Trading crypto without a middleman sounds like science fiction - but it’s real, and it’s called a decentralized exchange. Unlike Coinbase or Binance, where you hand over your keys and trust a company to hold your money, a DEX lets you trade directly from your wallet. No forms. No KYC. No bank account needed. Just you, your seed phrase, and a blockchain.

But if you’ve ever tried to swap ETH for USDC on Uniswap and ended up paying $4 in gas for a $25 trade, you know it’s not as simple as clicking ‘Buy.’ This isn’t just about tech - it’s about understanding gas fees, slippage, and why your transaction keeps failing. Let’s fix that.

What Exactly Is a Decentralized Exchange?

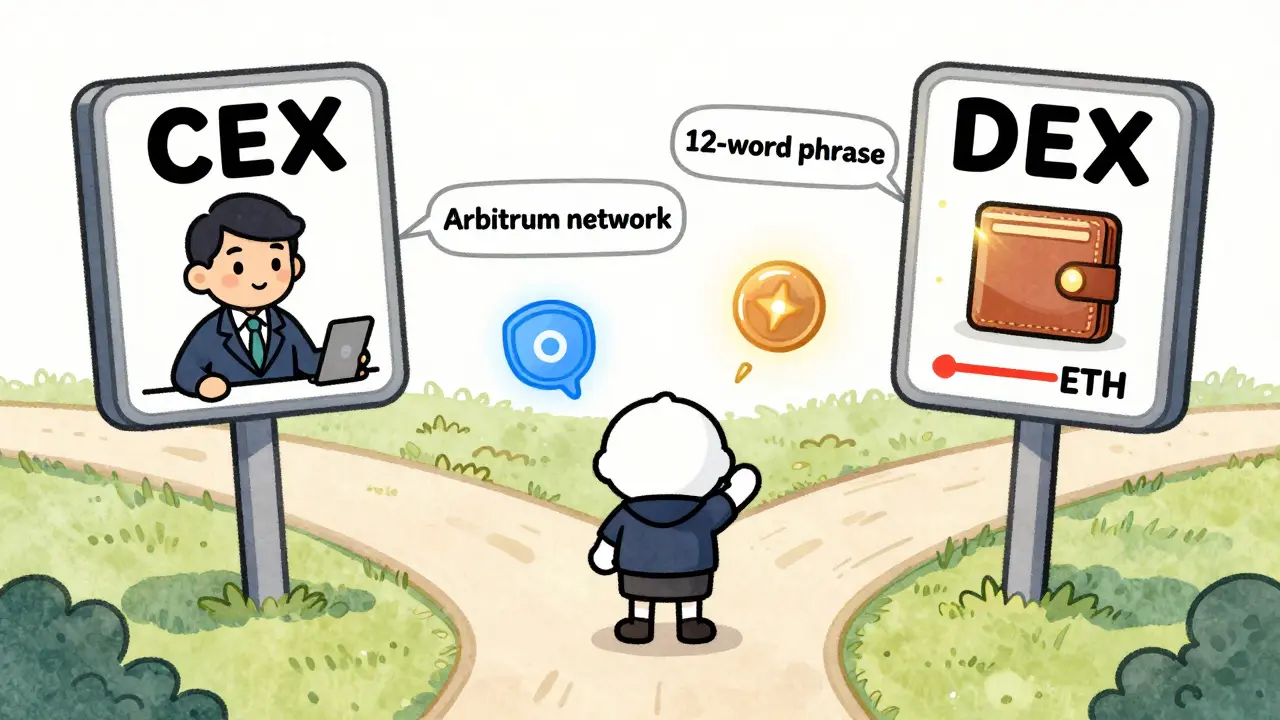

A decentralized exchange, or DEX, is a platform where you trade crypto without giving up control of your funds. There’s no company storing your coins. Instead, smart contracts - self-executing code on blockchains like Ethereum - handle every swap automatically.

The most popular DEX is Uniswap, which launched in 2018. Today, it handles over 60% of all DEX trading volume. Others like PancakeSwap (on BNB Chain) and Curve (for stablecoins) are also widely used. These platforms don’t match buyers and sellers like a stock exchange. Instead, they use liquidity pools - groups of tokens locked in smart contracts that let you trade instantly.

Why does this matter? Because if a centralized exchange gets hacked - like Mt. Gox in 2014 or FTX in 2022 - your money can vanish. On a DEX, your funds never leave your wallet. If the DEX goes down, your crypto is still safe. You just need to reconnect your wallet later.

What You Need Before You Start

You can’t use a DEX with a regular bank account or a Coinbase wallet. You need three things:

- A Web3 wallet - MetaMask is the most common. Others include Trust Wallet, Coinbase Wallet, or Phantom (for Solana). These wallets store your private keys and let you sign transactions.

- Native blockchain tokens - To pay for gas fees. If you’re on Ethereum, you need ETH. On BNB Chain, you need BNB. On Solana, you need SOL. You can’t pay gas in USDC or any other token - only the chain’s native currency.

- A crypto token to trade - You need something to swap. ETH, USDC, or even a new meme coin - as long as it’s on the same blockchain as your wallet.

Most beginners make the mistake of installing MetaMask but forgetting to fund it with ETH. If your wallet has $500 in USDC but $0 in ETH, you can’t trade. Ever. You’ll see an error like ‘insufficient funds for gas.’ That’s not a glitch - it’s how blockchains work.

Step-by-Step: How to Swap Tokens on a DEX

Here’s how to make your first trade on Uniswap (the most common DEX). The steps are similar on other platforms like PancakeSwap or SushiSwap.

- Install and set up your wallet - Download MetaMask from metamask.io. Create a new wallet. Write down your 12-word recovery phrase - and never share it. Set a strong password.

- Fund your wallet with ETH - Buy $10-$20 worth of ETH on a centralized exchange like Coinbase, then send it to your MetaMask wallet address. Don’t send other tokens to a MetaMask ETH address - you’ll lose them.

- Go to Uniswap.org - Always type the URL yourself. Fake sites like uniswap.app or uniswap.exchange are phishing traps. Bookmark the real one.

- Connect your wallet - Click ‘Connect Wallet’ in the top-right corner. Select MetaMask. Confirm the connection in your wallet app. You’ll see your wallet address appear.

- Select your tokens - In the ‘From’ field, pick the token you want to trade (e.g., ETH). In the ‘To’ field, pick what you want (e.g., USDC). Uniswap supports over 386,000 tokens - so if you don’t see it, paste the token contract address.

- Set your slippage tolerance - Slippage is the difference between the price you see and the price you get. For stablecoins like USDC, 0.5% is fine. For new tokens or volatile coins, set it to 1-3%. Too low? Your trade fails. Too high? You get ripped off.

- Click ‘Approve’ (if needed) - If you’re swapping a token you haven’t used before (like a new meme coin), Uniswap will ask you to ‘approve’ it to spend your tokens. This is a separate transaction. Pay the gas fee. Wait for it to confirm.

- Click ‘Swap’ - Review the amount you’re trading and the estimated output. Click ‘Swap’. Confirm in your wallet. Wait 15-30 seconds. You’ll see a transaction hash - that’s your proof it went through.

- Check your balance - Refresh your wallet. Your old token should be gone. Your new token should appear. Done.

Pro tip: If your swap fails, it’s almost always because your slippage was too low or you didn’t have enough ETH for gas. Increase slippage to 2% and try again.

Why Do Transactions Fail So Often?

According to a CoinGecko survey of over 5,000 DeFi users, 63% needed 3-5 tries before successfully completing their first DEX trade. The top reasons?

- Insufficient gas (42% of failures) - You didn’t have enough ETH to cover the fee. Always keep at least 0.01 ETH in your wallet.

- Slippage too low (29%) - You set it to 0.1%, but the price moved during the trade. Set it to 1-3% for new tokens.

- Wrong network - You connected MetaMask to Ethereum, but the token is on BNB Chain. Switch networks in your wallet settings.

- Expired transaction - You waited too long to confirm. Transactions time out after 10-15 minutes.

There’s no customer service to call. No chatbot. No email support. If your transaction fails, you either fix the settings or wait. That’s the trade-off for being in control.

Gas Fees: The Hidden Cost

Gas fees are the price you pay to use the blockchain. On Ethereum, they vary wildly. During quiet hours, you might pay $0.50. During a crypto rally, it can hit $20 or more.

Here’s the reality: If you’re swapping under $50 on Ethereum mainnet, you’re losing money to fees. That’s why Layer 2 solutions like Arbitrum and Optimism exist. They’re built on top of Ethereum but charge 90% less. A $50 swap on Arbitrum costs $0.15 in gas - not $4.

Switching to Arbitrum is easy:

- In MetaMask, click the network dropdown (it says ‘Ethereum Mainnet’).

- Select ‘Arbitrum One’.

- If it’s not listed, add it manually using the RPC details from arbiscan.io.

- Send a small amount of ETH from Ethereum to Arbitrum using the bridge on arbitrum.io.

Now you can use Uniswap on Arbitrum. Fees stay under $0.50. Your trades work. Your wallet doesn’t cry.

What About Liquidity Pools and Impermanent Loss?

If you’re just trading, you don’t need to worry about this. But if you want to earn fees by adding your tokens to a pool - say, 50% ETH and 50% USDC - you need to understand impermanent loss.

It’s not a loss until you withdraw. But if the price of ETH goes up 30% while you’re in the pool, you’ll end up with less ETH than if you’d just held it. That’s impermanent loss. It’s not a scam - it’s math.

According to TokenLogic’s July 2024 analysis, liquidity providers in volatile pairs lose an average of 5.2% over 30 days with 20% price swings. But they earn 8-12% in trading fees. So if you’re patient and pick stable pairs (like USDC/DAI), you can break even or profit.

Don’t add liquidity to new tokens unless you’re prepared to lose money. Stick to well-established pairs: ETH/USDC, WBTC/ETH, or USDC/DAI.

DEXs vs. Centralized Exchanges: What’s the Real Difference?

Here’s a quick comparison:

| Feature | Decentralized Exchange (DEX) | Centralized Exchange (CEX) |

|---|---|---|

| Control of funds | You hold your keys | Exchange holds your keys |

| Privacy | No KYC required | Government ID needed |

| Fees | 0.3% trading fee + gas | 0.1-0.6% flat fee |

| Speed | 15-30 seconds on Ethereum, under 1 second on Solana | Instant |

| Available tokens | Thousands of new tokens on day one | Only approved coins |

| Customer support | None | 24/7 chat, email, phone |

| Advanced orders | None (no stop-loss, limit orders) | Full order types available |

Use a CEX if you’re new, want to buy crypto with a credit card, or need to cash out fast. Use a DEX if you want to trade new tokens, avoid banks, or hold your own keys long-term.

What’s Next for DEXs?

DEXs aren’t standing still. Uniswap V4, launching in late 2024, will let developers build custom trading pools - think of it like building your own mini-exchange inside Uniswap. Ethereum’s Dencun upgrade already slashed Layer 2 fees by 90%.

Wallets are getting smarter too. Account abstraction (ERC-4337) will let you pay gas in USDC instead of ETH. You’ll be able to batch multiple trades into one click. No more approving tokens one by one.

By 2026, experts predict DEXs will handle 35-40% of all crypto trading volume - up from 15-20% today. The barrier isn’t tech anymore. It’s user experience. And that’s being fixed.

Frequently Asked Questions

Can I use a DEX without ETH?

No. Every blockchain needs its native token to pay for gas. On Ethereum, you need ETH. On BNB Chain, you need BNB. On Solana, you need SOL. You can’t pay fees in USDT, USDC, or any other token. Always keep at least 0.01 ETH (or equivalent) in your wallet for small trades.

Are DEXs safe?

Yes - if you use trusted platforms like Uniswap, PancakeSwap, or Curve, and you never share your seed phrase. The smart contracts are open-source and audited. But fake DEX websites are everywhere. Always type the URL yourself. Bookmark it. Never click links from Twitter or Telegram. If you send your funds to a scam site, there’s no way to get them back.

Why is my transaction stuck?

It’s not stuck - it’s waiting. Ethereum can take 15-60 seconds to confirm. If it’s been over 10 minutes, your gas fee was too low. You can speed it up by ‘canceling’ the transaction in MetaMask and resending it with a higher gas fee. Or just wait. It will eventually fail and your tokens will return to your wallet.

Can I trade Bitcoin on a DEX?

Not directly. Bitcoin runs on its own blockchain. But you can trade wrapped Bitcoin (WBTC) - a token that represents 1 BTC on Ethereum. WBTC is fully backed and audited. You can swap WBTC for ETH or USDC on Uniswap. Just remember: you’re not trading Bitcoin - you’re trading a token that mirrors it.

What’s the best DEX for beginners?

Start with Uniswap on Arbitrum. It’s simple, cheap, and reliable. Use MetaMask. Fund it with 0.02 ETH. Swap ETH for USDC. That’s your first trade. Once you’re comfortable, explore PancakeSwap on BNB Chain for lower fees. Avoid new, unknown DEXs. Stick to the top 5 by volume.

Final Thoughts

Using a DEX isn’t about being a crypto expert. It’s about being careful. You don’t need to understand smart contracts to swap tokens. You just need to know: don’t share your seed phrase, always check the URL, set your slippage to 1-3%, and keep a little ETH in your wallet.

The future of finance isn’t in banks. It’s in wallets. And the first step is learning how to use one.

Comments (9)

- nathan yeung

- January 20, 2026 AT 02:21 AM

Just did my first swap on Uniswap using Arbitrum and it was smooth as butter. $0.12 gas fee for a $100 trade? I’m sold. Why would anyone use mainnet anymore?

- Bill Sloan

- January 20, 2026 AT 09:20 AM

YESSSS!! 🎉 I was stuck for 3 days trying to swap my Shiba Inu tokens until I bumped the slippage to 3% - turned out my wallet was just being a drama queen. Now I’m hooked. DEXs are the future, and I’m here for it. 🚀

- Callan Burdett

- January 21, 2026 AT 00:10 AM

Bro. I just used a DEX for the first time and I didn’t die. I didn’t get hacked. I didn’t cry. I just swapped ETH for USDC and now I feel like a crypto wizard. 🧙♂️✨ This guide saved my sanity. Thank you.

- Dustin Secrest

- January 22, 2026 AT 11:12 AM

The real revolution isn’t the technology - it’s the epistemological shift. We’re moving from trust-based financial intermediaries to verifiable, cryptographic sovereignty. The gas fees? A temporary friction. The loss of customer support? A necessary recalibration of agency. We are not users anymore - we are nodes in a decentralized network of self-ownership. This isn’t finance. It’s ontology in motion.

- Katherine Melgarejo

- January 23, 2026 AT 04:37 AM

So you’re telling me I need to pay in ETH to trade USDC… and there’s no refund button? Cool. Cool cool cool. 😌

- Nishakar Rath

- January 24, 2026 AT 03:23 AM

Everyone’s acting like DEXs are some kind of miracle but let’s be real - 90% of these trades are just rich guys laundering shitcoins through fake liquidity pools. You think Uniswap is decentralized? Nah. It’s just a new way for VCs to front-run you while you’re busy setting slippage. And don’t even get me started on that Arbitrum nonsense - it’s centralized under the hood. Wake up people

- Patricia Chakeres

- January 24, 2026 AT 05:04 AM

Did you know that the ‘Uniswap’ domain was registered by a company linked to a former Coinbase employee? And the ‘Arbitrum’ bridge? Backed by a venture fund that also invested in FTX. This isn’t decentralization - it’s rebranding. Your ‘safe’ wallet? Still just a portal to a system that wants your data, your fees, and your trust. The real decentralization is still years away - if it ever comes.

- Liza Tait-Bailey

- January 25, 2026 AT 15:35 PM

OMG I just realized I sent 0.01 ETH to my MetaMask and forgot to switch to Arbitrum 😭 I was so confused why my swap kept failing… now I feel dumb but also kinda proud I figured it out. Thanks for the guide, you saved me from crying into my coffee ☕️

- Anthony Ventresque

- January 26, 2026 AT 08:06 AM

Just wanted to say - the part about impermanent loss? That’s the most honest thing I’ve read all week. I thought I was getting free money by adding liquidity… turns out I was just giving up potential gains. Not mad, just… enlightened. Maybe I’ll stick to swapping for now. Thanks for keeping it real.