Governance Token: How Crypto Voting Powers Decentralized Projects

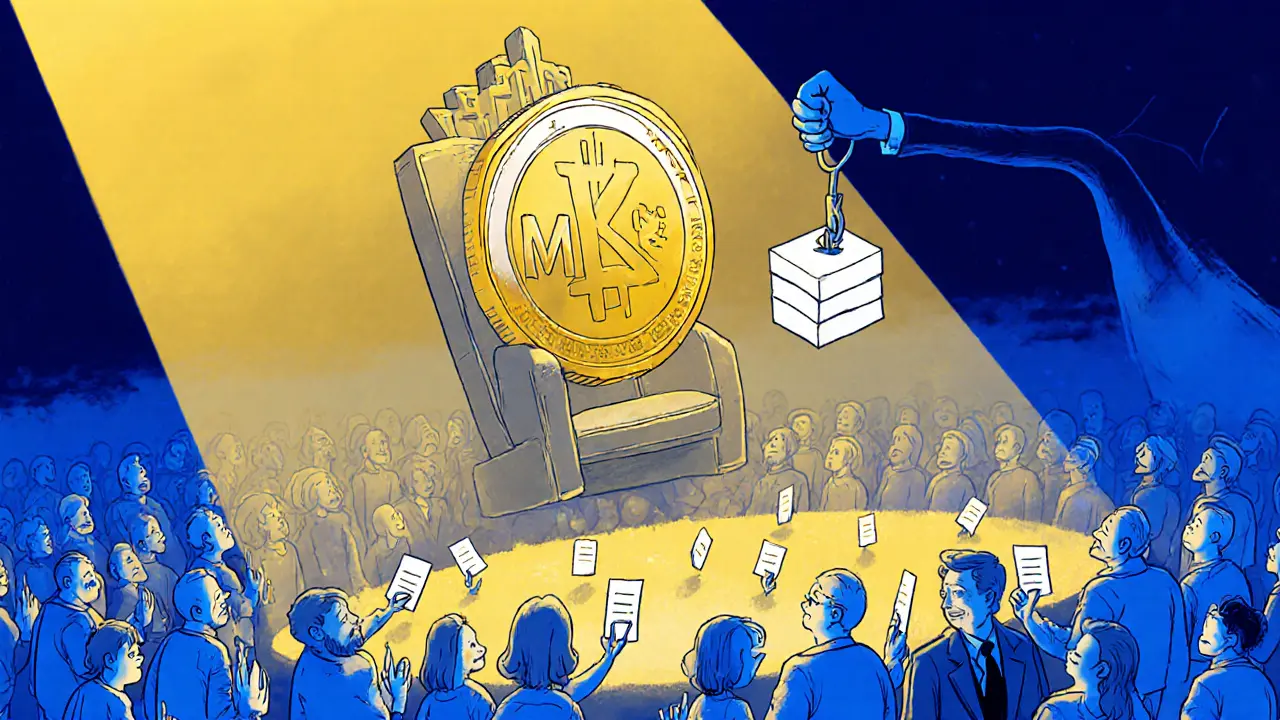

When you hold a governance token, a digital asset that gives you a say in how a blockchain project is run. Also known as a voting token, it turns you from a passive holder into an active participant in decisions like fee structures, protocol upgrades, or treasury spending. Unlike regular tokens that just store value, governance tokens give you a vote—usually one vote per token you hold. This is how decentralized networks avoid top-down control. No CEO makes the call. Instead, the community votes, and the code follows the majority.

These tokens are the backbone of DAOs, decentralized autonomous organizations that operate without traditional management. Think of them as digital cooperatives where every member gets a voice. Projects like Aave, Uniswap, and Curve use governance tokens to let users decide everything from how to spend their treasury to which new chains to support. You don’t need to be a coder or a billionaire—just hold the token, and your vote counts. But here’s the catch: most people don’t vote. In many DAOs, less than 5% of token holders show up to vote, meaning a small group ends up controlling the outcome. That’s why smart holders watch not just the price, but who’s proposing changes and who’s actually voting.

Tokenomics, the design of how a token is created, distributed, and used plays a huge role here. A governance token with a fair launch, wide distribution, and no whale concentration is more likely to stay truly decentralized. But if 10 wallets hold 80% of the supply, you’re just trading control from a company to a few rich holders. That’s why some projects lock voting power behind staking or time-based vesting—like veAERO on Aerodrome—to discourage short-term speculators from hijacking votes. And while governance tokens sound ideal, they come with risks: bad proposals, slow updates, or even rug pulls disguised as community votes.

What you’ll find below are real examples of governance in action—and in failure. You’ll see how Taraxa’s TARA token tries to shape its blockchain for business use, how Aerodrome’s AERO rewards long-term holders, and why some tokens like MOCHI and LFT have no real governance at all. Some projects let you vote. Others just pretend to. This collection cuts through the noise to show you which tokens actually give you power, and which are just marketing.

Understanding Governance Token Value in Decentralized Finance

Governance tokens let holders vote on blockchain protocol decisions, but their value is often speculative. Learn how they work, who controls them, and how to turn voting power into real influence.