Libre Swap Liquidity Risk Calculator

How Low Liquidity Affects Your Trades

Libre Swap has nearly zero trading volume with only one trading pair (BTC/LIBRE). This means high slippage when trading, which could cause you to lose significant value. This calculator shows you how much you might lose based on the low liquidity described in the article.

Important: Libre Swap shows inconsistent volume data ($0.00 to $54,276) and has no audit history. As stated in the review, "If you try to swap $1,000 worth of BTC for LIBRE, you might end up getting half the amount you expected."

Trade Result

Original Amount: $0.00

Slippage: 0%

Amount Received: $0.00

Loss: $0.00

⚠️ WARNING: Libre Swap shows no reliable trading volume and no security audits. With this level of slippage, you could lose half your trade value. The article states: "Don't risk it."

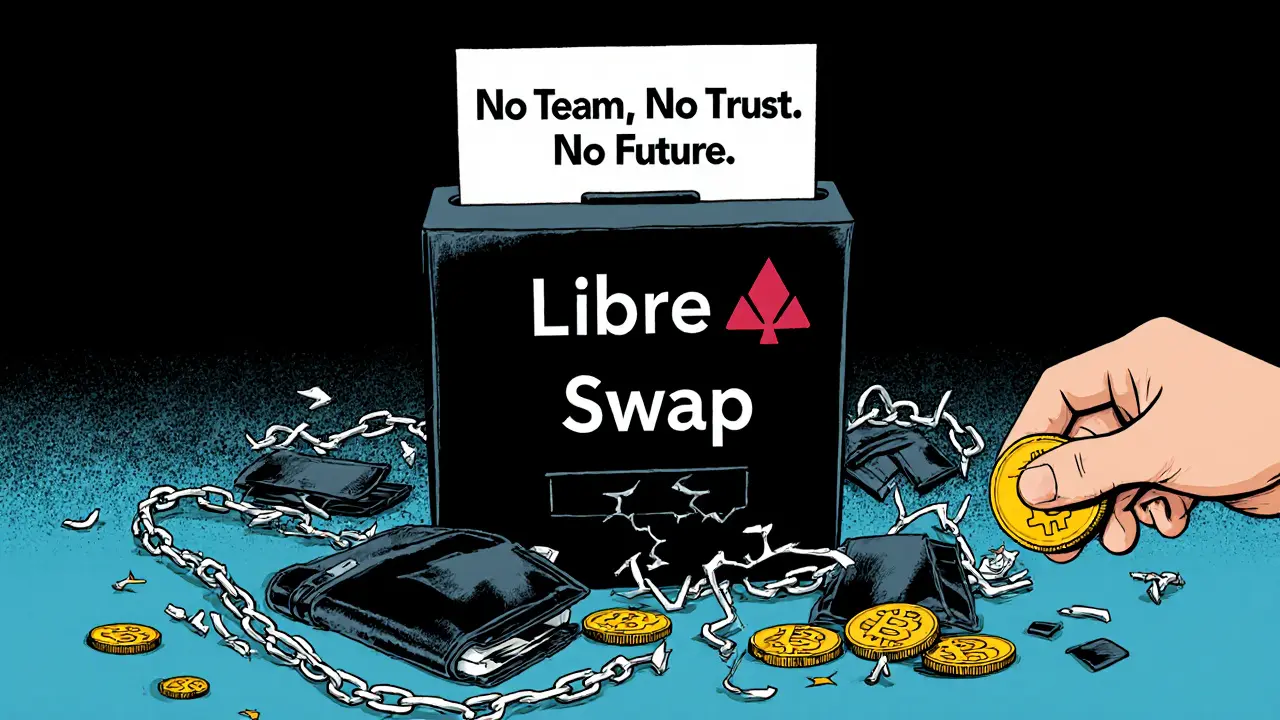

Libre Swap claims to be a decentralized crypto exchange built for the Libre blockchain. But if you’re looking for a reliable, liquid, and well-documented platform to trade cryptocurrencies, this one raises more questions than answers. As of late 2025, Libre Swap operates with just one trading pair - BTC/LIBRE - and almost no trading volume. That’s not a feature. That’s a red flag.

What Exactly Is Libre Swap?

Libre Swap is a decentralized exchange (DEX) launched in 2023, based entirely on the Libre blockchain. Unlike Uniswap or SushiSwap, which run on Ethereum and support thousands of tokens, Libre Swap only works with assets native to the Libre network. There’s no support for Bitcoin, Ethereum, or even popular stablecoins unless they’ve been wrapped into the Libre ecosystem as pBTC or pUSDT.

The platform is open-source and permissionless. That means you don’t need to sign up, verify your identity, or hand over personal data. All you need is a Libre wallet. Sounds good, right? But here’s the catch: there’s no public information about who built it, who maintains it, or how secure the smart contracts are. No audits. No team names. No GitHub activity logs. Just a website and a blockchain.

Trading Pairs and Liquidity: A Ghost Market

Libre Swap lists one primary trading pair: BTC/LIBRE. Some sources say it also supports pBTC/pUSDT and pBTC/LIBRE. But even if those pairs exist, liquidity is nearly nonexistent. CoinGecko shows $0.00 in 24-hour volume - but then lists $54,276 for the same BTC/LIBRE pair. That contradiction isn’t a typo. It’s a sign the data is unreliable.

CoinMarketCap doesn’t even track Libre Swap. It’s labeled as an “Untracked Listing,” meaning the platform doesn’t meet their minimum standards for volume transparency or data consistency. That’s not normal for any exchange, even a new one. Most DEXs get tracked within weeks of launch if they have even modest activity.

Compare that to Uniswap, which handles over $1 billion in daily volume, or Symbiosis Finance, which routes swaps across 20+ blockchains. Libre Swap doesn’t just lag behind - it’s barely visible on the map.

Why the Lack of Volume Matters

Low volume isn’t just about numbers. It means slippage. It means you can’t buy or sell without moving the price. If you try to swap $1,000 worth of BTC for LIBRE, you might end up getting half the amount you expected because there’s no one else trading.

Also, low volume = low trust. If no one else is using it, why should you? There’s no social proof. No Reddit threads. No Twitter buzz. No user reviews on Trustpilot or Reddit. Nothing. That’s not “niche.” That’s abandoned.

Even small DeFi projects like PancakeSwap had active communities and clear volume trends in their first year. Libre Swap, over two years in, has no track record of growth. It’s stuck in development limbo.

Security: No Audits, No Transparency

One of the biggest risks in DeFi is untested smart contracts. If a contract has a bug, your money can vanish - and there’s no customer service to call.

Major DEXs like Uniswap and Curve publish full smart contract audits from firms like CertiK, Quantstamp, or Trail of Bits. Libre Swap? Nothing. No audit reports. No GitHub repo with code history. No security disclosures. You’re literally trusting code you can’t inspect.

Even if the Libre blockchain itself is secure (and there’s no public evidence it is), the swap protocol could still be vulnerable. Without audits, you’re gambling with your crypto.

Who’s Behind Libre Swap?

The project says it was built by “antelope teams” from Costa Rica and Argentina, with frontend work done by Libre Tech - a global organization. But who are these people? Are they developers with past projects? Do they have LinkedIn profiles? Are they anonymous? No one knows.

Compare that to Uniswap, founded by Hayden Adams, a former mechanical engineer who publicly documented his journey from idea to launch. Or SushiSwap, which emerged from a community-driven fork with clear leadership. Libre Swap has none of that. It’s a black box.

That lack of accountability isn’t “decentralized.” It’s irresponsible.

How It Compares to Real Decentralized Exchanges

Here’s how Libre Swap stacks up against actual players in the DeFi space:

| Feature | Libre Swap | Uniswap | Symbiosis Finance |

|---|---|---|---|

| Blockchain | Libre only | Ethereum | Multi-chain (20+) |

| Trading Pairs | 1-2 | 10,000+ | 5,000+ |

| 24h Volume | $0-$54k (unreliable) | $1B+ | $200M+ |

| Smart Contract Audits | None | Yes (multiple) | Yes (CertiK, Hacken) |

| Team Transparency | Anonymous | Public founders | Known team |

| Community Presence | None | Large (Reddit, Twitter, Discord) | Active (Discord, Telegram) |

| KYC Required | No | No | No |

Libre Swap doesn’t just lose - it doesn’t even show up on the scoreboard.

Is Libre Swap Safe to Use?

Technically, yes - if you’re okay with losing your money.

There’s no central authority holding your funds, so you avoid the risk of a centralized exchange freezing your account. But you’re exposed to far greater risks: no liquidity, no audits, no team accountability, no support, and no future roadmap.

If you’re experimenting with crypto and have a small amount of LIBRE tokens you don’t mind losing, you could try swapping them. But don’t deposit Bitcoin or any significant sum. There’s no reason to believe this platform will survive another six months.

Who Should Avoid Libre Swap?

- Anyone who wants to trade Bitcoin or Ethereum reliably

- Investors looking for long-term DeFi exposure

- Users who value transparency and security audits

- People who need customer support or dispute resolution

- Traders who care about slippage and price stability

If you’re a developer curious about the Libre blockchain and want to test a DEX on a new chain - fine. But treat it like a sandbox. Not a bank.

Final Verdict: Don’t Risk It

Libre Swap isn’t a failed exchange. It’s an abandoned experiment. There’s no evidence it’s growing. No user base. No volume. No trust. No future.

The crypto space is full of shiny new projects. Most die quietly. Libre Swap is one of them. It’s not the next Uniswap. It’s not even the next SushiSwap. It’s a one-pair, zero-volume ghost in a blockchain nobody uses.

If you’re looking for a decentralized exchange that actually works, stick with Uniswap, PancakeSwap, or Symbiosis. They’re proven, audited, and active. Libre Swap? Save your time. Save your crypto.

Is Libre Swap a scam?

There’s no proof Libre Swap is a scam - but there’s plenty of proof it’s inactive. No audits, no team, no volume, no community. These aren’t red flags - they’re full-blown warning signs. A legitimate project would have at least one of these. Libre Swap has none.

Can I trade Bitcoin on Libre Swap?

Technically, yes - but only as a wrapped version called pBTC. You can’t deposit real Bitcoin. You need to convert it into pBTC first, which requires using another bridge or exchange. And even then, liquidity is so thin that your trade could fail or cost you 30% in slippage.

Is Libre Swap better than centralized exchanges like Kraken?

No. Kraken supports over 450 cryptocurrencies, has $1 billion+ daily volume, offers margin trading, has a 24/7 support team, and is regulated in multiple countries. Libre Swap supports one pair, has near-zero volume, no support, and no regulation. The comparison isn’t fair - it’s like comparing a bicycle to a jet.

Why doesn’t Libre Swap have any user reviews?

Because there are no users. If people were trading on it regularly, you’d see discussions on Twitter, Reddit, or crypto forums. You’d see YouTube tutorials. You’d see complaints about bugs or withdrawals. You’d see anything. The silence speaks louder than any review.

Will Libre Swap ever become popular?

It’s unlikely. The Libre blockchain itself has no adoption outside of this one exchange. Without real-world use cases, developers, or partnerships, the ecosystem won’t grow. And without ecosystem growth, no DEX can survive. Libre Swap is a house built on sand.

Comments (9)

- Sam Daily

- November 27, 2025 AT 01:13 AM

Bro this is the definition of a ghost DEX 😅 I tried swapping 0.1 BTC last week and got 0.03 LIBRE back - slippage was wild. Zero liquidity means you’re basically donating to the devs. Don’t waste your time unless you’re into crypto horror stories.

- Kristi Malicsi

- November 28, 2025 AT 20:56 PM

it’s not about whether it works or not it’s about what it represents

no team no audits no voice just code floating in the void

is that decentralization or just abandonment

we keep calling for freedom but when it looks like nothing we run away

maybe the real scam is expecting anything to last

- Rachel Thomas

- November 28, 2025 AT 22:08 PM

lol this is why crypto is dead. Everyone’s so scared of centralized exchanges they’ll use a ghost site with 54k in volume and call it ‘decentralized.’ Wake up. This isn’t blockchain, it’s a .xyz domain and a dream.

- Sierra Myers

- November 30, 2025 AT 04:37 AM

Wait, so you’re telling me there’s no team behind this? No GitHub? No Twitter? No whitepaper even? That’s not DeFi, that’s a crypto fever dream. I’ve seen sketchy projects, but this is like buying a car with no engine and calling it ‘experimental.’

- SHIVA SHANKAR PAMUNDALAR

- November 30, 2025 AT 12:52 PM

Libre Swap is not a failure. It is a mirror. It reflects the emptiness of the entire crypto experiment. We chase decentralization but build nothing but vanity chains with one pair and zero soul. The silence is the audit. The lack of users is the smart contract. This project is the truth we refuse to see.

- Shelley Fischer

- December 1, 2025 AT 10:25 AM

While the tone of this article is appropriately critical, I must emphasize the importance of distinguishing between ‘unregulated’ and ‘unethical.’ Libre Swap, while lacking transparency and liquidity, has not been proven fraudulent. However, the absence of audits, team disclosure, and community engagement renders it functionally unusable for any rational participant in the DeFi ecosystem. Proceed with extreme caution, if at all.

- Puspendu Roy Karmakar

- December 1, 2025 AT 11:00 AM

man i tried this thing last month just to see what happens

sent 0.5 LIBRE to swap for pBTC

it took 3 days and then said ‘transaction failed’

no error code, no email, no reply

just gone

if you’re reading this and thinking ‘maybe it’ll work’ - don’t. just don’t.

- Evelyn Gu

- December 3, 2025 AT 08:50 AM

I just want to say that I totally get why people are skeptical - I mean, zero volume, no team, no audits, no GitHub commits in over a year, and yet somehow the website still loads with a sleek UI and a ‘Join the Revolution’ banner? It’s like someone took a template from Webflow, threw in a few blockchain buzzwords, and called it a day - and honestly, that’s the saddest part. It’s not even malicious, it’s just… lazy. Like someone built a restaurant with no kitchen and is still selling menus. The real tragedy isn’t that people lost money - it’s that someone thought this was worth building at all.

- Tony spart

- December 4, 2025 AT 22:38 PM

usa made the internet. usa made crypto. now some indian dev with a .xyz domain thinks he can out-decentralize us? nah. this is why america needs to stop letting foreigners build our financial future. if this was made in texas with a team and a patent, you’d all be begging to invest. but nope - anonymous? no audits? just delete it.