China's cryptocurrency ban remains strictly enforced as of 2026, despite recent rumors suggesting new restrictions. This comprehensive policy prohibits all forms of digital asset trading, mining, and exchange services within the country. The ban has created significant challenges for Bitcoin holders both inside and outside China's borders.

Many people believed China introduced a fresh ban in 2025. However, this was fake news. The rumor spread through social media platforms like Telegram and X, but official sources confirmed no new rules were added. The current regulations have been in place since 2021. Let's break down what this actually means for Bitcoin holders.

China's Cryptocurrency Regulation Timeline

| Year | Key Regulation | Impact |

|---|---|---|

| 2013 | Bitcoin classified as virtual commodity, not legal tender | Financial institutions prohibited from handling Bitcoin |

| 2017 | Ban on ICOs and domestic exchanges | Public trading market dismantled; exchanges relocated overseas |

| 2021 | Crackdown on mining and trading; Financial Stability and Development Committee directive | Domestic mining operations shut down; trading activities prohibited |

| 2025 (Current) | Comprehensive ban on all crypto-related activities | All exchanges, mining, and trading illegal; financial institutions barred from services |

The 2021 directive was a turning point. The Financial Stability and Development Committee, led by China's Vice Premier, specifically targeted Bitcoin mining and trading as part of financial risk prevention. This move effectively shut down all domestic mining operations and forced exchanges to move offshore. However, the ban didn't stop trading entirely. Despite the rules, many Chinese citizens still trade Bitcoin through peer-to-peer platforms or overseas exchanges.

Financial institutions are strictly prohibited from offering any cryptocurrency services. Banks and payment processors must monitor transactions for crypto-related activity. If they detect any, they're required to freeze accounts and report to authorities. This makes converting Bitcoin to yuan extremely risky. One Bitcoin holder in Shanghai tried to deposit funds from a crypto exchange to his bank account. His account was frozen within hours, and he faced a lengthy investigation.

Why Enforcement Is Challenging

While the rules are clear, enforcing them is tough. The People's Bank of China issued a 2024 notice stating that cryptocurrencies weren't legal tender and prohibiting citizens from issuing or exchanging tokens. But in practice, trading continues. The decentralized nature of Bitcoin makes it hard to track. Many users use VPNs to access overseas exchanges or trade directly with others. This creates a shadow market that's difficult to police.

Anti-money laundering laws specifically target virtual currencies as a major channel for illegal activity. The Ministry of Public Security monitors funds through online tracking and offline inspections. This surveillance infrastructure creates significant compliance risks for anyone trying to interact with traditional financial systems using Bitcoin.

China's Digital Currency vs. Bitcoin

China's government has invested heavily in its own Central Bank Digital Currency (CBDC), known as the digital yuan. Unlike Bitcoin, the digital yuan is fully controlled by the state. Every transaction is monitored, and the government can track spending in real-time. This aligns with China's goal of maintaining financial oversight while modernizing payments.

Experts say China's push for a state-controlled digital currency shows why it won't accept Bitcoin. The government sees decentralized cryptocurrencies as a threat to its authority. The digital yuan project started in 2014, and by 2025, it's widely used for government salaries and public services. This strategic pivot makes it clear China prefers centralized digital money over decentralized alternatives.

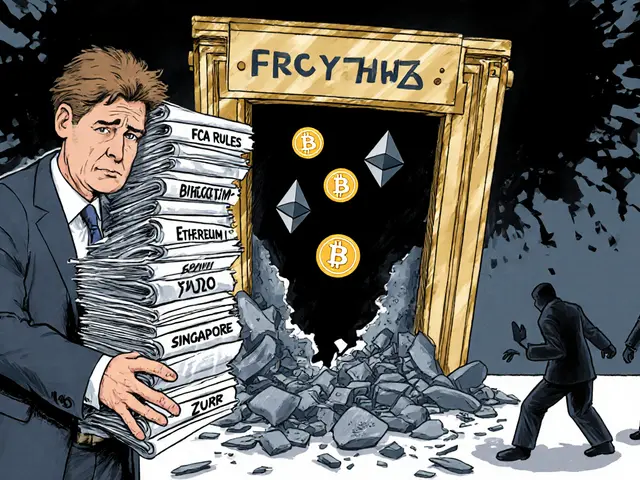

Global Impact of China's Ban

China's policies have ripple effects worldwide. When the 2021 ban was announced, Bitcoin prices dropped sharply. Analysts estimate that Chinese investors once accounted for 20% of global Bitcoin trading volume. Even today, any hint of policy changes causes market volatility. However, the ban has also pushed Chinese traders to use offshore services, creating a shadow market that's hard to track.

For Bitcoin holders outside China, the situation is different. International exchanges don't face the same restrictions. But Chinese citizens trying to access these platforms risk account freezes or legal action. The global market watches China closely because any future policy shift could trigger massive price swings. If China ever allowed regulated trading, demand from its 1.4 billion people could push Bitcoin prices to new highs.

Future Outlook

Experts don't expect China to lift the ban soon. The government's focus on the digital yuan suggests they see no role for decentralized cryptocurrencies like Bitcoin. The current regulatory framework is mature, with enforcement mechanisms in place. While some speculate about future changes, the lack of legal recourse for disputes and ongoing AML monitoring make the environment risky for Bitcoin holders.

For now, Bitcoin holders in China face a dead end. There's no legal way to convert holdings to yuan or access international markets. The government has made it clear that state-controlled digital currencies are the only path forward. This leaves little room for Bitcoin in China's financial future.

Is China's crypto ban still active in 2026?

Yes, China's cryptocurrency ban remains fully in effect. Despite rumors of a new ban in 2025, the current restrictions were implemented in 2021 and continue to be enforced. All forms of cryptocurrency trading, mining, and exchange services are illegal under Chinese law.

Can I still trade Bitcoin in China?

Technically, no. Chinese law prohibits all cryptocurrency trading activities. However, enforcement is challenging. Some users trade through peer-to-peer platforms or overseas exchanges, but this carries significant risks. Financial institutions actively monitor transactions, and accounts involved in crypto activity may be frozen or reported to authorities.

What happens if I try to convert Bitcoin to yuan in China?

Converting Bitcoin to yuan through Chinese banks or payment systems is extremely risky. Financial institutions are required to monitor for cryptocurrency-related transactions. If detected, your account will likely be frozen immediately, and you may face legal investigation. There is no legal recourse for disputes related to cryptocurrency holdings in China.

Why does China support its own digital currency but ban Bitcoin?

China views its Central Bank Digital Currency (CBDC), or digital yuan, as a tool for maintaining financial control. Unlike Bitcoin, which is decentralized and outside government oversight, the digital yuan allows the state to monitor all transactions. This aligns with China's goal of reducing reliance on foreign payment systems while keeping full authority over the financial infrastructure.

Are there any exceptions to China's crypto ban?

No, there are no exceptions. The ban covers all cryptocurrency-related activities, including mining, trading, and exchange services. Even overseas exchanges that serve Chinese residents are prohibited. The government has not indicated any plans to relax these rules, especially with its focus on developing the digital yuan.