DeFi Exchange: What It Is, How It Works, and Which Ones Still Matter

When you trade crypto on a DeFi exchange, a decentralized platform that lets users swap tokens directly from their wallets without needing a central company to hold their funds. Also known as a decentralized exchange, it runs on smart contracts and removes banks, brokers, and account freezes from the equation. This isn’t just a tech buzzword—it’s a shift in who controls your money. Instead of trusting Binance or Coinbase to hold your coins, you interact with code on a blockchain like Ethereum, Base, or BNB Chain. Your wallet signs the transaction, the contract executes it, and you’re done. No KYC. No withdrawal delays. No CEO deciding your fate.

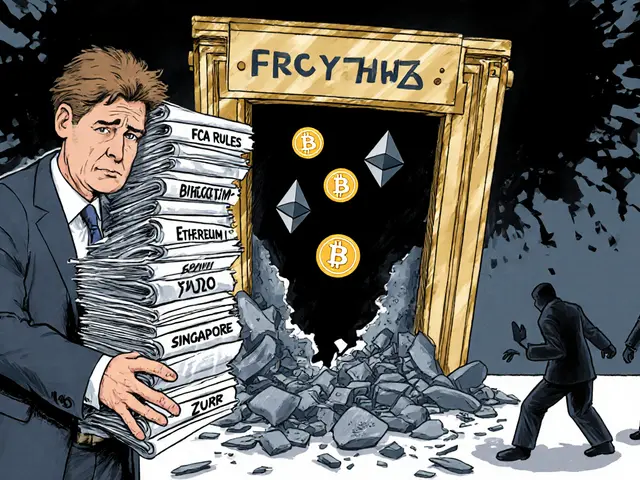

But not all DeFi exchanges are built the same. Some, like Uniswap v2, a simple, reliable automated market maker on the Base network, focus on ease of use and wide token support. Others, like Aerodrome Finance, a high-yield DEX built specifically for Base Chain, reward users with governance tokens just for trading. Then there are the ones that promise too much—like Arbidex, which claimed to automate arbitrage but forced users to hand over their keys, or MochiSwap, which turned into a speculative token with no team or audits. The difference? Real DeFi exchanges give you control. Fake ones just take your money.

What makes a DeFi exchange worth using today? Three things: liquidity, security, and transparency. If a platform has thin trading volume, your trades will slippage badly. If it hasn’t been audited, a bug could wipe out your funds—just like the bridge hacks that stole over $2 billion in crypto. And if you can’t see who’s behind the code, you’re gambling, not trading. That’s why THORChain stands out: it lets you swap native BTC and ETH without wrapping them, reducing trust assumptions. And why platforms like Aerodrome and Uniswap v2 on Base are still active—they’re open, verifiable, and used by real people.

DeFi exchanges also connect to bigger ideas. Governance tokens let you vote on fee changes or new token listings. Cross-chain swaps let you move assets between blockchains without relying on risky bridges. And smart contracts automate everything from liquidity pools to yield farming. But these features only matter if the platform is alive. LifeTime (LFT) and BIZZCOIN (BIZZ) were once promoted as DeFi platforms—they’re not anymore. Dead projects don’t update. Dead tokens don’t trade. And dead exchanges don’t protect your money.

This collection doesn’t list every DeFi exchange ever made. It shows you the ones that still work, the ones that failed, and the ones that tricked people into thinking they were safe. You’ll find reviews of real platforms, breakdowns of how cross-chain swaps actually function, and warnings about tokens masquerading as exchanges. Whether you’re swapping tokens on Base, checking if a DEX is audited, or avoiding another pump-and-dump scheme, the posts here cut through the noise. What you’ll find isn’t hype—it’s what’s left standing after the smoke clears.

Libre Swap Crypto Exchange Review: Is This Decentralized Exchange Worth Trying?

Libre Swap is a decentralized crypto exchange with almost no trading volume, no audits, and zero community presence. Learn why this platform isn't worth your time or crypto.