Ethereum Classic Halving: What It Means and Why It Matters

When you hear Ethereum Classic halving, a scheduled event that cuts the block reward for miners by 50% every few years to control new coin supply. Also known as ETC halving, it’s one of the few predictable events in crypto that directly shapes how much new ETC enters circulation. Unlike Ethereum, which switched to proof-of-stake, Ethereum Classic still runs on proof-of-work — meaning miners use real hardware to secure the network, and they get paid in ETC for their work. Every 5.8 million blocks, that payment drops in half. That’s the halving.

That reduction isn’t just a technical detail — it changes the economics of mining. Fewer rewards mean miners need higher ETC prices to stay profitable. If demand doesn’t keep up, some miners shut down, which can make the network less secure in the short term. But history shows that when supply drops and demand holds steady, prices often rise over time. The last ETC halving happened in 2020, and within 18 months, the price more than tripled. The next one is expected around 2025, and it’s already being watched by traders, miners, and long-term holders.

This event also ties into broader concepts like blockchain reward reduction, a design pattern used in decentralized networks to mimic scarcity, similar to how gold becomes harder to mine over time. Bitcoin does it every four years. Litecoin too. Ethereum Classic follows the same logic — it’s not arbitrary, it’s coded into the protocol. That’s why it matters more than a random price spike. It’s a structural shift. And it’s not just about price. It affects mining rigs, electricity costs, and even how exchanges list or delist ETC based on expected volatility.

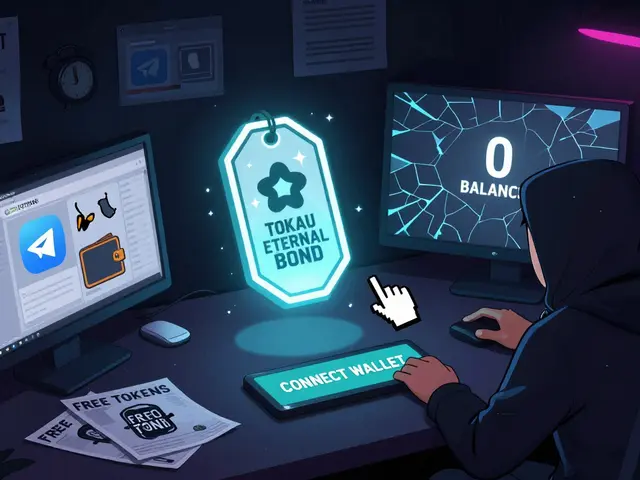

What you’ll find below are real-world breakdowns of what happens before, during, and after a halving. You’ll see how miners react, how wallets get impacted, and which projects tried to ride the ETC halving wave — and which ones vanished. There are no guesses here. Just facts from people who’ve been through it before.

Future Halvings and Long-Term Impact on Cryptocurrency Markets

Future cryptocurrency halvings in 2025-2028 will reshape Bitcoin, TAO, and Ethereum Classic by reducing new supply. These events historically drive long-term price growth, but this cycle brings unprecedented complexity and synchronized supply shocks.