WMD Funding Impact Calculator

How Stolen Crypto Funds Weapons

Based on United Nations reports and U.S. intelligence, every $1 billion stolen from cryptocurrency directly funds North Korea's weapons programs. Calculate what these funds could purchase:

Each test costs approximately $8.3 million

Each warhead costs approximately $100 million

Monthly food for North Korean citizens ($220/person)

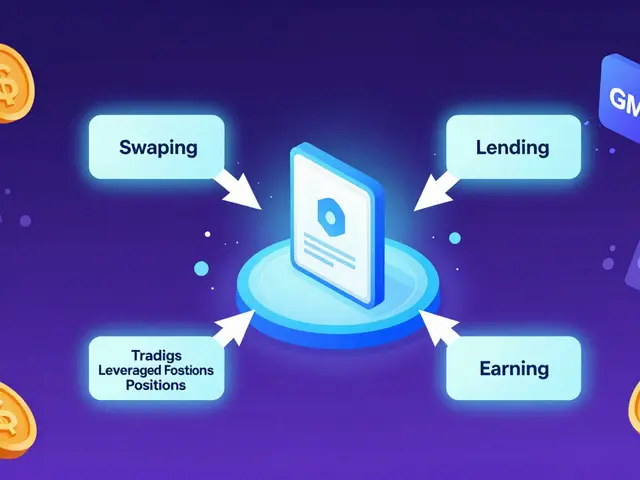

How the Money Moves

Stolen funds are laundered through mixers, privacy coins, and blockchain transactions. The U.S. Treasury has frozen $40M in identified addresses, but only 1% of stolen funds are currently tracked.

North Korea doesn’t need to sell oil or export labor to fund its nuclear weapons. It doesn’t even need to trade with the outside world. All it needs is a computer, a team of hackers, and a few thousand lines of malicious code. Since 2017, the regime has stolen over $3 billion in cryptocurrency - money that’s directly feeding its missile tests, nuclear warheads, and chemical weapons programs.

The Real Weapon Isn’t the Bomb - It’s the Hack

Most people think of North Korea’s military threat in terms of missiles and nukes. But the real engine behind its arsenal isn’t factories or mines. It’s cybercrime. The country’s primary foreign intelligence agency, the Reconnaissance General Bureau, runs a global network of hackers who don’t steal bank accounts - they steal crypto wallets. These aren’t random criminals. They’re state-sponsored operatives with military training, working under direct orders from Pyongyang. The Lazarus Group, also known as APT38 or TraderTraitor, is the main unit behind these attacks. They’ve hit exchanges, DeFi protocols, and even individual crypto traders. In 2022 alone, they stole $620 million from the Axie Infinity Ronin bridge. In 2024, they targeted Bybit, one of the world’s largest crypto exchanges, draining hundreds of millions more. Each heist follows the same pattern: infiltrate, steal, launder, cash out.How They Steal: Social Engineering Over Brute Force

Forget Hollywood-style hacking scenes with flashing screens and rapid typing. North Korean hackers rarely crack passwords or exploit zero-days. Instead, they exploit people. They pose as Canadian IT consultants. They apply for jobs at crypto startups using fake LinkedIn profiles and forged diplomas from non-existent universities. They do video interviews in perfect English, sometimes even using voice modulators to sound American or British. Once hired, they gain access to internal systems - then quietly copy private keys or seed phrases. Some even create fake developer accounts to sneak malicious code into open-source projects. One common tactic? Supply chain attacks. They compromise a popular crypto wallet plugin or a blockchain analytics tool. Thousands of users download the infected version. Every time someone signs a transaction, the hacker gets a copy of their private key. No need to break into a vault. Just wait for the users to walk right in.The Money Trail: Mixing, Moving, Masking

Stolen crypto doesn’t stay in one place. If it did, blockchain analysts could trace it back to Pyongyang in minutes. So North Korea uses crypto mixers - services that pool stolen funds with clean money, then redistribute them randomly to new wallets. Think of it like laundering cash through a casino: you deposit $100,000 in chips, shuffle them with others, then cash out $100,000 in different bills. No one knows which ones are yours. The FBI has tracked six specific Bitcoin addresses holding over $40 million in stolen funds. These wallets are currently inactive - not because the hackers are done, but because they’re waiting for the right moment to cash out. They’re holding out for a time when regulation is weaker, or when a new exchange in a lax jurisdiction opens up. They know the clock is ticking. The U.S. Treasury has blacklisted dozens of mixers. The UN has sanctioned over 30 crypto addresses linked to North Korea. But the hackers adapt. They use decentralized exchanges, privacy coins like Monero, and even NFT marketplaces to disguise their moves.

Why Cryptocurrency? Because It’s the Only Way Left

International sanctions have choked off North Korea’s traditional funding streams. Banks won’t touch them. Shipping companies won’t carry their goods. Foreign investors won’t touch their bonds. But cryptocurrency? It doesn’t need banks. It doesn’t need borders. It doesn’t need paperwork. That’s why North Korea turned to crypto. It’s the perfect workaround. No SWIFT transfers. No customs inspections. No paper trails. Just digital tokens moving across a global network that’s still too new, too decentralized, and too poorly regulated to stop them. The U.S. State Department calls it “illicit information technology work.” The UN calls it “sanctions evasion.” But the truth is simpler: it’s the only way the Kim regime can keep buying missile fuel, uranium, and plutonium.Who’s Fighting Back - And Why It’s Not Enough

The FBI, Treasury, and Europol are tracking the money. The U.S. has offered up to $15 million for information leading to the arrest of key hackers. South Korea and Japan have formed joint cyber units. In 2024, the Justice Department charged nine individuals in connection with crypto theft tied to North Korea’s WMD program. But the scale of the problem dwarfs the response. There are an estimated 5,000 North Korean cyber operatives working globally - many embedded in legitimate tech companies. The U.S. has fewer than 100 analysts focused solely on tracking North Korean crypto flows. And every time a new DeFi protocol launches, it’s another blind spot. Even when exchanges freeze stolen funds, the hackers just move to another platform. When a mixer is shut down, they build a new one. When a wallet is flagged, they split the funds across hundreds of micro-wallets. It’s a game of whack-a-mole - and North Korea has an endless supply of moles.

The Bigger Picture: A New Kind of Warfare

This isn’t just about money. It’s about power. North Korea is proving that a small, isolated country can threaten the global financial system with nothing but code. While the U.S. spends billions on fighter jets and aircraft carriers, North Korea spends its resources on hackers - and those hackers are doing more damage than any missile ever could. The regime doesn’t need to launch a nuclear strike to destabilize the world. It just needs to keep stealing crypto. Each heist weakens investor confidence in digital assets. Each laundering operation undermines global financial oversight. Each successful attack emboldens other rogue states - Iran, Russia, Venezuela - to follow suit. And the trend is only getting worse. As crypto adoption grows, so does the attack surface. More wallets. More exchanges. More smart contracts with hidden flaws. More opportunities for North Korean hackers to slip in unnoticed.What Can Be Done?

There’s no magic fix. But there are steps that can slow them down:- Exchanges must implement real-time transaction monitoring using AI tools trained on known North Korean wallet patterns.

- Wallet providers should require multi-party authentication for large transfers - no single person should control a seed phrase.

- Regulators need to classify crypto mixers as high-risk financial services and shut down unlicensed ones globally.

- Companies hiring remote developers should verify identities with government-issued biometrics - not just Zoom interviews.

- International cooperation must improve. Right now, North Korea exploits gaps between countries’ laws. One nation’s loophole is another’s open door.

How much money has North Korea stolen from cryptocurrency?

Between 2017 and 2023, North Korea stole an estimated $3 billion in cryptocurrency, according to United Nations reports and U.S. intelligence assessments. The majority of these thefts occurred through hacking attacks on crypto exchanges, DeFi platforms, and individual wallets. In 2022 and 2023 alone, over $1.2 billion was stolen in just two years.

Who are the Lazarus Group and APT38?

The Lazarus Group and APT38 are the same North Korean state-sponsored hacking team. They operate under the Reconnaissance General Bureau, North Korea’s main intelligence agency. They’ve been responsible for major crypto heists including the $620 million Ronin Bridge attack, the $100 million Harmony Bridge hack, and multiple attacks on Bybit and KuCoin. Their attacks are highly organized, well-funded, and directly tied to funding Pyongyang’s weapons programs.

How do North Korean hackers avoid getting caught?

They use crypto mixers to obscure transaction trails, split funds across hundreds of wallets, and convert stolen crypto into privacy coins like Monero. They also rely on social engineering - posing as legitimate developers or IT staff to gain access to corporate systems. Many operate from countries with weak cybersecurity enforcement, making arrests nearly impossible.

Why can’t the U.S. just freeze all North Korean crypto wallets?

Because most stolen crypto is no longer in the original wallet. It’s been mixed, moved, and fragmented across thousands of addresses. Even when one wallet is frozen, the hackers have already moved the money. Plus, many wallets are held by innocent third parties who unknowingly received stolen funds. Freezing them would hurt ordinary users and could destabilize markets.

Is cryptocurrency itself to blame for these thefts?

No. Cryptocurrency isn’t the problem - weak security, poor regulation, and unverified identities are. The same hackers could steal from banks, but they’d face stricter controls. Crypto’s decentralized nature makes it easier to move money without oversight. But the technology itself is neutral. The issue is how it’s used - and by whom.