Cryptocurrency: What It Is, How It Works, and What You Need to Know Now

When you hear cryptocurrency, digital money that runs on decentralized networks without banks or middlemen. Also known as crypto, it’s not just Bitcoin or Ethereum—it’s a whole system of tokens, protocols, and networks that let people send value directly to each other. This isn’t theory. People in Bolivia use it to send money home. Traders on Binance and CoinDCX swap it daily. And thousands have lost money because they clicked on fake airdrops that looked real.

Behind every crypto coin is a blockchain, a public, tamper-proof ledger that records every transaction across thousands of computers. Bitcoin’s network runs on this. So does Taraxa’s BlockDAG, which tracks supply chain deals. Even Venus BNB, the token you earn when you deposit BNB, relies on this same idea: no single company owns it, and no one can erase the history. But not all blockchains are built the same. Some adjust mining difficulty in real time to stay secure. Others, like Bitcoin, stick to old rules—even if it means slower, costlier transactions.

Then there’s DeFi, a version of finance built on crypto that lets you lend, borrow, and earn without banks. It’s where Juicebox failed, where MetaDAO tried to level the playing field for new token launches, and where THORChain lets you swap BTC for ETH without trusting a middleman. But DeFi isn’t magic. It’s full of risky tokens like MOCHI with no team and no audits. And if you don’t understand how governance tokens work—who really controls the votes—you’re just gambling.

And then there’s the airdrop trap. Every week, someone claims you can get free crypto just by connecting your wallet. But most of them—CDONK, CSS, KCAKE—are scams. Real airdrops, like the one from Solar’s SXP campaign, are tied to learning or using a new platform. They don’t ask for your private key. They don’t promise instant riches. They’re about adoption, not greed.

What you’ll find below isn’t a list of hype. It’s a collection of real stories: how North Korea stole $3 billion in crypto to fund weapons, why Bolivia lifted its ban, how insurance claims now clear in minutes thanks to smart contracts, and why Arbidex and FTX Turkey collapsed. Some posts explain how things work. Others warn you what to avoid. All of them are based on what’s actually happening—not what a YouTube ad says.

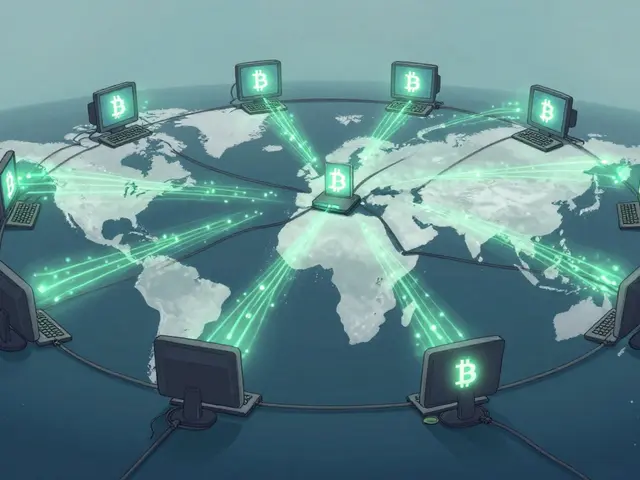

How P2P Networks Power Cryptocurrency Systems

P2P networks enable cryptocurrencies like Bitcoin and Ethereum to operate without banks or central authorities. Every user’s device helps verify transactions, making the system resilient, transparent, and censorship-resistant - but slower and harder to use than centralized alternatives.

What is DAOhaus (HAUS) crypto coin? A clear breakdown of the platform and token

DAOhaus (HAUS) is a no-code platform for creating decentralized organizations on Ethereum. The HAUS token enables governance, not speculation. Despite crashing 99.76% from its peak, it remains a practical tool for small, trusted teams.