For centuries, owning something meant paper deeds, notary stamps, and weeks of paperwork. If you wanted to buy a piece of real estate, you needed lawyers, banks, and intermediaries at every step. Now, imagine owning 1% of a Manhattan apartment for $100-no middlemen, no delays, no bureaucracy. That’s not science fiction. It’s happening today, and it’s changing everything about what ownership really means.

What Digital Asset Ownership Actually Is

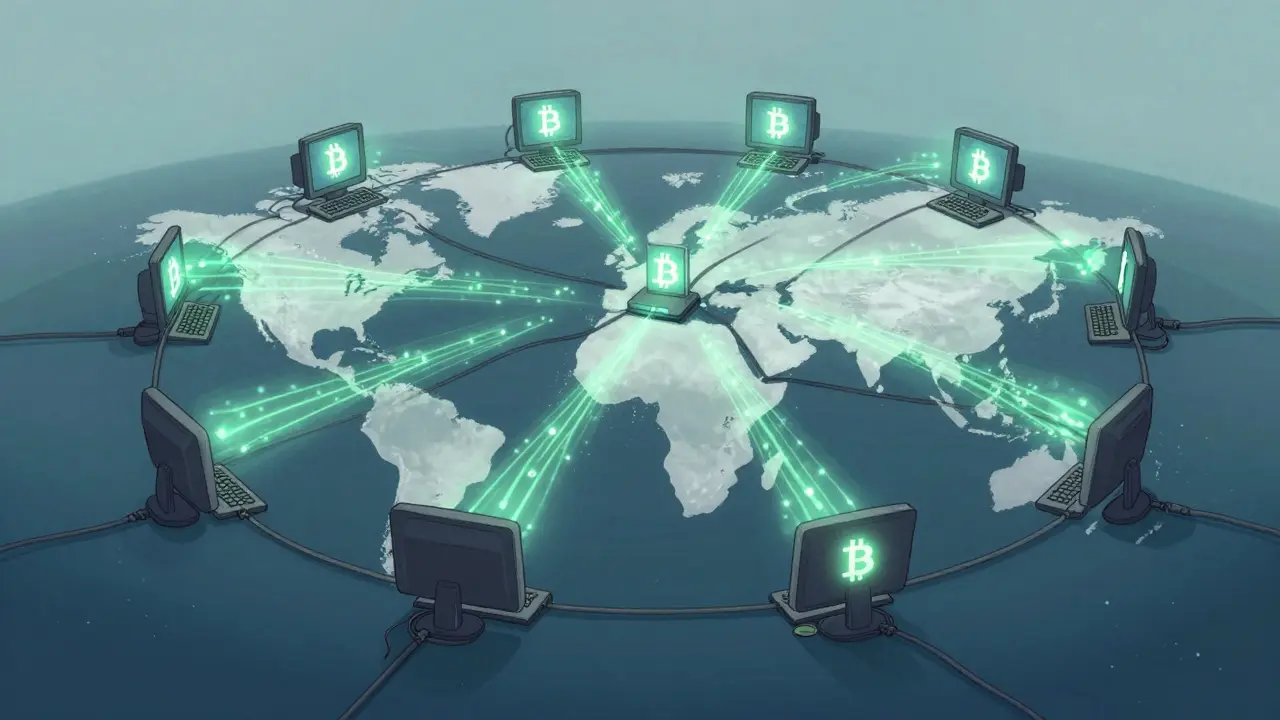

Digital asset ownership isn’t just about buying Bitcoin or an NFT of a pixelated ape. It’s about using blockchain technology to prove you own something-anything-and transfer that ownership instantly, securely, and without third parties. This includes real estate, stocks, art, music rights, even shares in a startup. The core idea is simple: instead of relying on a central authority like a bank or government registry to confirm your ownership, you hold a cryptographic key that proves it on a public, unchangeable ledger. Ethereum, launched in 2015, made this practical by introducing smart contracts-self-executing code that automatically enforces rules. Want to split ownership of a building among 500 people? A smart contract handles the math, distributes rental income, and tracks who owns what-no human needed. That’s the power. And it’s not theoretical. Platforms like Real Estate Metaverse (REM) already let people buy fractions of properties starting at $100, with income paid directly to their wallets every month.Why Institutions Are Moving Fast

You might think only crypto enthusiasts care about this. But the real shift is happening in boardrooms. As of early 2025, 86% of institutional investors-pension funds, hedge funds, private equity firms-are either already invested in digital assets or plan to be within the year. And 59% of them intend to put more than 5% of their total assets into them. Why? Because the numbers don’t lie. Traditional securities settle in 2-3 days. Digital assets settle in under 30 seconds. The cost? A few cents per transaction versus $15-$50 in legacy systems. That’s not just efficiency-it’s billions saved annually across global markets. BlackRock, JPMorgan, and other giants aren’t just watching. They’re building. BlackRock plans to launch tokenized private equity funds in February 2026 with minimum investments of $1,000. Compare that to the traditional $250,000 minimum. Suddenly, everyday investors get access to assets once reserved for the ultra-rich.Tokenized Real-World Assets Are the Real Story

Most people still think of digital assets as cryptocurrencies. But the fastest-growing segment isn’t Bitcoin or Ethereum. It’s tokenized real-world assets-RWAs. These are physical things like buildings, farmland, infrastructure, or even fine art, converted into digital tokens on a blockchain. Boston Consulting Group forecasts the RWA market will hit $16 trillion by 2030. That’s three times the projected value of pure cryptocurrencies. Why? Because these assets were previously locked up-illiquid, hard to divide, expensive to trade. Tokenization changes that. A single office tower can be split into 10,000 tokens. Each token represents a tiny ownership stake. People can buy, sell, or trade them 24/7, like stocks. No more waiting for quarterly fund reopenings or dealing with complex legal paperwork. And it’s not just real estate. Think music royalties, carbon credits, fine wine collections, even intellectual property. All of it can now be owned fractionally, traded globally, and tracked transparently.

The Tech Behind It: Who’s Leading?

Not all blockchains are equal. Ethereum still dominates, handling 56.3% of all tokenized asset transactions as of early 2025. But it’s not alone. Solana, with its speed and low fees, now holds 18.7% of the market. Polygon, focused on scaling and compatibility, has 12.1%. Each platform has trade-offs: Ethereum is secure but slow and expensive during peak times; Solana is fast but has had outages; Polygon is cheap but less decentralized. The real innovation isn’t just the blockchain-it’s the protocols built on top. ERC-3643 (T-ReX) lets institutions issue regulated security tokens with built-in compliance rules. ERC-6551 turns NFTs into smart wallets, meaning your digital artwork can now hold other assets, pay rent, or even execute trades on its own. That’s not just ownership-it’s autonomy. Custody has also evolved. Sixty-three percent of institutions now use multi-party computation (MPC) wallets. Instead of one key that can be stolen, MPC splits the key across multiple devices and people. No single point of failure. Combine that with institutional cold storage (used by 76% of firms) and insurance policies averaging $250 million per custodian, and you’ve got a security model that’s more robust than most banks.The Dark Side: Regulation, Risk, and Reality

This isn’t a utopia. The biggest hurdle isn’t technology-it’s regulation. In the U.S., the SEC under Chairman Mark Uyeda is working on “Project Crypto,” aiming to clarify what counts as a security, create a legal framework for tokenized assets, and open innovation pathways. But until rules are consistent, institutions hesitate. Globally, it’s chaos. China bans all crypto ownership. India taxes digital asset gains at 30%. The EU’s MiCA regulation, which took full effect in January 2025, brings clarity-but only within its borders. There are 47 different regulatory frameworks across major economies. That’s a nightmare for global investors. Then there’s the risk of loss. Unlike traditional stocks, which are protected by SIPC insurance up to $500,000, digital assets have no safety net. If you lose your private key, or your exchange gets hacked, you’re out of luck. The $2.1 billion FTX collapse showed how fragile trust can be when custody isn’t standardized. And tax reporting? A nightmare. One Reddit user said their tax complexity increased 300% compared to traditional assets. Tracking every trade, every airdrop, every staking reward across multiple chains is a job for specialists-not your average CPA.

Who’s Winning and Who’s Getting Left Behind

The market is splitting into three camps. First, traditional finance: JPMorgan, BlackRock, and others are using their brand, capital, and client base to dominate institutional adoption. They’re not building blockchains-they’re buying custody providers and integrating tokenized assets into existing platforms. Second, blockchain-native firms like Anchorage and Fireblocks. They’re the engineers behind the scenes, offering secure custody, compliance tools, and infrastructure. They hold 33% of the institutional market share. Third, tech giants. Google and Amazon are quietly entering with cloud-based blockchain services. They don’t care about crypto-they care about selling compute power, storage, and APIs to institutions that need to run nodes and manage digital assets at scale. Retail investors? They’re still mostly chasing speculative tokens. But the real opportunity isn’t in buying Dogecoin. It’s in owning a slice of a warehouse in Texas, a solar farm in Arizona, or a patent portfolio. That’s where the value is being built.What You Need to Know to Get Started

If you’re an individual investor, you don’t need to run a node or audit smart contracts. But you do need to understand what you’re buying. Look for platforms that offer tokenized real-world assets with clear legal backing, regulated custody, and transparent income distribution. Avoid anything that sounds like a “guaranteed return” or “risk-free crypto.” If it’s too good to be true, it is. For businesses, the path is clearer but harder. Implementing digital asset ownership takes 6-9 months and costs an average of $2.3 million. You need: custody solutions (hybrid models are safest), blockchain integration with your existing systems, compliance automation tools (regtech platforms cost around $280,000 a year), and staff trained in blockchain architecture and tax law. Demand for these skills has jumped 320% since 2020. The learning curve is steep. But the cost of waiting is higher. By 2030, 89% of institutional investors expect digital asset ownership to be fully integrated into mainstream finance. That means your portfolio, your business, and your money will be affected-whether you’re ready or not.What’s Next: The Next Five Years

Look ahead to 2026. The U.S. Federal Reserve will pilot a wholesale Central Bank Digital Currency (wCBDC), allowing banks to settle trillions in seconds. BlackRock’s tokenized funds will go live. More real estate, private equity, and even government bonds will be tokenized. By 2030, experts predict digital assets will make up 15-20% of all global financial assets-up from just 3.2% today. This isn’t a side project. It’s the foundation of the next financial system. Ownership will no longer be tied to paper, geography, or gatekeepers. It will be digital, global, and programmable. The question isn’t whether this will happen. It’s whether you’ll be part of it-or watching from the sidelines.Can I really own a fraction of a building with digital assets?

Yes. Platforms like Real Estate Metaverse (REM) and others allow you to buy tokens representing ownership stakes in real property, starting as low as $100. Each token entitles you to a proportional share of rental income and potential appreciation. These tokens are backed by legal agreements and recorded on a blockchain for transparency and security.

Are digital assets safer than traditional investments?

It depends. On the technology side, blockchain is more secure than paper records-it can’t be altered or forged. But if you lose your private key or use an unregulated exchange, you can lose everything with no recourse. Traditional assets benefit from legal protections like SIPC insurance; digital assets generally don’t. Institutional-grade custody (MPC wallets, cold storage, insurance) reduces risk significantly, but retail investors must be extra cautious.

Why are institutions investing so heavily now?

Institutions see digital assets as a way to cut costs, speed up settlement, unlock liquidity in illiquid assets, and create new revenue streams. Tokenized real estate, private equity, and bonds can be traded 24/7 with near-instant settlement and fees under $0.15 per transaction-compared to days and $50+ in traditional systems. The efficiency gains are massive, and the market is growing fast.

What’s the difference between crypto ownership and tokenized asset ownership?

Crypto ownership means holding a native cryptocurrency like Bitcoin or Ethereum-its value is speculative and tied to market sentiment. Tokenized asset ownership means holding a digital representation of a real-world asset-like a share of a building, a bond, or a stock. These tokens derive value from the underlying asset, not just speculation. Tokenized assets are more stable, regulated, and tied to tangible economic value.

Is digital asset ownership legal in the U.S.?

Yes, but it’s complicated. The U.S. doesn’t have a single, unified law yet. The SEC regulates tokenized assets as securities if they meet certain criteria. The GENIUS Act (2024) started creating a framework, and MiCA in the EU provides clearer rules. As long as you’re buying regulated, compliant tokenized assets through approved platforms, it’s legal. But unregulated tokens or exchanges carry legal risk.

Will digital assets replace traditional ownership?

Not replace-augment. Paper deeds and stock certificates won’t vanish overnight. But for new investments, especially in real estate, private equity, and funds, digital ownership will become the default. It’s faster, cheaper, and more accessible. Over the next decade, most new financial products will be issued as digital assets. Legacy systems will remain for existing holdings, but new capital will flow through blockchain.

Comments (5)

- Dave Lite

- January 10, 2026 AT 06:06 AM

Bro, ERC-6551 is the real game-changer-your NFT isn't just a JPEG anymore, it's a smart wallet that can pay rent, collect royalties, and even auto-sell if the floor drops. I've got a Bored Ape that's now generating passive income from a tokenized NYC loft I co-own. No middlemen, no delays, just code doing the work. The future isn't just digital-it's autonomous.

And MPC wallets? Absolute must-have for anyone holding more than a few grand. Split keys across devices, no single point of failure. I use Anchorage-zero drama, zero hacks. If you're still using a MetaMask on your phone for serious assets, you're playing Russian roulette with your portfolio.

- Becky Chenier

- January 11, 2026 AT 05:00 AM

It’s fascinating how this shift redefines ownership beyond just technology-it’s about access, equity, and inclusion. I’ve watched my cousin in rural Ohio buy a 0.03% stake in a wind farm through a regulated platform. She now gets quarterly payouts. That’s not speculation. That’s economic participation.

Still, the regulatory patchwork is terrifying. One day you’re compliant, the next you’re in legal limbo. We need harmonized global standards-not more bureaucracy, but clarity. The tech is ready. The law isn’t.

- Tracey Grammer-Porter

- January 12, 2026 AT 07:15 AM

okay so i just bought my first tokenized asset yesterday-a 0.1% slice of a solar farm in nevada for $120 and honestly i’m still in shock

no lawyers, no paperwork, just a link and a wallet

and now i get paid every month like clockwork

i didn’t even know this was possible until last week

who knew you could own part of the future for less than a pizza?

also i have no idea how taxes work here but i’m googling it rn lol

- sathish kumar

- January 13, 2026 AT 04:34 AM

While the technological advancements in blockchain-based asset tokenization are undeniably profound, one must not overlook the critical imperative of legal harmonization across jurisdictions. The current fragmentation of regulatory frameworks-ranging from outright prohibition in China to punitive taxation in India and the nascent but fragmented compliance regimes in the United States-creates substantial systemic risk for global capital allocation.

Furthermore, the absence of universally recognized legal personhood for smart contracts and the lack of standardized dispute resolution protocols for tokenized asset disputes remain significant impediments to institutional adoption. Until these foundational legal infrastructures are established, the economic promise of tokenization will remain partially unrealized, regardless of technical sophistication.

- jim carry

- January 14, 2026 AT 20:45 PM

I LOST EVERYTHING. I trusted a "regulated" platform. They said it was insured. They lied. My $47,000 in tokenized farmland? Gone. No SIPC. No recourse. The CEO vanished. The blockchain didn’t care. I cried for three days. I’m not even mad anymore-I’m just hollow.

They told me "ownership is yours." But what does that mean when the only thing you own is a private key and a prayer?

I used to believe in this. Now I just see ghosts in the ledger.

Post-Comment

Categories

Popular Articles