Crypto Tax Avoidance: What’s Legal, What’s Not, and How to Stay Safe

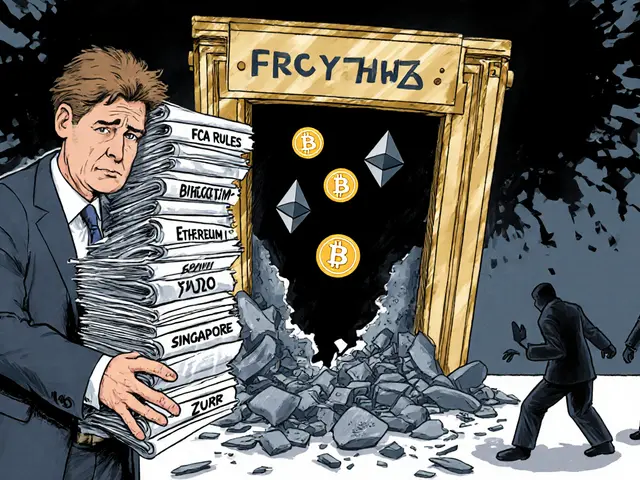

When people talk about crypto tax avoidance, the legal practice of minimizing tax liability using recognized rules and deductions. Also known as tax optimization, it’s not about hiding transactions—it’s about structuring them right. Many confuse it with tax evasion, which is illegal. But if you’re buying, selling, or swapping crypto, the IRS and other global tax agencies treat those actions as taxable events. The key isn’t avoiding taxes altogether—it’s paying the right amount at the right time.

Real users don’t guess their tax obligations. They track every trade, every airdrop, and every staking reward. That’s why posts on this page cover crypto compliance, the set of rules and documentation needed to meet legal reporting standards, and how platforms like FIU-IND, India’s financial intelligence unit that enforces crypto reporting force users to keep clean records. You can’t dodge taxes by using a no-KYC exchange—your wallet history still leaves a trail. Even if you’re in a country with weak enforcement, your exchange might report to global agencies. The UAE’s removal from the FATF grey list didn’t just boost its reputation—it made crypto reporting mandatory for all local businesses.

Some think using a crypto mixer or moving funds across chains hides their activity. But as the North Korea hacks show, sophisticated actors still get caught. Mixers don’t erase blockchain data—they just make tracing harder. Tax agencies now use chain analysis tools that can follow coins across bridges and protocols. If you’re using DeFi platforms like THORChain, a decentralized cross-chain swap protocol that avoids wrapped tokens, you still owe taxes on the swaps. The same goes for earning interest on vBNB, a token representing staked BNB on the Venus Protocol. That interest? Taxable income. And if you got tokens from a fake airdrop like KCAKE or CELT? You might still owe taxes on their perceived value at receipt.

There’s no magic trick. The smartest crypto users don’t hide—they document. They use tools to log transactions, know their cost basis, and understand when a transaction triggers a capital gain. They check if their exchange is registered under MiCA, the European Union’s comprehensive crypto asset regulation, because those platforms automatically provide tax reports. They know that airdrops, forks, and NFT sales all have different tax treatments. And they avoid risky platforms like MochiSwap or Libre Swap—not just because they’re scams, but because tracking taxes on dead tokens is a nightmare.

What you’ll find here aren’t loopholes. They’re real-world examples of how people handle crypto taxes legally. From how India bans unregistered exchanges to how UK regulations are shifting, this collection shows what compliance looks like on the ground. No fluff. No promises of free money. Just what works, what fails, and what you need to do before tax season hits.

Legal Crypto Tax Avoidance vs Illegal Tax Evasion: What You Must Know

Learn the clear line between legal crypto tax avoidance and illegal tax evasion. Know what’s allowed, what gets you in trouble, and how to stay compliant with IRS rules in 2025.