UK Crypto Regulations: What You Need to Know About Legal Crypto in the UK

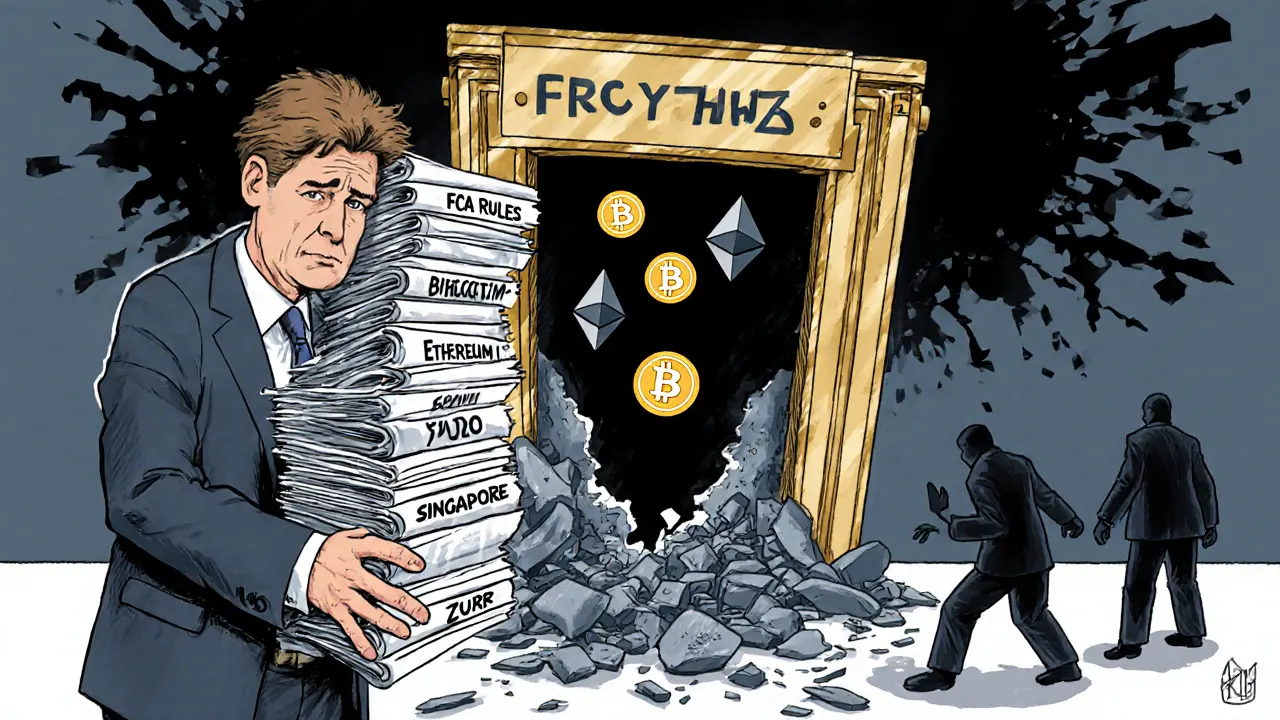

When you trade, hold, or build with crypto in the UK crypto regulations, the legal framework that governs how cryptocurrency is treated by financial authorities in the United Kingdom. Also known as British crypto law, it’s not about banning crypto—it’s about controlling how it’s used, taxed, and reported. The FCA, the Financial Conduct Authority, the UK’s main financial watchdog that enforces crypto rules doesn’t ban crypto trading, but it does ban unregulated crypto derivatives and requires all exchanges operating in the UK to register with them. If a platform isn’t on the FCA’s official list, you’re trading at your own risk—and the FCA won’t help you if things go wrong.

There’s a big difference between legal crypto use and illegal activity. The AML crypto UK, anti-money laundering rules that force crypto businesses to verify users and report suspicious activity rules mean exchanges like Coinbase and Kraken must collect your ID, proof of address, and transaction history. This isn’t just bureaucracy—it’s meant to stop criminals from using crypto to hide stolen funds or fund illegal operations. If you’re running a business, you need a license. If you’re just trading for yourself, you still need to report gains to HMRC. The crypto taxation UK, how the UK government taxes profits from buying, selling, or trading cryptocurrency system treats crypto like property. Every trade, every swap, every airdrop you claim could be taxable. Forget about it, and you could face penalties.

What you’ll find here isn’t a legal textbook. It’s a practical collection of real cases, warnings, and breakdowns. You’ll see how UK crypto rules affected exchanges like Binance and FTX Turkey. You’ll learn what happens when a project ignores FCA registration. You’ll get clear examples of what counts as tax evasion versus smart tax planning. And you’ll find out why some airdrops and DeFi platforms vanish overnight—not because they failed, but because they never followed the rules in the first place. This isn’t about fear. It’s about staying safe, staying legal, and knowing where the lines are before you step on them.

UK Crypto Hub Ambitions: Regulations, Restrictions, and Realities in 2025

The UK aims to be a global crypto hub with strict regulations to protect consumers, but political shifts and slow implementation are undermining its ambitions. Learn what's allowed, what's banned, and where the UK stands in 2025.