Crypto Capital Gains Calculator

Calculate Your Crypto Tax Liability

This calculator helps you understand your potential capital gains tax based on your cryptocurrency transactions. Remember: all crypto transactions are taxable events when you dispose of crypto (sell, trade, or use for purchases).

When you buy, sell, or trade cryptocurrency, you’re not just making a financial move-you’re triggering a taxable event. But here’s the problem: most people don’t realize it. A 2021 study in Norway found that 88% of crypto holders didn’t report their holdings on tax returns. That’s not a small mistake. It’s a massive blind spot. And while some of those people just didn’t know the rules, others crossed the line from smart planning into outright fraud.

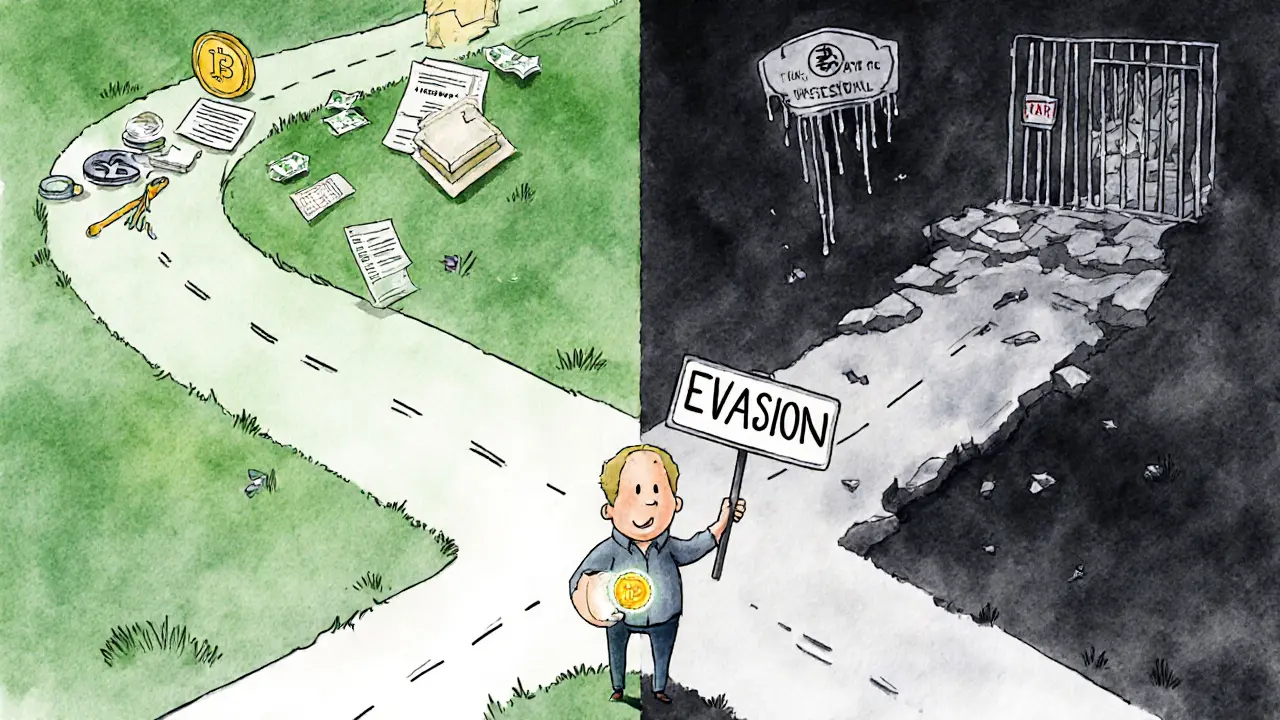

What’s the real difference between tax avoidance and tax evasion?

Let’s cut through the noise. Legal tax avoidance isn’t hiding anything. It’s using the rules to your advantage. Think of it like maximizing your 401(k) contributions or taking the home office deduction. You’re not breaking the law-you’re working within it. Tax evasion, on the other hand, is lying to the IRS. It’s hiding transactions, falsifying records, or pretending crypto income never happened. One is financial strategy. The other is a crime.The IRS doesn’t guess. They track. Exchanges like Coinbase, Kraken, and Binance now report transaction data directly to the government. Starting in 2026, all U.S. crypto exchanges will be required to send you-and the IRS-a Form 1099-DA. This form will show every capital gain or loss from your trades. If you didn’t report it, they’ll know. And they’ll come after you.

When does crypto become taxable?

You don’t owe taxes just for holding Bitcoin. Taxes kick in when you dispose of it. That means:- Selling crypto for U.S. dollars

- Trading one crypto for another (like ETH for SOL)

- Using crypto to buy goods or services (yes, even a coffee)

- Earning crypto as income (staking rewards, mining, airdrops, or salary paid in crypto)

Each of these events creates a taxable event. The IRS treats crypto as property, not currency. That means capital gains rules apply. If you bought Bitcoin for $20,000 and sold it for $30,000, you made a $10,000 gain. That’s taxable. If you held it less than a year, it’s short-term capital gains-taxed at your regular income rate. If you held it over a year, it’s long-term-often taxed at 0%, 15%, or 20%, depending on your income.

Legal ways to reduce your crypto tax bill

There are smart, legal moves you can make. Here’s what works:- Hold for over a year-This alone can cut your tax rate in half or more. If you’re not in a rush to sell, waiting just a few months can save thousands.

- Tax-loss harvesting-If you have crypto that’s lost value, sell it. You can use those losses to offset gains from other trades. You can even deduct up to $3,000 in net losses against your ordinary income each year. Any extra losses roll over to next year.

- Use tax-advantaged accounts-If you have a Roth IRA, you can buy crypto inside it. Gains grow tax-free, and withdrawals after 59½ are tax-free too. Not all brokers allow it, but some do.

- Gift crypto to family-You can gift up to $19,000 per person in 2025 without triggering gift tax. The recipient takes your cost basis. If they’re in a lower tax bracket, they’ll pay less when they sell.

- Donate crypto to charity-You get a deduction for the full market value of the crypto at the time of donation, and you avoid paying capital gains tax on the appreciation. It’s a double win.

These aren’t loopholes. They’re legal tools built into the tax code. You’re not hiding anything. You’re just timing and structuring your moves to stay within the rules.

What counts as illegal tax evasion?

Evasion is when you actively try to hide what you did. Common red flags:- Not reporting staking or mining rewards as income

- Using privacy coins like Monero or Zcash to obscure transaction trails

- Trading on decentralized exchanges (DEXs) like Uniswap and assuming the IRS can’t see it

- Failing to report crypto holdings on foreign exchanges

- Using crypto to pay employees or contractors without issuing 1099s

Here’s the truth: even if you use a DEX or a non-KYC exchange, your transactions are still on the blockchain. The IRS doesn’t need your exchange to tell them everything. They use blockchain analysis tools to trace wallet addresses, link them to known exchanges, and match them to your identity. If you’ve ever bought crypto on Coinbase and later sent it to a private wallet, they can still trace it.

In Norway, even when the tax authority had full access to exchange data, 80% of crypto traders still didn’t report their gains. That’s not ignorance. That’s deliberate noncompliance. And it’s getting harder to get away with.

Who’s most likely to get caught?

The data shows a pattern. Most unreported crypto activity comes from young, urban, male investors. That doesn’t mean others are safe-it means the IRS knows where to look. If you’re a 28-year-old software engineer in San Francisco who bought ETH in 2021 and never filed taxes on it, you’re on their radar. The average tax evasion amount per person? Between $200 and $1,087. That’s not a fortune. But when you’re talking about hundreds of thousands of people, it adds up fast.Enforcement isn’t random. The IRS uses data matching. If your bank shows a $15,000 deposit and you didn’t report income, they’ll cross-check your crypto wallet activity. If you transferred crypto from Binance to a wallet and then cashed out to your bank, they’ll find it. They’ve been doing this since 2018.

Why keeping records matters more than ever

You can’t claim tax-loss harvesting if you don’t know what you bought or when. You can’t prove you held crypto for over a year if you can’t show the purchase date. Most people lose their records because they used multiple wallets, apps, or exchanges.Start tracking everything:

- Date and time of every buy, sell, trade, or transfer

- Amount and type of crypto involved

- Fair market value in USD at the time of each transaction

- Wallet addresses used

- Exchange or platform where the transaction occurred

Use a crypto tax tool like Koinly, CoinTracker, or TokenTax. They connect to your wallets and exchanges and auto-generate your tax forms. It’s not expensive. It’s cheaper than an IRS audit.

What happens if you get caught evading taxes?

The penalties are severe. For tax evasion:- Fines up to $100,000 (or $500,000 for corporations)

- Up to 5 years in prison

- Interest and penalties that can double or triple your original tax bill

- Asset seizure

The IRS doesn’t need to prove you intended to cheat. If you didn’t report income and you can’t explain where it came from, they can assume it’s evasion. And they will.

There’s a better path: the IRS’s Voluntary Disclosure Program. If you come forward before they contact you, you can fix past mistakes with reduced penalties. It’s not free, but it’s far better than a criminal investigation.

The future is transparent

Blockchain is public. Every transaction is recorded forever. The days of thinking you can hide crypto from the IRS are over. Even if you use a non-U.S. exchange, the IRS has agreements with foreign tax agencies. They’re getting better at connecting wallets to real identities.Legal tax avoidance isn’t just smart-it’s necessary. The rules are complex, but they’re not secret. You don’t need to be a tax expert. You just need to be honest, organized, and proactive.

Stop guessing. Start tracking. Use the tools available. Get help if you’re unsure. The goal isn’t to pay less-it’s to pay what you owe, legally, without risking your future.

Is it legal to use a decentralized exchange to avoid crypto taxes?

No. Using a decentralized exchange (DEX) doesn’t make your transactions invisible to the IRS. Blockchain records are public. The IRS uses blockchain analytics tools to trace wallet addresses, even if they’re not linked to an exchange. If you’ve ever bought crypto on a regulated exchange and later moved it to a DEX, your history is still traceable. Not reporting those trades is tax evasion, no matter how you did it.

Do I owe taxes if I lost money trading crypto?

You still need to report all trades, even losing ones. But you can use those losses to offset your gains. If your total losses exceed your gains, you can deduct up to $3,000 per year against your regular income. Any extra losses carry forward to future years. Reporting losses properly is part of legal tax avoidance-it reduces your bill without hiding anything.

What if I never received a 1099 from my crypto exchange?

You still owe taxes. Form 1099-DA will be required starting in 2026, but even before that, exchanges only report certain transactions. If you traded on multiple platforms, moved crypto between wallets, or used a DEX, you might not get a 1099. That doesn’t mean you’re off the hook. The IRS expects you to report all taxable events, regardless of whether you received a form.

Can I be audited just for owning crypto?

Yes. The IRS has flagged crypto ownership as a high-risk area for audits. If you have a large bank deposit with no reported income, or if your tax return shows no crypto activity but your bank shows crypto-related transfers, you could be flagged. Audits don’t require suspicion of fraud-they can happen just because your return looks unusual.

Are staking rewards taxable?

Yes. Staking rewards are treated as ordinary income at their fair market value when you receive them. If you earn 0.5 ETH as a reward and it’s worth $1,200 at the time, you owe income tax on $1,200. When you later sell that ETH, you’ll also owe capital gains tax on any increase in value from that $1,200 baseline. Many people forget this and end up underreporting income.

Comments (8)

- Savan Prajapati

- November 27, 2025 AT 11:35 AM

Bro just report it. Why make life hard? IRS ain't playing. I traded on Binance, moved to MetaMask, thought I was slick. Got flagged. Lost 3k in penalties. Don't be me.

- jeff aza

- November 29, 2025 AT 10:47 AM

Let’s be precise: the IRS treats crypto as property under IRC §1001, and taxable events are triggered by dispositions under §61(a). The Form 1099-DA, per the Infrastructure Act §80603, mandates reporting of cost basis and fair market value-so even DEX trades are now traceable via chainalysis + KYC linkage. If you’re using Zcash or Monero to obfuscate, you’re not ‘avoiding’-you’re committing 26 U.S.C. §7201 evasion. Period.

- Tony spart

- November 30, 2025 AT 21:42 PM

Oh wow, another government shill article. 🤡 You think the IRS gives a damn about some guy in Ohio trading Shiba Inu? They’re too busy chasing billionaires who use offshore trusts. Meanwhile, I’m supposed to spend 20 hours tracking every tiny trade so some bureaucrat can take 30%? Nah. I’ll take my chances. #FreeCrypto #TaxTheRich

- Janice Jose

- December 1, 2025 AT 23:26 PM

I appreciate this breakdown. I used to think holding crypto was tax-free until I got a 1099 from Coinbase last year. I panicked, then hired a crypto CPA. Best $400 I ever spent. Now I use Koinly and file everything on time. No stress. No nightmares. Just peace.

- Joel Christian

- December 3, 2025 AT 02:44 AM

why do they even care?? i mean like... its just digital money?? i lost 15k on doge and now they want me to pay taxes on my 2k gain?? this is so unfair 😭 i just wanna chill and hodl

- Vijay Kumar

- December 5, 2025 AT 00:25 AM

You think the IRS is the enemy? No. You are the enemy of your own future. You think you’re clever hiding in DeFi? The blockchain remembers everything. Your ego is your tax liability. Surrender to the system. Or burn.

- Casey Meehan

- December 5, 2025 AT 19:06 PM

Hold up-so if I gift $19k in BTC to my cousin who’s in 0% tax bracket, they sell it and pay $0? 🤯 That’s wild. I’m doing this next year. 😎 #CryptoTaxHack

- Michael Labelle

- December 7, 2025 AT 12:28 PM

Just a quiet nod to Janice-same here. Got caught up in the hype, didn’t track anything. Last year, I spent a weekend cleaning up 3 years of trades with TokenTax. Filed everything. Got a tiny refund. Felt like a grown-up for the first time. No drama. No panic. Just… done.