Central Bank Bolivia: What It Is, How It Works, and Why It Matters in Crypto

When you hear Central Bank Bolivia, the government-run institution that controls Bolivia’s national currency, the boliviano, and oversees all banking activity in the country. It is also known as Banco Central de Bolivia, and it holds full authority over money supply, interest rates, and financial stability. Unlike many countries that are testing or allowing cryptocurrency, Bolivia’s central bank has taken one of the strictest stances in the world: crypto is illegal for use as payment, and financial institutions are banned from dealing with it.

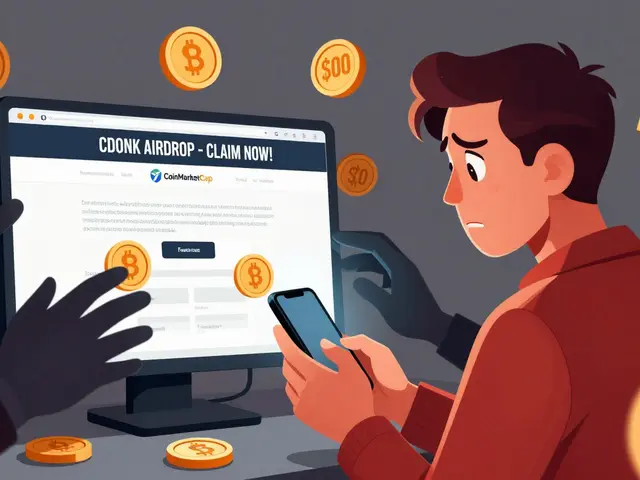

This isn’t just about control—it’s about fear. The Central Bank Bolivia sees decentralized money as a threat to its power. If people start using Bitcoin or Ethereum, they bypass the bank’s ability to track transactions, print money, or enforce sanctions. That’s why in 2014, the bank officially banned all cryptocurrency transactions, and in 2020, it cracked down even harder by blocking access to exchanges and fining banks that helped customers trade digital assets. This move made Bolivia one of the few countries where owning crypto isn’t just risky—it’s against the law.

But here’s the twist: while the Central Bank Bolivia, a state-controlled monetary authority with no transparency or public oversight. It is also known as Banco Central de Bolivia, and it holds full authority over money supply, interest rates, and financial stability. fights crypto, ordinary Bolivians still find ways around it. Many use peer-to-peer networks, foreign wallets, or cash-based trades to access digital assets. Meanwhile, neighboring countries like Argentina and Brazil are embracing crypto as a hedge against inflation and currency devaluation. Bolivia’s rigid stance puts it in direct conflict with global trends—and leaves its citizens without access to tools that could protect their savings.

The monetary policy, the set of tools used by a central bank to manage inflation, employment, and economic growth. It is also known as central bank policy, and it includes interest rates, reserve requirements, and open market operations. set by the Central Bank Bolivia is tightly controlled, but it hasn’t stopped inflation. The boliviano has lost value over time, and many locals rely on U.S. dollars for major purchases. This is exactly the kind of situation where crypto could help—yet the bank refuses to consider it. Instead of adapting, it doubles down on control, even as its own citizens turn to underground markets.

Meanwhile, crypto adoption in Latin America, the growing use of digital currencies across countries like El Salvador, Argentina, and Colombia to bypass weak banking systems and high inflation. It is also known as crypto use in emerging markets, and it’s driven by real economic pain, not speculation. keeps rising. People aren’t buying crypto because it’s trendy—they’re buying it because their local banks don’t protect their money. Bolivia’s ban doesn’t stop demand. It just pushes it underground, where there’s no safety net, no legal recourse, and no oversight.

What you’ll find in the posts below isn’t a list of crypto projects tied to Bolivia. It’s a collection of real stories about how governments react to crypto—when they ban it, ignore it, or try to control it. From North Korea’s crypto theft to India’s exchange crackdowns, these posts show how central banks around the world are struggling to keep up. And in every case, the people find a way.

Complete Cryptocurrency Prohibition in Bolivia: What Changed and Why It Matters

Bolivia once banned cryptocurrency entirely, but in 2024 it reversed course, lifting its decade-long ban and creating a new legal framework. Today, crypto is legal, regulated, and widely adopted - especially for remittances and stablecoin use.

Categories

Popular Articles

Oct 4 2025

Dec 10 2025