90% of holders vote against a proposal, a whale can still pass it if they control enough tokens. This is the biggest criticism of current governance models.

What happens if I don’t vote?

Your vote doesn’t count. The proposal passes or fails based only on those who vote. In most DAOs, fewer than 10% of token holders participate. That means a small group-often whales or institutional investors-controls the outcome. By not voting, you’re giving up your say in how the protocol evolves.

Are governance tokens regulated?

Regulators are still figuring it out. Some agencies, like the U.S. SEC, have suggested that governance tokens could be considered securities if they’re sold with the expectation of profit based on others’ efforts. Projects are now designing governance systems to avoid this classification, often by making voting rights explicit and separate from investment promises. But legal clarity is still lacking.

How do I start participating in governance?

First, make sure you hold the token in a wallet that supports voting (like MetaMask). Then visit the protocol’s governance portal-usually a site like Snapshot or Tally. Read the current proposals, join the community Discord or forum, and ask questions. You don’t need to be an expert. Just show up. Participation is the first step to having real influence.

Comments (7)

- Vance Ashby

- November 27, 2025 AT 16:47 PM

bro i held MKR for 2 years and never voted once... thought it was just a speculative asset. then one day i checked and some whale had voted to add crypto-backed loans with 0% collateral. i lost half my portfolio. now i vote every week. it’s not a hobby, it’s survival.

- Brian Bernfeld

- November 29, 2025 AT 00:53 AM

let me tell you something real. governance isn’t about democracy-it’s about who shows up. i’ve seen proposals with 12 votes pass that affected $2B in TVL. 12. People think blockchain is decentralized? Nah. It’s just a new kind of oligarchy with better UI. If you’re not in the Discord, reading the docs, and showing up to calls-you’re not a participant. You’re a spectator getting robbed in real time.

And don’t get me started on quadratic voting. It’s the only thing that even slightly levels the field. But even that’s just a Band-Aid. We need reputation-based systems where your influence grows with participation, not just wallet size. Stop treating this like a stock market and start treating it like a city council meeting. Because it is.

- Ian Esche

- November 29, 2025 AT 22:43 PM

USA built the internet, USA built crypto, and now some dude in Singapore with 0.01% of UNI is telling us how to run our protocols? Nah. This whole thing is a socialist fantasy dressed in blockchain. If you want real power, hold BTC. At least that shit doesn’t change rules based on some guy’s whim.

- Felicia Sue Lynn

- December 1, 2025 AT 21:00 PM

The philosophical underpinning of governance tokens reveals a deeper tension: the illusion of agency in systems designed for capital concentration. One may possess a token, yet remain disempowered by structural asymmetries masked as meritocracy. The act of voting, when performed without collective coordination, becomes performative rather than transformative. We must ask: is decentralization a technical architecture, or a social contract? And if the latter, who is responsible for its preservation when the majority disengages?

Perhaps the answer lies not in better voting mechanisms, but in cultivating civic responsibility within digital communities. The code is neutral. The culture is not.

- Christina Oneviane

- December 3, 2025 AT 07:49 AM

Oh wow, so if I vote, I get to be part of the 5% who decide whether the whales get to print more DAI or not? How thrilling. My 0.002% vote is basically a participation trophy in a game where the house always wins. Thanks for the PSA, I’ll go back to ignoring my wallet now. 😘

- fanny adam

- December 4, 2025 AT 10:58 AM

It is not coincidence that every major governance token has experienced a sudden spike in whale accumulation immediately after a major airdrop. The pattern is consistent: 1) distribute tokens to retail users, 2) allow whales to buy low on exchanges, 3) enable whale-controlled proposals to pass with <10% participation, 4) devalue the token through protocol changes that benefit concentrated holders. This is not governance. This is a coordinated extraction protocol disguised as open-source innovation. The SEC is aware. They are waiting for the first major treasury drain to justify classification as a security. You are being played.

- Eddy Lust

- December 6, 2025 AT 07:29 AM

man i used to think voting was just for nerds with too much time on their hands... until i saw a proposal pass that made my 100 MKR worth $30 instead of $300. now i read every proposal like it’s my last meal. i even made a little spreadsheet: ‘Proposal X → Risk Level → My Mood After Voting’. turns out, showing up ain’t just power-it’s therapy. also, if you’re not using Snapshot, you’re doing it wrong. it’s like reddit but for not getting rug pulled.