Crypto Updates in July 2025: Airdrops, Exchanges, and Token Trends

When tracking crypto airdrops, free token distributions to eligible wallet holders, often tied to new protocol launches or community milestones. Also known as token giveaways, they’re one of the most direct ways everyday users get exposure to emerging blockchains. In July 2025, the pace of airdrops didn’t slow down—even as market conditions got choppy. Projects like BlockSync, a Layer-2 solution for decentralized identity and NexusChain, a privacy-focused smart contract platform rolled out eligibility checklists that actually worked. No more guessing if your wallet qualified. You knew because the system told you, step by step.

Meanwhile, cryptocurrency exchanges, platforms where users buy, sell, and trade digital assets. Also known as crypto trading platforms, they’re the gateway for most people entering the space. got real about fees and safety. Several top exchanges cut withdrawal fees by up to 40% in July, and two major ones finally added multi-sig cold storage as default. That’s not marketing—it’s infrastructure. Users started asking: Who’s actually securing my assets, not just promising to? The answer mattered more than hype. Tokenomics also shifted. More projects stopped burning tokens just for show. Instead, they tied token supply changes to real usage metrics—like active dApp users or staking participation. That’s a sign of maturity. Not every coin survived, but the ones that did started making sense on paper.

If you were holding any wallet in July 2025—whether it was a hardware device like Ledger or a browser-based one like Phantom—you were likely part of at least one airdrop snapshot. And if you traded on any exchange, you felt the impact of lower fees and faster settlements. This wasn’t a month of wild pumps. It was a month of cleanup. Of fixing what broke. Of rewarding those who stuck around. Below, you’ll find the posts that broke down exactly which airdrops paid out, which exchanges improved most, and which token models actually held up under pressure. No fluff. Just what worked.

Arbidex Crypto Exchange Review: Does This Arbitrage Platform Still Work in 2025?

Arbidex promised automated crypto arbitrage across exchanges in 2018, but it required users to surrender custody of funds. Today, the platform is inactive, its ARX token is nearly worthless, and the model has been rendered obsolete by decentralized alternatives.

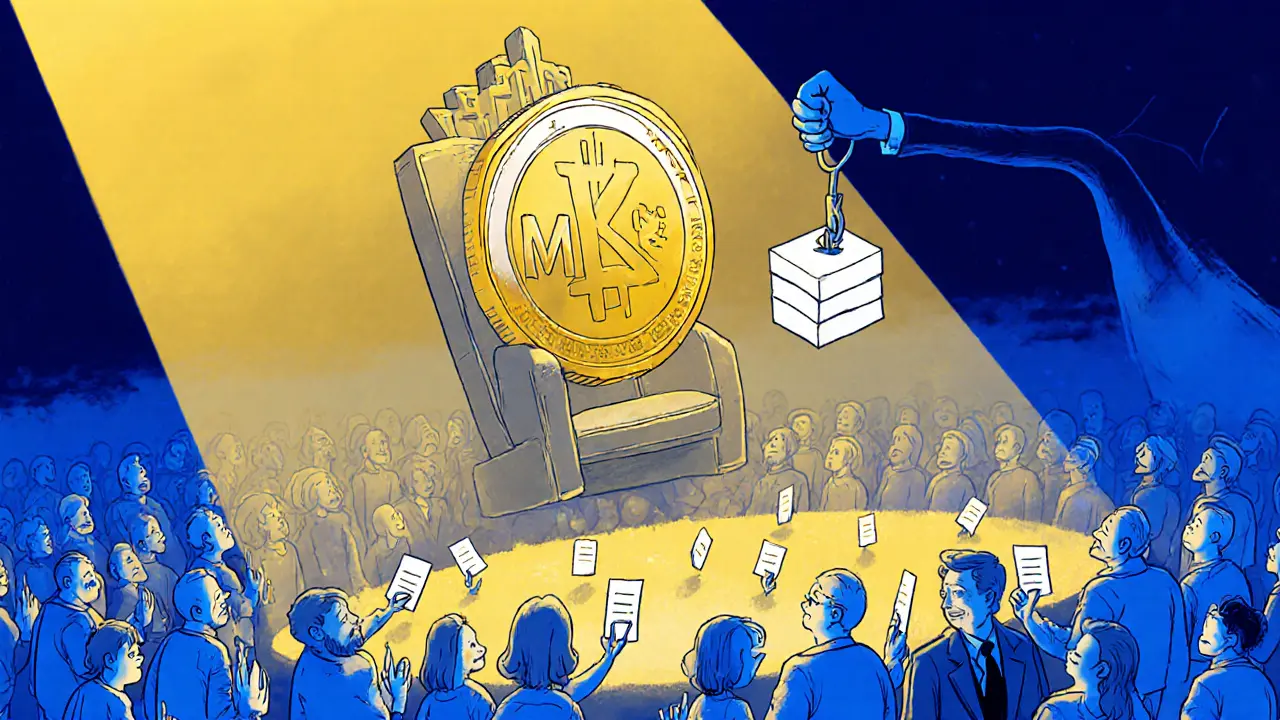

Understanding Governance Token Value in Decentralized Finance

Governance tokens let holders vote on blockchain protocol decisions, but their value is often speculative. Learn how they work, who controls them, and how to turn voting power into real influence.