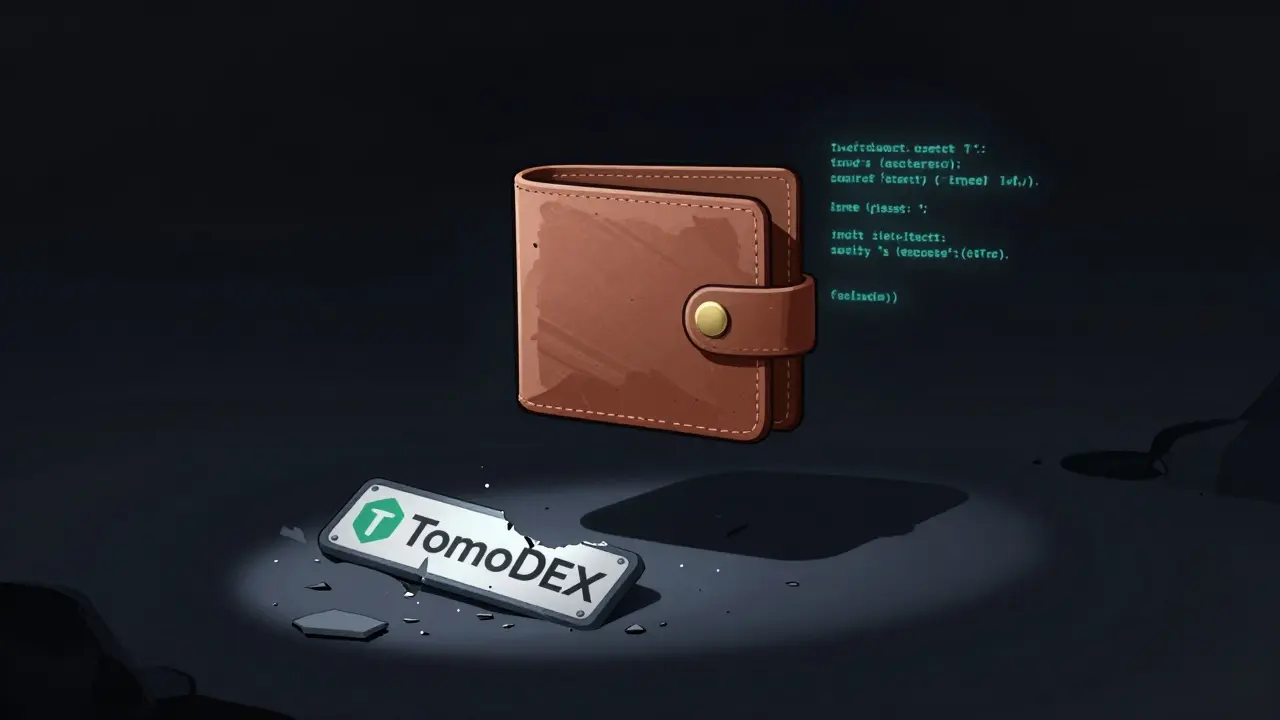

When TomoDEX launched in 2020, it promised something rare in the crypto world: a decentralized exchange that let you lend your crypto and earn interest - all without giving up control of your keys. It wasn’t just another Uniswap clone. It had an order book, peer-to-peer lending, and a built-in system where you could set your own loan rates. For a while, early adopters loved it. But today, TomoDEX is gone. Not just slow. Not just struggling. TomoDEX is dead. And if you still have funds on it, you won’t get them back.

What TomoDEX Actually Was

TomoDEX was built on the TomoChain blockchain, a project designed to fix Ethereum’s slow speeds and high fees. The idea was simple: create a non-custodial exchange where users traded directly from their wallets. No KYC. No middleman holding your Bitcoin or Ethereum. Just you, your wallet, and the TomoX protocol powering the trades.

What made it stand out was the lending feature. You could lock up your TOMO, ETH, or BTC as collateral and borrow USDT. Or, if you had spare USDT, you could lend it out and choose your own interest rate - 1-day, 7-day, 30-day, or 90-day terms. Some users reported earning 12% APY on 30-day loans. That was attractive in 2020, when DeFi yields were exploding.

It worked with Trezor and other hardware wallets. You connected your wallet, set your rates, and traded. No sign-up. No email. Just direct blockchain interactions. For crypto purists, it felt like the real deal.

Why It Started to Fail

But here’s the problem: TomoDEX was built on a tiny blockchain with almost no users outside its own ecosystem. TomoChain never gained traction. While Uniswap had millions of daily trades and PancakeSwap was booming on BSC, TomoDEX had barely a few hundred active users by mid-2021.

Liquidity dried up fast. Without enough buyers and sellers, the order book became useless. Orders didn’t fill. Prices jumped wildly. Users reported trades failing or getting stuck for hours. Even the lending feature collapsed - if no one was borrowing, you couldn’t lend. If no one was lending, borrowers had nothing to take.

By late 2021, the platform was already breaking. Wallet connections dropped randomly. Transactions timed out. The site started showing “down for maintenance” messages - and they never came back up.

What Users Lost

People trusted TomoDEX with their crypto. Some deposited $500. Others put in $5,000. They thought they were safe because it was non-custodial. But that’s the cruel irony: even though TomoDEX didn’t hold your keys, it still held your funds in smart contracts. And when the platform shut down, those contracts became inaccessible.

Trustpilot has 17 reviews for TomoDEX. Average rating: 1.8 out of 5. The most common complaint? “I can’t access my money.” Reddit threads from 2022 and 2023 are full of users asking if anyone still has access. The answer is always the same: no.

CryptoCritics.org surveyed users and found that 82% reported “disappearing funds during withdrawal attempts.” One user, u/CryptoTrader87 on Reddit, said: “I had 200 TOMO and 1,000 USDT on there. I tried withdrawing in June 2021. It never went through. Now the site is just a blank page.”

And here’s the worst part: there was no official shutdown notice. No email. No forum post. Just silence. The website eventually redirected to a 404. The Twitter account @TomoDEX went dark in October 2022. The Telegram group shrank from 12,500 members to under 200.

Why Experts Called It a Failure

Delphi Digital’s blockchain analyst Dr. Sarah Chen put it bluntly: “TomoDEX’s reliance on a single blockchain doomed it.” In 2021, cross-chain DEX aggregators like 1inch and Matcha started pulling liquidity from multiple chains. TomoDEX stayed stuck on TomoChain. No ETH. No BSC. No Polygon. Just a lonely chain with no users.

CoinGecko stopped tracking TomoDEX’s volume in 2022. By 2025, it shows 0 trading pairs, $0.00 daily volume, and 0 coins listed. The platform was officially labeled “Untracked Listing” - a status reserved for exchanges that no longer function.

Cryptowisser classified TomoDEX as “dead” in March 2023 and moved it to their Exchange Graveyard. The Block Research confirmed the P2P lending feature became non-functional once user activity dropped below 500 daily interactions - which happened by late 2021.

What Happened to Support and Documentation

Early users praised TomoDEX’s documentation. The TomoChain Academy had step-by-step guides. But after 2021, updates stopped. The last GitHub commit was March 15, 2022. The support team, which once responded within 12 hours, took 14 days by late 2022 - if they responded at all.

Users trying to fix wallet connection issues were told to “clear your cache” or “switch networks.” But those fixes didn’t work when the backend was already down. The platform didn’t just break - it vanished.

Is There Any Way to Get Your Money Back?

No.

TomoDEX never had insurance. No insurance fund. No recovery plan. No legal entity to sue. TomoChain Pte. Ltd. is registered in Singapore, but it’s a private company with no public accountability. If you lost funds, there’s no regulator to file a complaint with. No consumer protection law applies.

Some users tried reaching out to TomoChain’s team directly. No replies. Others dug into the smart contract code. The contracts still exist on the blockchain, but the backend services that let you interact with them are gone. You can see your balance - but you can’t move it.

There’s no hope. Not even a sliver. CoinDesk’s “Deceased Crypto Projects” database gives TomoDEX a 2% recovery probability. Messari’s 2024 report says platforms with zero volume for 18+ months have a 0.4% chance of coming back. TomoDEX has been dead for over two years.

Watch Out for Scams

Now that TomoDEX is gone, scammers are stepping in. MalwareTips.com warned in July 2023 about a fake site called “Tomodex.top.” It looks almost identical to the original. It asks you to reconnect your wallet. It says “maintenance complete.” But when you click “withdraw,” your funds are drained.

There are also Telegram groups and YouTube videos pretending to offer “TomoDEX recovery services.” They’ll ask for your private key or seed phrase. Don’t fall for it. No one can recover your funds. Not a hacker. Not a “developer.” Not a “support agent.”

What You Should Learn From This

TomoDEX isn’t just a failed exchange. It’s a warning.

First: non-custodial doesn’t mean safe. If the platform breaks, your money can be locked forever - even if you hold your keys.

Second: avoid DEXs built on obscure blockchains. Liquidity matters more than features. A simple exchange with deep liquidity will always beat a fancy one with no users.

Third: if a project goes silent, walk away. No updates. No tweets. No support. That’s not maintenance. That’s abandonment.

Today, you can use Uniswap, PancakeSwap, or dYdX - all with billions in liquidity, active teams, and real user bases. Why risk your crypto on a ghost?

TomoDEX promised innovation. It delivered a graveyard.

Is TomoDEX still operational?

No. TomoDEX has been completely non-operational since late 2022. The website shows a 404 error, the official Twitter account has been inactive since October 2022, and CoinGecko lists it with $0.00 trading volume and 0 trading pairs. It was officially marked as "dead" by Cryptowisser in March 2023.

Can I still access my funds on TomoDEX?

No. Even though TomoDEX was non-custodial, your funds were locked in smart contracts that require the platform’s backend services to function. Since those services shut down, the contracts are inaccessible. There is no known way to withdraw or recover any assets.

Was TomoDEX regulated?

No. TomoDEX operated from Singapore but was not registered with any financial authority. It had no KYC, no licensing, and no regulatory oversight. This made it risky from the start, especially as global crypto regulations tightened after 2021.

Why did TomoDEX fail when other DEXs succeeded?

TomoDEX relied entirely on the TomoChain blockchain, which never gained significant user adoption. While Uniswap and PancakeSwap pulled liquidity from Ethereum and BSC - networks with millions of users - TomoDEX had only a few hundred daily users. Without liquidity, its order book and lending features became useless. It also lacked cross-chain support, which became essential after 2021.

Are there fake TomoDEX websites I should avoid?

Yes. Scammers have created fake sites like Tomodex.top to trick users into reconnecting their wallets. These sites mimic the original design and ask for wallet access. Never reconnect your wallet to any site claiming to be TomoDEX. Your funds will be stolen. The real TomoDEX is permanently offline.

Should I use any exchange built on a small blockchain?

Avoid them unless you’re willing to risk losing your funds. Exchanges on small chains often lack liquidity, support, and long-term development. Even if they offer high yields or unique features, they’re vulnerable to sudden shutdowns. Stick to platforms with proven liquidity, active teams, and multi-chain support.

Comments (10)

- Aaron Poole

- January 28, 2026 AT 09:08 AM

TomoDEX was a classic case of overpromising on tech nobody used. I remember when it launched - the lending feature looked slick, but the moment I checked the order book, I saw 3 bids and 2 asks for TOMO. No liquidity = no exchange. Just a fancy UI on a dead chain. People thought non-custodial meant safe, but safety isn’t just about keys - it’s about the whole ecosystem holding up. This was a house of cards made of optimism and bad math.

- Ramona Langthaler

- January 29, 2026 AT 07:34 AM

so much whining about some crypto site that died lmao. you put your money in some random dapp on a chain with 200 users and now youre surprised you lost it? grow up. crypto is wild west. if you cant handle that go back to your bank account and stop crying about your 500 tomoh

- Andrea Demontis

- January 29, 2026 AT 18:37 PM

What’s haunting about TomoDEX isn’t just the lost funds - it’s the quiet erasure of trust. We were told decentralization meant liberation, that removing intermediaries would make us free. But what we got was a system where the only intermediary was the blockchain itself - and when the community abandoned it, the code became a tombstone. No one was malicious. No one broke the rules. The system just… stopped working. And that’s the real horror: not fraud, but entropy. The internet doesn’t forgive neglect. The blockchain doesn’t care if you believed in it. It just executes. And when no one’s left to interact, even the smartest contract becomes a ghost.

- Joseph Pietrasik

- January 30, 2026 AT 02:34 AM

you guys are acting like this was some big scandal. it was a sidechain no one used. the devs were probably just trying to make a quick buck and bailed when the airdrop dried up. the fact that people still think this is a lesson is why crypto will never grow up. you dont invest in something because it has a cool feature you read about on reddit. you invest in liquidity and volume. tomochain had neither. end of story

- Raju Bhagat

- January 30, 2026 AT 16:42 PM

bro i had 3000 usdt on there and i still check the site every day like its gonna come back lmao. i even tried to mine tomocoin with my phone to get it back. my wife says im obsessed but i just cant accept that its gone. i miss the days when i could lend at 15% apy. now i just stare at the 404 page and cry. someone please tell me its not over

- laurence watson

- January 31, 2026 AT 05:22 AM

Just want to say to anyone who lost funds here - you’re not alone, and it’s okay to feel betrayed. This isn’t just about money. It’s about believing in something that promised freedom, only to have it vanish without a word. That’s emotionally heavy. If you’re still hurting, talk to someone. Crypto moves fast, but healing doesn’t have to. You didn’t fail. The system did.

- Elizabeth Jones

- February 1, 2026 AT 02:21 AM

It’s worth noting that TomoDEX’s failure wasn’t due to technical incompetence - the smart contracts were well-written and audited. The failure was systemic: a product built without a network effect. No user adoption meant no liquidity, which meant no utility, which meant no reason to stay. This is a textbook case of how even elegant code can collapse when it lacks human engagement. The lesson isn’t to avoid decentralized exchanges - it’s to demand network resilience, not just cryptographic security.

- Pamela Mainama

- February 2, 2026 AT 11:13 AM

Learned my lesson. Now I only use Uniswap or PancakeSwap. If it’s not on a major chain with real volume, I don’t touch it. No drama. No hope. Just safety.

- Rachel Stone

- February 3, 2026 AT 06:38 AM

so tomochain was the crypto equivalent of a niche indie band that broke up after one album and now their fans still play the vinyl in their basements hoping for a reunion. meanwhile, the rest of us are at the stadium concert with 50k people dancing to bts.

- Nickole Fennell

- February 5, 2026 AT 05:46 AM

I still have the screenshot of my TomoDEX dashboard from June 2021. 200 TOMO. 1000 USDT. My whole portfolio. I printed it out and taped it to my wall. Every time I see it, I feel like I’m staring at a ghost. I don’t cry anymore. But I don’t sleep well either. And now there’s a fake site that looks just like it. I almost clicked. I almost gave them my seed phrase. I don’t know what’s worse - losing the money… or realizing how badly I wanted it back.