Decentralized Decision-Making in Crypto: How Blockchains Enable True Community Control

When you hear decentralized decision-making, a system where no single person or company controls outcomes, and rules are enforced by code and community votes. It's the core idea behind why Bitcoin still works after 15 years—no CEO, no boardroom, no one can shut it down. This isn’t just theory. It’s how real crypto projects make changes: whether it’s upgrading a network, changing fees, or spending treasury funds. And it’s happening every day in DAOs, digital organizations run by token holders who vote on proposals, not by hired managers.

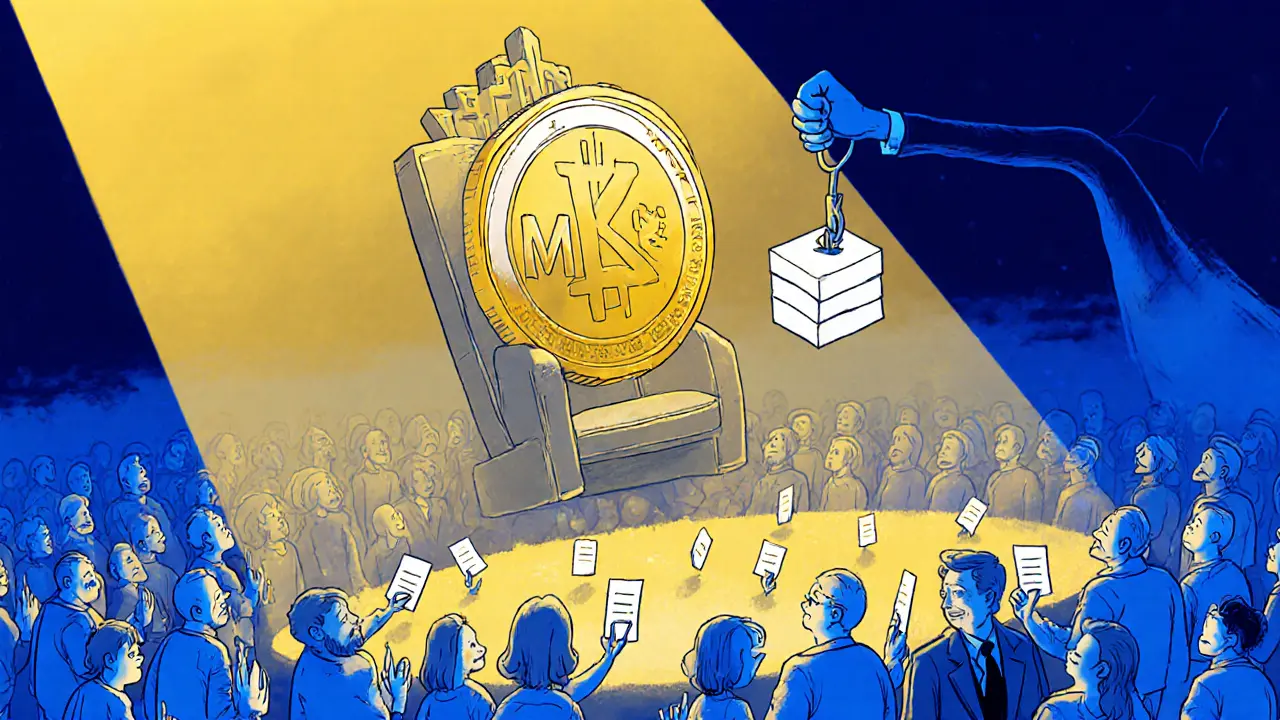

Think of it like a town meeting, but online and automated. If a group of users wants to change how a blockchain works, they don’t ask a CEO—they submit a proposal. Everyone who holds the project’s token gets to vote. The more tokens you hold, the more weight your vote carries. That’s crypto voting, a system where ownership equals influence. But it’s not perfect. Some big holders dominate votes, and many people don’t even bother showing up. That’s why tools like smart contracts, self-executing code that automatically enforces rules without human intervention are critical—they make sure votes are counted fairly and changes happen exactly as agreed.

Real-world examples show both the power and the pitfalls. Taraxa uses decentralized decision-making to let businesses record supply chain deals on-chain without a middleman. THORChain lets users swap crypto across networks without trusting anyone—because the rules are coded into the protocol. Meanwhile, projects like Libre Swap and MochiSwap failed because they had no real governance—no one could vote on what went wrong, so nothing got fixed. The difference? One had a system where users had a say. The other didn’t.

What you’ll find below aren’t just articles about crypto. They’re case studies in who really holds the power. From how North Korea steals crypto to how UAE got off the FATF grey list, every story ties back to control: who has it, how they use it, and what happens when it’s taken away. Whether it’s a bridge hack, a failed airdrop, or a dead token, the root cause is often the same—centralized control hiding behind the word "decentralized." Here, you’ll learn how to spot the real decentralized systems from the fakes, and why it matters for your money.

Understanding Governance Token Value in Decentralized Finance

Governance tokens let holders vote on blockchain protocol decisions, but their value is often speculative. Learn how they work, who controls them, and how to turn voting power into real influence.