Leverage Risk Calculator

FTX Turkey showed how dangerous leverage trading can be. Over 78% of users held leveraged positions that were wiped out when the exchange collapsed. This calculator demonstrates how leverage amplifies both gains and losses.

Enter your investment amount and leverage level to see potential outcomes

FTX Turkey was never just another crypto exchange. For thousands of Turkish users during 2021 and early 2022, it was a lifeline. With inflation hitting 85% annually, the Turkish lira was crumbling. People turned to Bitcoin, Ethereum, and other cryptocurrencies to protect their savings. FTX Turkey promised fast TRY deposits, low fees, and a Turkish-language interface - everything locals needed to trade safely. But on November 11, 2022, it vanished overnight. No warning. No notice. Just silence.

How FTX Turkey Worked - and Why It Looked Too Good to Be True

FTX Turkey operated as a localized version of the global FTX platform, launched to serve Turkish users directly. It let people deposit Turkish lira via bank transfer with a minimum of just 100 TRY (about $5 at the time). Trades were fast, fees were low - as low as 0.05% for makers - and the platform supported advanced tools like leveraged tokens and futures contracts with up to 3x leverage. For experienced traders, it was powerful. For everyday users? Dangerous.The platform had a clean, simple interface in Turkish. Customer support answered in Turkish. Withdrawals to local banks worked smoothly - until they didn’t. FTX Turkey claimed to use the same security as its global parent: SSL encryption, two-factor authentication, and cold storage for 95% of assets. It even offered fee discounts if you held FTT, its native token. Many users trusted it because it looked professional. But appearances lied.

Here’s the key fact no one told you: FTX Turkey had no license from Turkey’s Capital Markets Board (SPK). While competitors like Paribu and Binance Turkey had some form of local registration or partnership, FTX Turkey operated under its Bahamas-based license. That meant it wasn’t regulated in Turkey. Not legally. Not officially. Not even close. And when things went wrong, Turkish authorities had no power to force it to return your money.

Why Turkish Users Flocked to FTX Turkey

Turkey had one of the highest crypto adoption rates in the world in 2022 - about 18% of the population owned crypto, according to the Central Bank. Inflation made traditional savings useless. People didn’t want to keep money in banks that lost value every month. They wanted to move it into something stable. Crypto seemed like the answer.FTX Turkey rode that wave. It didn’t just accept TRY - it made it easy. You could buy Bitcoin with your salary in minutes. You could trade ETH against USD or even tokenized stocks like Apple and Tesla. The platform offered more than 120 trading pairs, more than most local exchanges. And it had deep liquidity - meaning trades executed fast without big price swings.

On Trustpilot, FTX Turkey had 4.1 out of 5 stars before the collapse. Users praised quick deposits, responsive support, and the ability to trade 24/7. Reddit threads were full of people saying, “I finally found a reliable exchange.” But those reviews were written before the crash. They didn’t know what was coming.

The Collapse: What Really Happened on November 11, 2022

The global FTX exchange collapsed because it used customer funds to cover its own losses and fund risky bets - including loans to its sister company, Alameda Research. When rumors spread, users rushed to withdraw. FTX didn’t have enough cash. It couldn’t pay. And FTX Turkey, despite being marketed as local, was just a branch of that same broken system.On November 11, 2022, FTX Global filed for Chapter 11 bankruptcy in Delaware. Within hours, FTX Turkey stopped withdrawals. By November 14, Turkey’s Financial Crimes Investigation Board (MASAK) confirmed the shutdown and launched a criminal investigation. The platform’s order book depth dropped 92% in the 72 hours before the collapse. That meant even if you tried to sell, there were no buyers. Your money was trapped.

What made it worse? Most Turkish users held leveraged positions - 78% of them, according to MASAK. These are high-risk products that can wipe out your entire balance in minutes. When the market swung, many lost everything. One Reddit user lost 187,000 TRY - about $10,000 - that was meant for his mother’s surgery. He wasn’t alone. MASAK found that 83% of FTX Turkey users held less than 5,000 TRY. These weren’t wealthy investors. They were ordinary people trying to protect their savings.

What Happened to the Money?

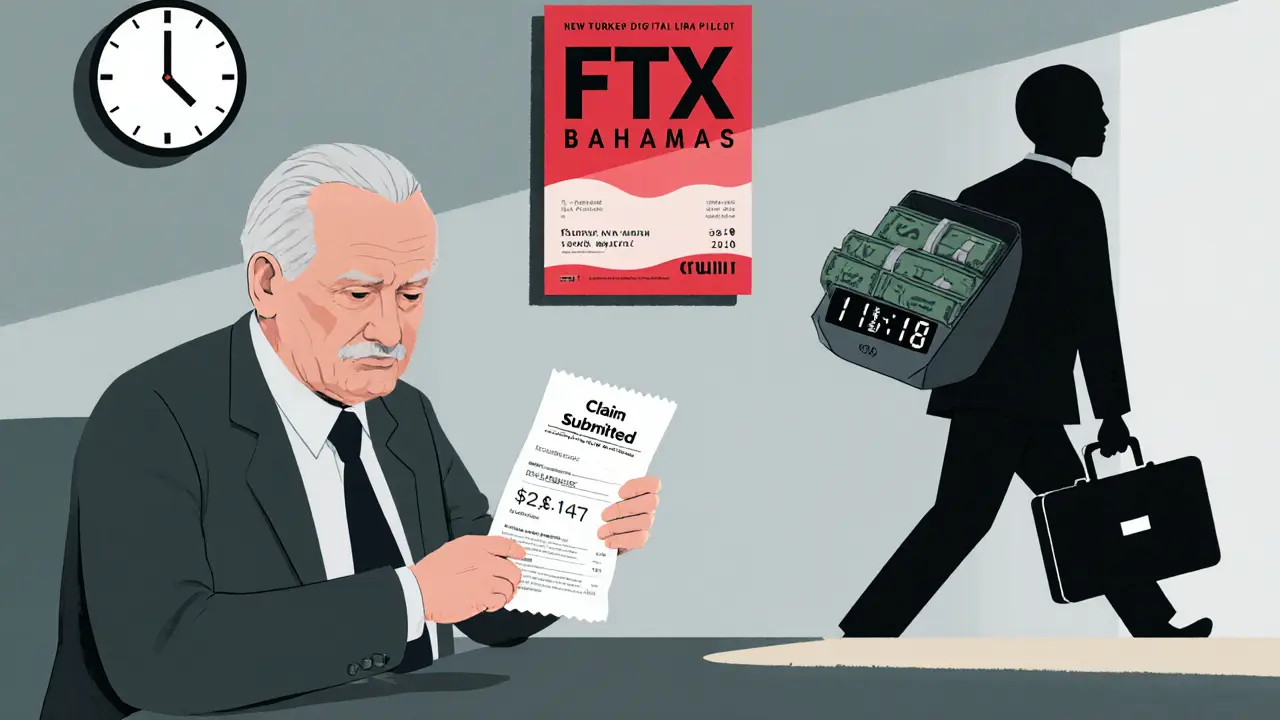

After the collapse, FTX told users to submit their bank account details for refunds. Thousands did. But almost none got paid. In MASAK’s December 2022 survey, 68% of users who provided their bank info never received a cent. The U.S. bankruptcy court later confirmed that Turkish claimants made up 2.3% of all FTX claims - around 18,000 people - with an average claim of $2,147.Recovery is slow, messy, and uncertain. To file a claim, you needed to submit original ID, transaction screenshots, and bank statements - all in English. Many users didn’t speak English well. The process was designed for lawyers, not retirees or small business owners. By October 2023, MASAK’s final report declared FTX Turkey had operated illegally in Turkey. There was no legal path to get your money back.

Some users turned to peer-to-peer platforms like LocalBitcoins. Others moved to exchanges with local licenses, like Paribu or Binance Turkey. But trust in centralized exchanges was shattered. A January 2023 survey showed only 28% of Turkish crypto users would use a similar platform again.

How FTX Turkey Compared to Other Turkish Exchanges

Before the collapse, FTX Turkey was often compared to Paribu, Binance Turkey, and Thodex (which collapsed in 2021). Here’s how it stacked up:| Feature | FTX Turkey | Paribu | Binance Turkey |

|---|---|---|---|

| TRY Deposit Minimum | 100 TRY | 100 TRY | 100 TRY |

| Trading Fees (Maker/Taker) | 0.05%-0.07% / 0.1%-0.2% | 0.25%-0.4% | 0.1% (standard) |

| Number of Crypto Pairs | ~120 | ~80 | ~200+ |

| Derivatives (Futures, Leverage) | Yes (up to 3x) | No | Yes |

| SPK License | No | Yes | Yes (via Bgator) |

| Local Customer Support | Yes (Turkish) | Yes | Yes |

FTX Turkey had the lowest fees and the best derivatives tools - but zero legal protection. Paribu had higher fees but was registered. Binance Turkey had more coins and some regulation. If you were a beginner, Paribu was safer. If you were advanced and knew the risks, FTX offered more. But no one should have trusted an unlicensed exchange with their life savings.

Lessons Learned: What Every Turkish Crypto User Should Know Now

The FTX Turkey collapse wasn’t a glitch. It was predictable. Experts like Professor Levent Gökdemir of Boğaziçi University called it “regulatory arbitrage” - a company exploiting weak oversight to profit while leaving users exposed.Here’s what you should remember:

- Never trust an exchange that doesn’t show its SPK license. Check the official SPK registry. If it’s not there, it’s not legal.

- Don’t keep more than 3 days’ worth of trading capital on any exchange. Keep the rest in a hardware wallet.

- Avoid leveraged tokens and futures if you’re not an expert. These products can wipe you out in seconds.

- Use only licensed platforms. Paribu, Bitci, and Binance Turkey are registered. FTX Turkey wasn’t.

- Be skeptical of “too good to be true” fees. Low fees often mean hidden risks.

The Turkish government responded by launching a national digital lira pilot in late 2023. Finance Minister Mehmet Şimşek said it was meant to give people a safe, regulated alternative to volatile crypto. That’s the real legacy of FTX Turkey: it didn’t just lose money. It lost trust.

Is FTX Turkey Coming Back?

No. Not a chance.The U.S. bankruptcy case is ongoing, but recovery for Turkish users is minimal. MASAK’s criminal investigation is closed. FTX Turkey’s domain, ftxtr.com, is offline. Its servers are gone. The company’s leadership is under investigation. There is no legal or technical path for revival.

Some websites still list FTX Turkey as “active” - those are scams. They’re trying to steal your information or funds. If you see an offer to “recover your FTX Turkey funds,” it’s a fraud. Report it to MASAK.

The only thing left is the lesson: crypto is powerful. But centralized exchanges are not banks. They’re private companies - and without regulation, they can disappear with your money in a day.

Was FTX Turkey a legitimate exchange in Turkey?

No. FTX Turkey operated without a license from Turkey’s Capital Markets Board (SPK). It relied on its Bahamas-based registration, which gave it no legal standing in Turkey. Turkish authorities confirmed in November 2022 that it violated anti-money laundering laws by operating without required registration.

Can I get my money back from FTX Turkey?

It’s extremely unlikely. Over 18,000 Turkish users filed claims in the U.S. bankruptcy case, with an average claim of $2,147. So far, no significant payouts have been made. MASAK’s final report confirmed FTX Turkey operated illegally, meaning there’s no legal obligation for repayment. Most users never received anything after submitting their bank details.

What’s the safest crypto exchange in Turkey today?

The safest options are exchanges registered with Turkey’s Capital Markets Board (SPK), such as Paribu, Bitci, and Binance Turkey (operating via its local partner Bgator). These platforms are subject to Turkish financial oversight, which means they must follow stricter rules on fund storage and customer protection.

Why did so many Turkish people lose money on FTX Turkey?

Most users were retail investors unfamiliar with high-risk products. 78% held leveraged tokens or futures, which can lose 100% of value in a single market move. When FTX collapsed, those positions were wiped out instantly. Many users also trusted the platform because it looked professional and had Turkish support - but none checked its legal status.

Is it safe to use any crypto exchange in Turkey now?

Only if it’s licensed by SPK. After FTX’s collapse, Turkey tightened rules. All exchanges must now hold 100% reserve backing and register officially. Unlicensed platforms are illegal. Always verify an exchange’s SPK license before depositing funds - even if it has a Turkish website and support.

Categories

Popular Articles