Crypto Arbitrage Profit Calculator

Calculate Your Potential Arbitrage Profit

Understand if cross-exchange price differences can actually be profitable after fees and transaction time. Based on real-world crypto trading data from 2025.

Back in 2018, Arbidex promised something bold: a crypto exchange that automatically finds and exploits price differences between major exchanges like Kraken, Bittrex, and Bitfinex - all without you lifting a finger. It wasn’t just another trading site. It claimed to be the first platform to aggregate liquidity across exchanges and turn tiny price gaps into profit, sometimes as high as 4-5%. Sounds like magic? Maybe. But today, in late 2025, that magic has faded - and the question isn’t whether Arbidex still works, but whether it ever truly did.

What Arbidex Actually Did

Arbidex wasn’t a traditional exchange where you buy Bitcoin with USD. Instead, it acted like a middleman that connected to other exchanges, scanned for price mismatches, and executed trades automatically. For example, if Bitcoin was trading at $42,000 on Kraken and $42,200 on Bittrex, Arbidex would buy low on Kraken and sell high on Bittrex - pocketing the $200 difference per BTC. This is called arbitrage, and it’s been around since the early days of crypto. But Arbidex said it solved the biggest problem: delays.

Transferring Bitcoin between exchanges takes time. Usually 10-30 minutes. That’s long enough for prices to change and kill your profit. Arbidex claimed its system bypassed that by holding funds in its own wallet, so trades happened instantly. You deposited your crypto into Arbidex, and it did the rest. In theory, this made it faster than any bot you could run yourself.

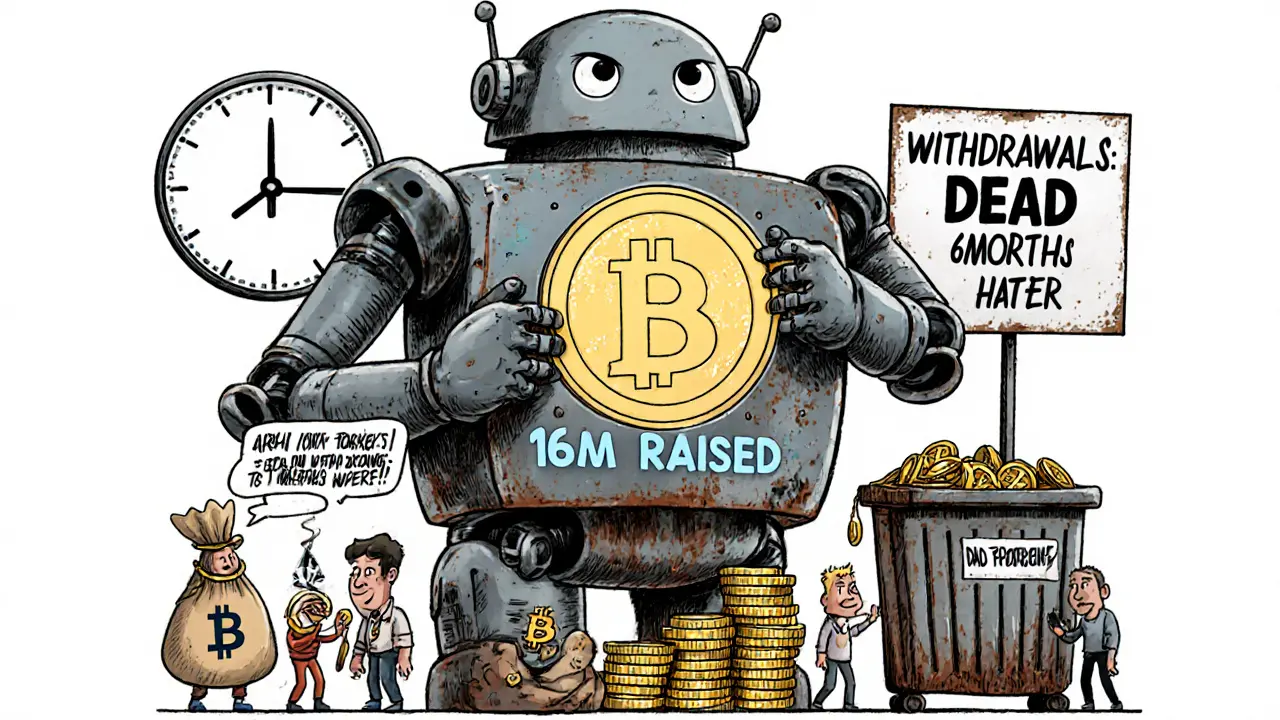

They even had a native token, ARX (originally called ABX), which gave users higher trading limits. Without ARX, you could only do arbitrage trades up to 0.1 BTC. With it, you could go much higher. That created a classic token incentive model - buy the token to unlock better features. And they raised $16 million in their 2018 token sale, hitting their hard cap. At the time, that looked like a big win.

The Catch: You Had to Trust Them

Here’s the problem: to use Arbidex, you had to give up control of your funds. You didn’t just connect your exchange account - you moved your Bitcoin, Ethereum, or other assets into Arbidex’s wallets. And during the token sale period, you couldn’t even withdraw them until after identity verification. That’s a red flag no matter how you slice it.

Imagine handing your keys to a stranger and being told, “We’ll drive your car for you, and you can get it back in six months.” That’s what Arbidex asked users to do. If the platform vanished - or got hacked - your money was gone. No insurance. No recovery. Just silence.

Compare that to today’s top platforms like dYdX or Apex Omni. They let you trade directly from your own wallet. You never give up custody. That’s the whole point of DeFi. Arbidex was built on the opposite idea: centralized control. And in crypto, centralized = risk.

Why It Failed to Deliver

Arbidex’s biggest flaw wasn’t the tech - it was the market. Arbitrage opportunities don’t last long. As soon as a price gap appears, dozens of bots jump on it. By the time Arbidex’s system detected it, the spread was already shrinking. And even if it caught a good one, the transfer delays between exchanges still existed. The platform claimed to solve this, but it didn’t. It just hid the delay by holding your funds.

That’s not innovation. That’s just moving the risk from you to them.

Plus, the crypto world moved on. In 2025, no one’s chasing 4% arbitrage on Bitcoin. The market is too efficient. The real money is in DeFi yield farming, perpetual futures, and decentralized order books - none of which Arbidex offered. Its entire model relied on outdated, volatile conditions that simply don’t exist anymore.

And then there’s the token. ARX hit an all-time high of $13.37 in 2018. Today? It trades around $0.00048. That’s a 99.99% drop. CoinGecko shows almost no trading volume. No major exchange lists it anymore. Even Atomic Wallet, which still lists ARX, doesn’t offer the original arbitrage function - just staking for ETH or SOL. The token is dead.

What Users Said - And Why Nobody Talks About It Now

Back in 2018, BitcoinTalk had some mixed reviews. One user wrote: “If Arbidex overcomes this issue [transfer delays], it will be a great advance.” But they never did. Withdrawal restrictions, low limits without ARX, and no API access made it frustrating for serious traders. The platform never released proper documentation. No technical whitepaper. No public roadmap. Just Medium posts and Twitter updates.

Today? There’s almost nothing. No Reddit threads. No Trustpilot reviews. No YouTube tutorials. Even CryptoRobotics, which once listed ARX as a copy-trading asset with 2,582 trades and 281.6% profit, hasn’t updated its stats in years. That’s not a thriving platform. That’s a ghost.

WhalePortal’s 2025 review of the best decentralized exchanges didn’t mention Arbidex once. Neither did CoinSpot, Cointelegraph, or CoinDesk. The entire industry has moved past it. And that’s the clearest sign of all: no one cares anymore.

Arbidex vs. Modern Alternatives

Let’s put Arbidex next to what’s actually working today:

| Feature | Arbidex (2018) | Apex Omni (2025) | dYdX (2025) | IDEX (2025) |

|---|---|---|---|---|

| Centralized or Decentralized | Centralized | Centralized | Decentralized | Hybrid DEX |

| Custody of Funds | You deposit to them | You deposit to them | You keep your wallet | You keep your wallet |

| Arbitrage Engine | Yes (cross-exchange) | No | No | No |

| Spot Trading Fees | Unknown (claimed low) | 0% | 0.02% maker | 0.15% taker |

| Token Required | Yes (ARX) | No | No | No |

| Current Activity | None | High | High | Active |

Modern platforms like Apex Omni and dYdX don’t need arbitrage engines. They’re fast, cheap, and liquid enough that price gaps barely exist. And they let you trade from your own wallet. That’s why they’re winning.

Arbidex tried to solve a problem that no longer exists. And in doing so, it created a bigger one: trust.

Is Arbidex Worth Using Today?

No.

The platform is effectively dead. The ARX token is worthless. The website may still load, but there’s no evidence of active trading, customer support, or development. Even the price predictions on WeEx.com say ARX will see “0.00% change” in 2025 - meaning it’s not going anywhere.

If you still have ARX tokens, don’t expect to trade them profitably. If you’re looking for arbitrage opportunities, use a decentralized exchange like dYdX or a low-fee centralized platform like Kraken. Run your own bot if you’re technical. But don’t hand your crypto to a platform that hasn’t updated its system in six years.

Arbidex was a product of its time - the wild, unregulated ICO boom of 2017-2018. It promised something exciting, but it never delivered real security, transparency, or sustainability. And now, it’s just another cautionary tale.

What You Should Do Instead

If you want to profit from crypto arbitrage today:

- Use a decentralized exchange like dYdX or IDEX - keep your funds in your wallet.

- Try Apex Omni for zero-fee spot trading and low-cost futures.

- Use tools like 3Commas or CryptoHopper to run your own arbitrage bots across multiple exchanges - without giving up custody.

- Stick to major exchanges with deep liquidity: Binance, Kraken, Coinbase. Price gaps there are tiny and fleeting - but you’re safe.

Arbidex’s idea was ahead of its time - but its execution was behind. And in crypto, being behind means you’re already gone.

Is Arbidex still operational in 2025?

No, Arbidex is not operational in any meaningful way. The platform stopped updating its services after 2019. Its website may still exist, but there’s no evidence of active trading, customer support, or development. The ARX token has virtually no trading volume, and major crypto platforms no longer list it as a viable option.

Can I still withdraw my funds from Arbidex?

It’s highly unlikely. During its active period, Arbidex required identity verification before allowing withdrawals, and many users reported long delays or complete blocks. Since 2020, there have been zero verified reports of successful withdrawals. If you deposited funds into Arbidex and haven’t withdrawn them, you should assume they are lost.

What happened to the ARX token?

The ARX token peaked at $13.37 in 2018 but now trades at around $0.00048 - a drop of over 99.99%. It’s listed on a handful of low-volume exchanges and Atomic Wallet, but only for staking unrelated assets like ETH or SOL. The original arbitrage function tied to ARX has been discontinued. The token has no utility left.

Why did Arbidex fail when other arbitrage bots succeeded?

Arbidex failed because it required users to deposit funds into a centralized wallet - creating massive counterparty risk. Other arbitrage bots work by connecting to your existing exchange accounts (like Binance or Kraken) without taking custody. They’re safer, more transparent, and don’t rely on trust. Arbidex’s model was outdated even in 2018, and the market quickly moved toward decentralized solutions.

Are there any legal risks in using Arbidex today?

There are no active legal risks because Arbidex is no longer functioning as a service. However, holding ARX tokens may raise regulatory questions in some jurisdictions, as they’re classified as unregistered securities in the U.S. by some analysts. If you’re holding ARX, consult a tax or legal professional - but don’t expect to trade or cash out.

Comments (8)

- Sam Daily

- November 27, 2025 AT 17:30 PM

Man, I remember when Arbidex was the hot new thing - everyone was talking about it like it was the second coming of Bitcoin. I even bought ARX tokens thinking I’d be rich by 2020. Spoiler: I’m not. I lost my entire $500 stake and learned the hard way that if a platform makes you hand over your keys, it’s not innovation - it’s a trap. Don’t trust anyone who says ‘trust us’ in crypto. The only safe crypto is the crypto you control.

- SARE Homes

- November 27, 2025 AT 21:52 PM

Oh, please. You think you’re so clever pointing out that Arbidex was centralized? Newsflash: EVERYTHING was centralized in 2018! Even Binance was just a glorified PayPal with crypto. The real failure? Not realizing that arbitrage doesn’t survive in a world where every hedge fund has 200 bots scanning microsecond gaps. Arbidex didn’t fail because it was centralized - it failed because it was SLOW. And slow in crypto is dead. You’re all just nostalgic for a graveyard.

- SHIVA SHANKAR PAMUNDALAR

- November 28, 2025 AT 23:03 PM

Arbidex was never about profit. It was about the myth. The story. The illusion that you could sit back while magic made you rich. That’s what every ICO sells - not technology, but fantasy. And people drank it like cheap whiskey at a college party. Now the hangover hits. We’re all just ghosts haunting a website that doesn’t answer emails anymore. The real arbitrage? Selling hope. And Arbidex was the best vendor.

- Rachel Thomas

- November 29, 2025 AT 20:53 PM

So wait, you’re saying I should just use Kraken? Like, the same one I’ve used since 2016? Yeah, right. I’m not going back to that. Arbidex was the future. Now I’m stuck with boring apps that don’t even have a token. This is why crypto sucks now. Everything’s too clean. Too safe. Too... corporate.

- Tom MacDermott

- December 1, 2025 AT 18:32 PM

Wow. Just… wow. Someone actually wrote a 2000-word obituary for a crypto scam and called it a ‘review.’ Congrats. You’ve turned a dead token into a TED Talk. Next up: ‘A Deep Dive Into My 2013 Bitcoin Wallet That Got Lost in a Hard Drive Crash.’ I’m crying. I’m laughing. I’m filing for a Pulitzer. Or maybe just a restraining order against your blog.

- Kristi Malicsi

- December 2, 2025 AT 02:00 AM

It’s funny how we all thought we were so smart back then. Like we were hacking the system. But we were just handing our cash to strangers who didn’t even have a real office. I still have my ARX tokens. I keep them like a museum piece. A warning. Not an investment. Sometimes I look at the price and laugh. Not because I lost money. But because I believed in magic. And magic doesn’t pay bills.

- Shelley Fischer

- December 2, 2025 AT 23:44 PM

While the sentiment expressed in this analysis is largely accurate, it is imperative to underscore the regulatory and fiduciary implications of centralized custodial platforms during the 2017–2019 ICO period. The absence of KYC/AML compliance, combined with the non-disclosure of wallet addresses and lack of third-party audits, constitutes a material breach of fiduciary duty under U.S. securities law. Arbidex’s collapse was not merely a market failure-it was a legal inevitability. Investors should treat such projects not as technological innovations, but as unregistered securities offerings with inherent counterparty risk. The modern DeFi paradigm, by contrast, adheres to the principle of non-custodianship, which remains the only sustainable model in decentralized finance.

- Sierra Myers

- December 4, 2025 AT 13:09 PM

Still holding ARX? Good luck.