MetaDAO (old) (META) isn’t just another cryptocurrency. It’s a protocol built on Solana designed to fix one of crypto’s biggest problems: unfair token launches. For years, early investors, insiders, and whales have dominated new token sales, leaving regular users with little chance and even less trust. MetaDAO tried to change that by using market-driven governance instead of votes, and by locking away almost all its tokens at launch - then burning 979,000 of them. That’s not a typo. It burned nearly all of its supply to prove it wasn’t playing games.

How MetaDAO works - no votes, just markets

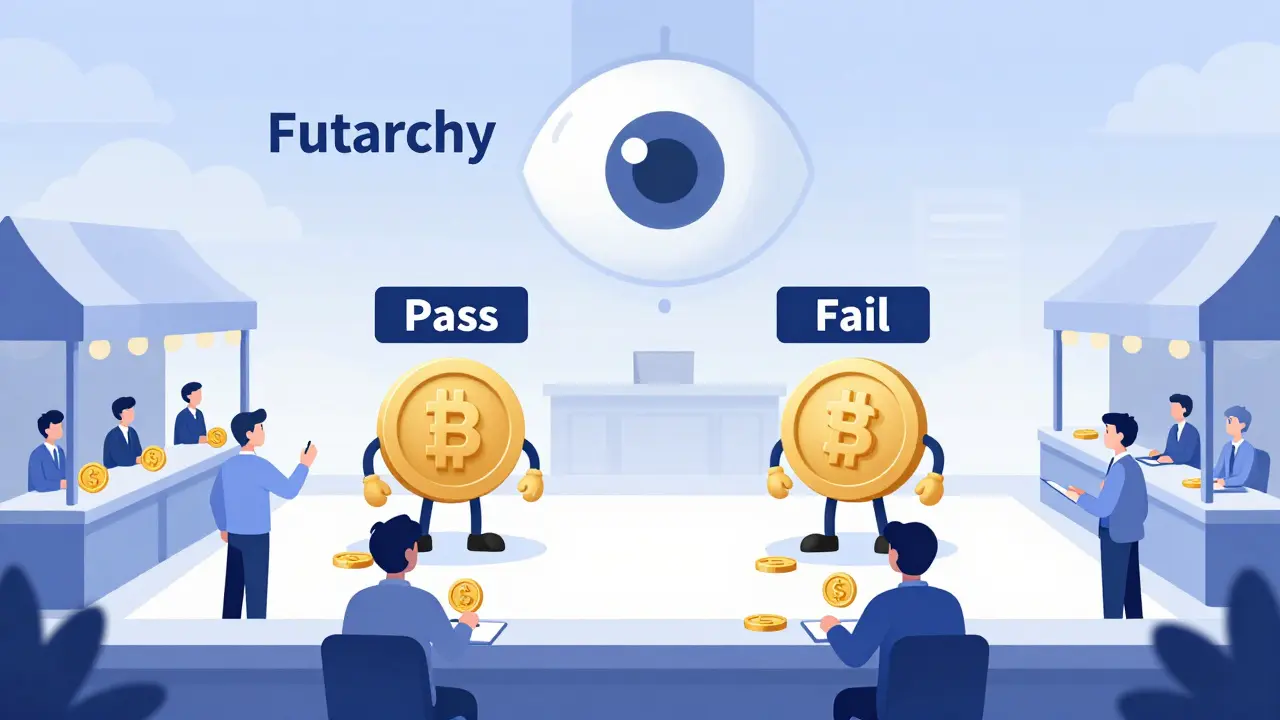

Most DAOs run on voting. You hold tokens, you vote on proposals. MetaDAO does something different. It uses something called futarchy. Instead of asking people to vote yes or no, it lets them bet on whether a proposal will make the token go up or down. If the market thinks a proposal will increase the value of META, it passes. If the market thinks it’ll hurt the price, it gets rejected. There’s no debate. No lobbying. Just price action.This isn’t theoretical. MetaDAO created two fake tokens for every proposal: one called "pass" and one called "fail." People trade these like stocks. If the "pass" token’s price rises, it means the crowd believes the proposal will boost the token’s value. That’s all it takes to approve a change. It’s like letting the market decide what’s best - not the biggest wallet.

The token supply: burned, not just locked

When MetaDAO launched in November 2023, it started with 1 million META tokens. Only 10,000 went to early supporters. The rest - 990,000 - sat in the DAO treasury. Then, in March 2024, the community voted to burn 979,000 of them. That left just 20,861,831 META in circulation. All of them are already out. No more mining. No more unlocks. No hidden reserves.This is rare. Most projects hoard tokens for team members, investors, or future marketing. MetaDAO burned almost everything. That’s why its market cap is so volatile - there’s not a lot of supply to move around. One big buy order can spike the price. One big sell can crash it. As of December 2024, the price was around $6.30, with a 24-hour trading volume of over $3.5 million. That’s small compared to Bitcoin or Ethereum, but it’s active.

Why "old"? The naming confusion

You’ll see "MetaDAO (old)" on CoinMarketCap and some exchanges. That’s not because the team rebranded. It’s because CoinMarketCap labels it that way to distinguish it from potential future versions. MetaDAO’s own website, metadao.fi, doesn’t mention an "old" version. There’s no official upgrade or fork. The "old" tag is just an exchange artifact - likely because they’re preparing for MetaDAO 2.0, which is scheduled for Q1 2025 and will add cross-chain support.So if you’re looking at MetaDAO now, you’re looking at the real thing. The one with the burned treasury. The one with the futarchy model. The one that’s still running on Solana.

How it helps new projects launch fairly

MetaDAO doesn’t just exist for its own token. It’s a platform for other projects to launch tokens without being gamed. Here’s how:- Projects use USDC to raise funds through a 4-day commitment window.

- Founders set a discretionary cap - not a hard limit. This stops bots and snipers from snapping up all the tokens the second it opens.

- 20% of the raised USDC and 2.9 million META tokens go into a liquidity pool on Raydium.

- That pool automatically buys META when the price drops below the ICO price and sells when it rises - creating a built-in stabilizer.

This system avoids the chaos of first-come-first-served launches (like early Raydium sales) and the unfairness of pro-rata systems (like SolanaPad), where users with multiple wallets get 10x more tokens than others.

Since launch, MetaDAO has helped 27 projects go live. On average, those projects hit a $28.7 million market cap within 30 days. That’s impressive for a small protocol.

Who’s using it? Real user feedback

Reddit users report mixed experiences. One user, CryptoBuilder88, said they got 2x to 5x returns on three MetaDAO launches in 2024, praising the transparency. Another, DeFiWatcher2024, complained that the discretionary cap was too unpredictable - making it hard to know how many tokens they’d actually get.On Trustpilot, MetaDAO has a 3.7/5 rating. Positive reviews often say "fair distribution" and "no insider dumping." Negative ones say "the interface is too complicated" and "I didn’t understand the decision markets." That’s the biggest barrier. You need to know how to use a Solana wallet, buy USDC, and navigate a market-based voting system. It’s not beginner-friendly.

As of December 2024, there were 4,490 unique holders of META. The top 10 wallets held 28.7% of the supply. That’s concentrated, but not as bad as some other tokens. Still, it’s a red flag for true decentralization.

Pros and cons: Is MetaDAO worth it?

Pros:- Zero token inflation - supply is fixed and burned down to 20.8 million.

- Futarchy reduces manipulation - decisions are based on market predictions, not wallet size.

- Automatic buy/sell mechanism protects early buyers and discourages dumping.

- Proven track record - 27 successful launches with real returns.

- Only on Solana - no Ethereum, Polygon, or other chains. Limits reach.

- Complex interface - not easy for new users to understand decision markets.

- Discretionary caps - founders can limit participation, which some see as a loophole.

- Low liquidity compared to major DAOs - market cap is $134M on CoinMarketCap, but only $17.5M on CoinGecko. That discrepancy suggests data issues or low depth.

Compared to Aragon or DAOstack, MetaDAO is tiny. Aragon powers over 1,200 DAOs across multiple chains. MetaDAO is one chain, one model, one team. But it’s focused. And it’s working - for now.

What’s next? MetaDAO 2.0 and the road ahead

The team is building MetaDAO 2.0, set to launch in early 2025. The big upgrade? Cross-chain support. That means projects won’t be stuck on Solana anymore. They’ll be able to launch on Ethereum, Base, or others using MetaDAO’s fair-launch model.They’ve already integrated with Jupiter Aggregator, making it easier for holders to swap META without switching platforms. That’s a smart move - liquidity is everything.

But challenges remain. Messari’s October 2024 report said 78% of DAO protocols without venture backing fail within two years. MetaDAO has no institutional investors. No big name backing. It’s built by anonymous developers and sustained by community trust. That’s rare. And risky.

Regulatory clouds also hang over it. The SEC hasn’t ruled on DAOs yet, but their July 2024 guidance warned that governance tokens could be seen as securities. MetaDAO argues it’s a protocol, not an investment. That distinction might save it - or not.

Should you care about MetaDAO (META)?

If you’re into fair token launches, decentralized governance, and Solana-based DeFi - yes. MetaDAO is one of the few projects that actually tried to fix the broken system instead of just profiting from it.If you’re looking for a safe, stable investment - no. The price swings wildly. The user base is small. The interface is clunky. It’s not a coin to hold for years. It’s a tool for participants who want to be part of a better system.

MetaDAO doesn’t promise riches. It promises fairness. And in crypto, that’s rare enough to matter.

Is MetaDAO (META) a good investment?

MetaDAO isn’t designed as a long-term store of value. Its price is volatile because of low liquidity and high speculation. It’s better viewed as a utility token for participating in fair token launches. If you’re active in Solana DeFi and want to join early project launches, holding META gives you access. But don’t buy it expecting steady growth. The value comes from participation, not price.

Why is MetaDAO called "old"?

The "old" label comes from CoinMarketCap’s system, not MetaDAO itself. The team hasn’t rebranded or replaced the token. The tag is likely a placeholder for MetaDAO 2.0, which is planned for early 2025 and will add cross-chain support. The original protocol is still live and active. You’re not buying an outdated version - you’re buying the current one.

How do I get MetaDAO (META) tokens?

You can buy META on exchanges like Bitget, Raydium, and Jupiter. You’ll need a Solana wallet like Phantom or Backpack. You’ll also need USDC to pay for transactions. There’s no staking or mining - all tokens are in circulation. The easiest way is to swap USDC for META on a decentralized exchange on Solana.

Can I participate in MetaDAO launches without owning META?

No. To join a project launch through MetaDAO, you need to hold META tokens. They act as a membership key. The more META you hold, the higher your chance of getting allocated tokens in a new launch - but it’s not guaranteed. The discretionary cap and market-based allocation still apply, so holding more doesn’t guarantee more.

Is MetaDAO safe from rug pulls?

MetaDAO’s design makes rug pulls extremely difficult. The team burned 979,000 tokens and locked the rest in a transparent treasury. All treasury actions require governance approval via futarchy. Plus, 2.9 million META tokens are locked in liquidity pools that auto-buy below ICO price. If the team tried to dump, the system would automatically counter it. That’s not foolproof, but it’s one of the most secure models in crypto.

What’s the difference between MetaDAO and MakerDAO?

MakerDAO is a decentralized stablecoin system that issues DAI and manages collateral. MetaDAO is a fair-launch protocol for new crypto projects. MakerDAO is worth over $1 billion. MetaDAO is worth around $130 million. MakerDAO uses voting. MetaDAO uses markets. MakerDAO is on Ethereum. MetaDAO is on Solana. They serve completely different purposes.

Does MetaDAO have a mobile app?

No. MetaDAO has no official mobile app. You interact with it through Solana wallets and web interfaces like metadao.fi or Jupiter. You can use Phantom or Backpack on mobile, but the decision markets and launch participation require desktop-level navigation. Mobile users are limited to checking prices or swapping tokens - not active governance.

Comments (8)

- Madison Agado

- December 5, 2025 AT 10:00 AM

What’s wild is how MetaDAO flips the script: instead of asking who has the most votes, it asks who has the most skin in the game. It’s not democracy-it’s epistocracy through price signals. If the market believes a proposal will grow the token, it passes. No lobbying. No whale manipulation. Just pure, unfiltered belief priced into binary assets. That’s not just innovative-it’s philosophically elegant. Most DAOs are just voting forums with extra steps. This? This feels like a new kind of collective intelligence.

And the burn? 979,000 tokens gone. Not locked. Not escrowed. Burned. That’s a signal louder than any whitepaper. It says: we don’t need a safety net. We trust the system. That’s rare in crypto, where everyone’s hoarding for the next pump. MetaDAO’s team didn’t just build a protocol-they built a statement.

It’s not perfect. Low liquidity means price swings are brutal. But that’s the cost of honesty. No hidden reserves. No team tokens. No future unlocks. You know exactly what you’re buying. And that’s worth more than any 10x return.

It’s not for everyone. But for those who want crypto to mean something beyond speculation? This is the closest thing we’ve got to a moral architecture.

I’m not invested. But I’m watching. And I’m rooting for it.

- Tisha Berg

- December 6, 2025 AT 14:50 PM

Love that this exists. Seriously. So many projects say they’re ‘fair’ but then they dump tokens on early buyers or lock 80% for the team. MetaDAO actually walks the talk. No fluff. Just burned supply and market-based decisions.

And the fact that it’s helping other projects launch fairly? That’s the real win. Not just for MetaDAO holders-but for the whole Solana ecosystem. More fair launches mean less rug pulls, less distrust.

Yeah, the interface is clunky. Yeah, you need a Solana wallet. But if you’re serious about DeFi, you’ve got to learn these tools. It’s not supposed to be easy for everyone. It’s supposed to be fair for those who show up.

Keep going, MetaDAO. You’re doing something right.

- Billye Nipper

- December 6, 2025 AT 22:23 PM

OMG, I JUST GOT IN ON A LAUNCH THROUGH METADAO AND MADE 4.5X IN 72 HOURS!!! 🤯🙌

It felt so scary at first-I didn’t understand the ‘pass’ and ‘fail’ tokens-but I just followed the price action and trusted the system. And it WORKED. I didn’t need to be a whale. I didn’t need to spam wallets. I just held META and showed up.

Now I’m telling ALL my friends. Yes, it’s complicated. Yes, the app is clunky. But if you want to actually WIN in crypto instead of getting rekt by insiders-this is your chance.

MetaDAO 2.0 can’t come soon enough. Cross-chain? YES PLEASE. I’m ready to go global with this.

Thank you, anonymous devs. You’re the real heroes.

- Thomas Downey

- December 8, 2025 AT 14:17 PM

One must pause and reflect upon the profound epistemological implications of this so-called 'futarchy' model. The notion that market pricing-subject to manipulation, irrational exuberance, and herd behavior-can serve as a legitimate arbiter of governance is not merely naive; it is an affront to the very foundations of rational decision-making.

One does not entrust the future of a decentralized autonomous organization to the whims of retail traders with access to a smartphone and a Discord server. This is not innovation; it is institutionalized chaos dressed in the garb of decentralization.

Furthermore, the claim that burning 979,000 tokens constitutes 'transparency' is a rhetorical sleight of hand. The act of destruction does not confer legitimacy; it merely reduces supply to inflate volatility, thereby attracting speculators and amplifying the very inequities it purports to eliminate.

One must ask: who benefits from this? Not the community. Not the user. The algorithm. The market. The chaos. And therein lies the true failure of MetaDAO: it does not govern. It merely amplifies.

- Josh Rivera

- December 9, 2025 AT 19:56 PM

Oh wow, another crypto project that thinks burning tokens = integrity. 🙄

Let me guess-next they’ll tell us that deleting their GitHub repo means they’re ‘decentralized.’

979k burned? Cool. So now there’s less supply to trade, which means a $3.5M daily volume can spike 300% on one whale’s whim. That’s not fair-it’s a rigged roulette wheel with fewer numbers.

And ‘futarchy’? Yeah, right. So if a bunch of guys on Twitter decide to pump a proposal, the market ‘votes’ yes? Genius. Next you’ll tell me the stock market is a democracy.

And don’t get me started on the ‘discretionary cap.’ That’s just ‘we’ll let in whoever we like’ with a fancy name.

MetaDAO isn’t fair. It’s just the latest flavor of crypto theater with a Solana sticker on it.

- Chris Jenny

- December 10, 2025 AT 13:35 PM

THIS IS A SETUP. I TELL YOU. THEY BURNED 979,000 TOKENS... BUT WHAT IF THEY KEPT THE PRIVATE KEYS TO THE BURN WALLETS??

THEY DIDN'T BURN THEM. THEY JUST HID THEM. LOOK AT THE BLOCKCHAIN. THERE'S A BACKDOOR. I'VE SEEN THE PATTERNS. THE SAME ADDRESSES THAT DID THE BURN ARE NOW SENDING SMALL TRANSACTIONS TO JUPITER AGGREGATOR.

THEY'RE RECREATING THE SUPPLY IN THE SHADOWS.

THEY'RE USING THE 'FUTARCHY' TO MANIPULATE THE MARKET TO MAKE IT LOOK LIKE PEOPLE ARE VOTING... BUT IT'S ALL CODED.

THE SEC IS WATCHING. THEY KNOW. THEY JUST WAIT FOR THE RIGHT MOMENT TO CRACK DOWN.

THEY'RE USING SOLANA BECAUSE IT'S FAST AND ANONYMOUS. NO AUDIT. NO TRANSPARENCY. JUST SMOKE AND MIRRORS.

DO NOT BUY. DO NOT TRUST. THIS IS A PHISHING LURE FOR THE GULLIBLE.

THEY'RE BUILDING META DAO 2.0 TO ESCAPE THE LAW. I KNOW IT.

- Annette LeRoux

- December 11, 2025 AT 13:13 PM

Honestly? I came for the tech. I stayed for the vibe. 🌱

There’s something quietly beautiful about a system that says: ‘We don’t need to control you. We just need you to care enough to bet on what’s right.’

It’s not perfect. The UI is rough. The liquidity is thin. But it’s honest. And in crypto, honesty is the rarest coin of all.

I’ve seen so many projects promise fairness... then quietly dump. MetaDAO? They burned their safety net. That’s courage. Not stupidity.

And the fact that it’s helping 27 other projects launch without rug pulls? That’s legacy-building.

It’s not a get-rich-quick scheme. It’s a get-righteous-quick scheme. And honestly? I’ll take that over another memecoin any day.

Also, I just bought my first META on Phantom. And yes, I cried a little. Not because I made money. Because I finally felt like I was part of something that actually tried.

❤️

- Vincent Cameron

- December 13, 2025 AT 09:22 AM

MetaDAO is less a protocol and more a mirror. It reflects the contradictions of crypto: the desire for decentralization, the hunger for fairness, the addiction to speculation.

The futarchy model is elegant in theory-market signals as governance-but in practice, it’s just a more sophisticated version of the same old game. The people who understand how to manipulate price signals are still the ones who win. The ‘little guy’ still gets crushed by timing, liquidity, and information asymmetry.

And the burn? A performative gesture. It looks good on a blog post. But if the remaining supply is held by 10 wallets, you haven’t democratized anything-you’ve just concentrated power into fewer hands.

What MetaDAO really is, is a test case: can a community sustain a system without incentives, without control, without hierarchy? So far, the answer is: barely.

It’s not the future of DAOs. It’s a fragile experiment. And that’s what makes it fascinating.

But don’t confuse fascination with sustainability.