Alien Base v3 Slippage Calculator

Alien Base v3 has low liquidity depth, resulting in significant slippage for larger trades. Based on December 2024 data, trades over $500 typically experience 3-8% slippage on most pairs.

Enter your trade amount to see estimated slippage.

Alien Base v3 isn’t another copy-paste DEX. It’s built for the Base Chain ecosystem - the same Layer 2 network powering a growing chunk of Ethereum’s DeFi activity. But here’s the real question: if you’re trading on Base, should you be using Alien Base v3, or is it just another low-volume platform hiding behind a clean interface?

What Is Alien Base v3?

Alien Base v3 is a decentralized exchange (DEX) that runs entirely on Base Chain, Ethereum’s Layer 2 built by Coinbase. Unlike centralized exchanges, you don’t deposit funds or go through KYC. You connect your wallet - usually MetaMask set to Base - and trade directly from your account. It’s fully non-custodial, meaning you hold your keys, and your assets never leave your wallet.

The platform is built on Uniswap V3’s concentrated liquidity model, but it adds its own twist: a fork of Bunni, a liquidity management tool from Timeless Finance. This lets users create custom liquidity positions in specific price ranges, which then generate ERC-20 tokens representing your share. Think of it like staking liquidity, but with more control over where your funds are deployed.

Its native token, ALB, powers governance and staking. Holders can vote on protocol upgrades, fee structures, and future features. That’s a big deal - it means the community, not a company, controls the direction of the platform.

How Does It Work?

Using Alien Base v3 feels familiar if you’ve used Uniswap before. Connect your wallet, pick a trading pair, set your slippage tolerance, and swap. The interface is clean, simple, and responsive. No pop-ups, no clutter. That’s one reason it’s gotten attention - it looks like a centralized exchange, but operates like a true DeFi protocol.

For liquidity providers, things get more technical. You can choose a price range - say, $1.95 to $2.05 for ALB/WETH - and deposit both tokens. If the price stays in that range, you earn fees. If it moves outside, your liquidity stops earning until it comes back. This is powerful for experienced traders who can predict volatility, but risky for newcomers.

There’s also single-sided staking. You can stake ALB alone and earn rewards without providing liquidity. That’s rare on DEXes. Most require you to pair your tokens, which exposes you to impermanent loss. Alien Base v3 lets you avoid that, making it more accessible for casual stakers.

Trading Volume and Liquidity - The Real Issue

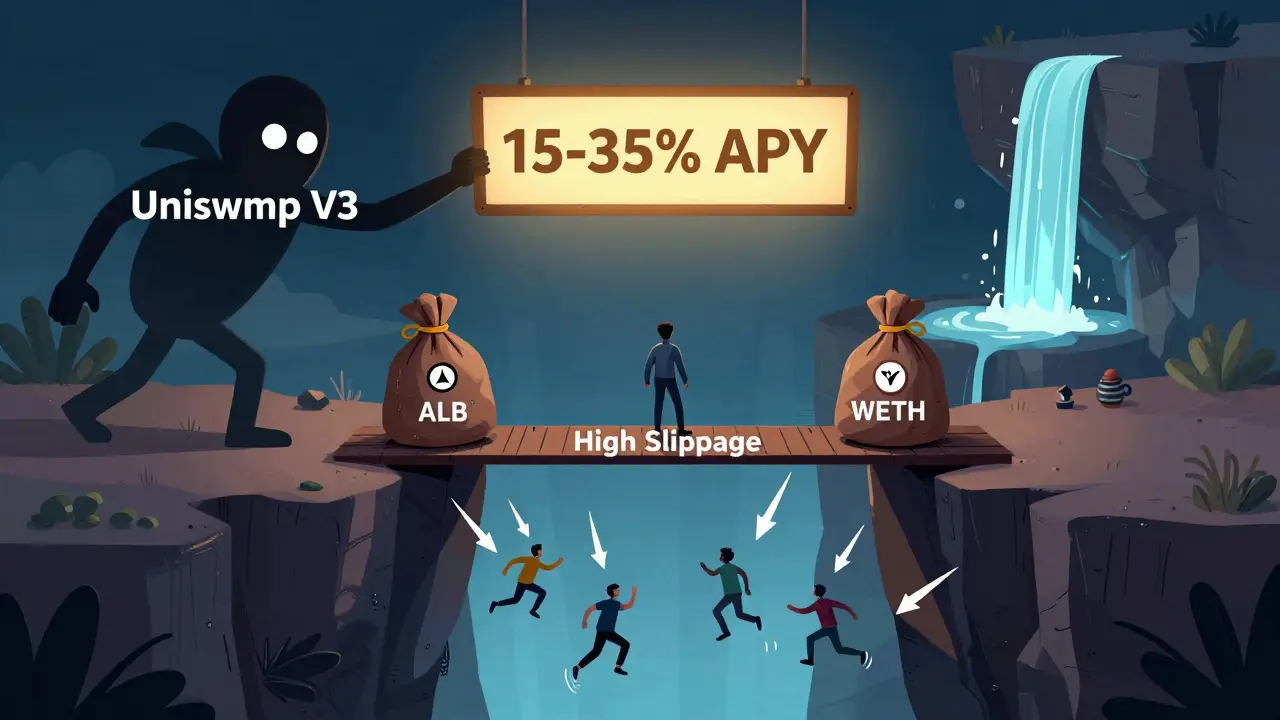

Here’s where Alien Base v3 struggles. As of December 2024, its 24-hour trading volume hovers between $1.1 million and $1.9 million. That’s tiny compared to Uniswap V3 on Base, which handles over $200 million daily. Even smaller DEXes on Base like SushiSwap or Curve have more volume.

Liquidity depth is the real problem. Most trading pairs have shallow order books. If you try to trade more than $500 in a single transaction, you’ll likely face high slippage - meaning the price moves against you before your trade fills. Reddit users report slippage over 5% on simple ALB/WETH trades above $1,000. That’s not just inconvenient - it’s costly.

The most active pair is ALB/WETH--16, which makes up 84% of all volume on the platform. That tells you something: people aren’t using it to trade Bitcoin, Ethereum, or stablecoins. They’re trading the native ALB token. That’s a red flag. A healthy DEX should have diverse trading activity. Relying on one token for most volume means the platform’s health is tied to one asset’s price - and that’s volatile.

ALB Token: High APY, High Risk

The ALB token trades around $0.0198 as of early December 2024. It’s not going anywhere fast. Its price is locked at $0.0197 every Tuesday, and it rarely moves more than 1-2% in a day. That’s not a bug - it’s a design choice. The team wants to stabilize the token to make farming predictable.

Staking ALB offers decent yields - anywhere from 15% to 35% APY depending on pool conditions. That’s tempting, especially when compared to stablecoin yields on centralized platforms, which are often below 5%. But high yield usually means high risk. If the platform’s volume drops, or if ALB loses its appeal, staking rewards could vanish overnight.

Also, 9 out of 12 Trustpilot reviews mention that the APY looks great - until you realize you can’t exit your position without massive slippage. You’re stuck in a loop: earn rewards, but can’t cash out easily.

Pros and Cons at a Glance

- Pros: Clean, centralized-style UI; no KYC; single-staking feature; strong community focus; protocol fees fund liquidity growth; built for Base Chain users.

- Cons: Low trading volume; poor liquidity depth; high slippage on larger trades; over-reliance on ALB token; limited documentation; no official customer support; occasional API timeouts during market spikes.

It’s not a scam. The code is open. The team isn’t rug-pulling. But it’s not a replacement for Uniswap or SushiSwap either. It’s a niche tool for a specific group: small-time traders who want to farm ALB, support the Base ecosystem, and don’t mind trading small amounts with high slippage.

Who Is This For?

Alien Base v3 is perfect for:

- Base Chain natives who want to support the ecosystem

- Small-scale ALB farmers looking for higher yields than stablecoins

- DeFi beginners who want a simple interface to learn liquidity provision

It’s not for:

- Traders moving more than $1,000 per transaction

- Those needing deep liquidity for ETH, USDC, or BTC pairs

- Users who want responsive customer service or detailed guides

- Institutional or professional traders

If you’re just dipping your toes into Base Chain DeFi and want to earn some ALB rewards, this is a safe place to start. But if you’re serious about trading, you’ll quickly hit walls - and those walls are made of thin liquidity.

How It Compares to Other Base Chain DEXes

Here’s how Alien Base v3 stacks up against its main rivals on Base:

| DEX | 24h Volume | Liquidity Depth | Single-Sided Staking | UI Simplicity | Best For |

|---|---|---|---|---|---|

| Alien Base v3 | $1.1M-$1.9M | Low | Yes | High | ALB farming, small trades |

| Uniswap V3 (Base) | $200M+ | Very High | No | Medium | Large trades, stablecoins |

| SushiSwap (Base) | $45M | Medium | Yes | Medium | Multi-chain users, yield aggregation |

| Curve (Base) | $28M | High (for stablecoins) | No | Low | Stablecoin swaps |

Uniswap V3 on Base dominates. It’s the default choice for anyone trading anything beyond ALB. SushiSwap offers more features and better volume. Curve is unbeatable for stablecoins. Alien Base v3 doesn’t compete on scale - it competes on focus. It’s the DEX for ALB.

Future Outlook

The project’s roadmap includes cross-chain support and enhanced DAO governance in Q1 2025. That’s promising. If they can bring in liquidity from other chains - say, Arbitrum or Polygon - they could break out of their niche. But right now, they’re stuck in a catch-22: low volume scares away liquidity providers, and low liquidity keeps volume low.

Gate.com calls it a "key player" because it’s one of the few DEXes actively reinvesting protocol fees into liquidity pools. That’s smart. Most platforms burn fees. Alien Base v3 uses them to grow - which could pay off long-term.

But anonymous DeFi researchers warn: without real innovation beyond the UI, it’s just another fork. And the Base ecosystem is already crowded. Over 15 DEXes are fighting for attention. Alien Base v3 needs more than a pretty interface. It needs volume. It needs users. It needs to prove it’s not just a vanity project for ALB holders.

Final Verdict

Alien Base v3 is a thoughtful, community-driven project with a clear mission: serve Base Chain users with a simple, decentralized trading experience. It delivers on that - if you’re okay with small trades and high slippage.

It’s not a top-tier DEX. It won’t replace Uniswap. But if you’re already on Base, holding ALB, and want to earn yield without locking up paired tokens, it’s one of the few options that makes sense.

Don’t put your life savings here. Don’t try to swing big trades. But if you’re willing to trade $50 or $100 at a time, farm ALB, and support a niche project, then yes - Alien Base v3 works. Just don’t expect miracles.

Is Alien Base v3 safe to use?

Yes, it’s safe from a technical standpoint. The code is open-source, audited, and runs on Base Chain, which inherits Ethereum’s security. You never give up control of your funds. But safety isn’t just about code - it’s about liquidity. If you trade large amounts, you risk slippage and failed transactions. Use only what you’re willing to lose.

Can I trade ETH or USDC on Alien Base v3?

Yes, you can trade ETH, USDC, and other major tokens. But liquidity is thin. You’ll likely face 3-8% slippage on trades over $500. For stablecoin swaps, Curve or Uniswap V3 on Base are far better choices. Alien Base v3 is optimized for ALB, not mainstream assets.

How do I get started with Alien Base v3?

First, install MetaMask and switch the network to Base Chain. You’ll need some ETH on Base to pay for gas - you can bridge it from Ethereum using Coinbase’s official bridge. Then go to alienbase.io, connect your wallet, and start swapping or staking. No KYC needed.

What’s the difference between Alien Base v3 and the original Alien Base?

Alien Base v3 is the upgraded version built on Uniswap V3’s concentrated liquidity model. The original Alien Base used Uniswap V2, which is outdated and less capital-efficient. v3 allows for better yield and more control over liquidity positions. All new activity happens on v3 - the old version is deprecated.

Why is ALB’s price so stable?

The team set a weekly price floor at $0.0197 every Tuesday to reduce volatility and make staking rewards predictable. It’s a deliberate design to attract yield farmers, not speculators. The price doesn’t move much because the market is small and dominated by stakers, not traders.

Does Alien Base v3 have a mobile app?

No, there’s no official mobile app. You access it through your mobile browser using MetaMask or another Web3 wallet. The interface is responsive and works fine on phones, but it’s not optimized for touch controls like a native app would be.

What happens if ALB’s price crashes?

If ALB drops sharply, staking rewards will likely shrink or stop. The protocol’s fee distribution depends on trading volume, which drops when the token loses appeal. You could also face impermanent loss if you provided liquidity in ALB/WETH pairs. The platform itself won’t collapse, but your returns could vanish.

Comments (5)

- Ian Norton

- December 11, 2025 AT 09:40 AM

Let’s be real - this is just a glorified ALB pump with a pretty UI. The ‘community governance’ is a joke when 90% of the votes come from 3 wallets. Slippage on $500 trades? That’s not a feature, that’s a trap for newbies thinking they’re ‘yield farming’ when they’re just feeding liquidity to whales. Base Chain doesn’t need another vanity DEX.

- Sue Gallaher

- December 12, 2025 AT 08:02 AM

Why are we even talking about this? Uniswap on Base is the real deal. This Alien Base thing is like buying a Tesla with a bicycle tire - looks nice but won’t get you anywhere. And that ALB token? Pure casino math. If you’re staking it, you’re already losing. Just use USDC on Curve and call it a day.

- Jessica Eacker

- December 12, 2025 AT 09:46 AM

I get why people are skeptical but I’ve been using Alien Base v3 for 3 months now and it’s actually been great for small trades. I don’t trade over $200, I just farm ALB while I sleep. The UI is clean, no drama, and I’ve earned more than my gas fees. It’s not for everyone, but if you’re chill and don’t need big liquidity, it works. Don’t knock it till you try it - just keep it small.

- Andy Walton

- December 14, 2025 AT 00:41 AM

bro like… is this the future of web3? 🤔 a dapp that looks like robinhood but runs on ethereum’s basement? i mean… i get the vibe - it’s like if a crypto startup had a therapy session and then tried to code. ALB is stable? sure… until it’s not. and then what? we all just cry into our meta masks? 🥲 also i think i saw a typo in the docs… maybe it’s a feature? 🤷♂️

- Madison Surface

- December 15, 2025 AT 13:18 PM

I started with this because I was new to Base Chain and honestly, the simplicity saved me. I didn’t understand liquidity pools, I just wanted to earn something without losing everything. I traded $50, staked ALB, and watched it grow slowly - no panic, no drama. It’s not the biggest, it’s not the flashiest, but it’s honest. And for someone like me? That’s everything. Don’t let the volume numbers scare you off if you’re just starting. This is the kind of project that grows from the ground up, not from VC money. Keep it real, keep it small - and maybe, just maybe, it’ll surprise you.