BNB Chain: What It Is, How It Works, and Why It Matters in Crypto

When you trade tokens like BNB Chain, a high-speed blockchain built by Binance to support decentralized apps and low-cost transactions. Also known as BSC, it’s one of the most used blockchains for DeFi, NFTs, and gaming — not because it’s the most secure, but because it’s fast and cheap. Unlike Ethereum, which often costs $10 or more in gas fees during peak times, BNB Chain keeps transaction costs under $0.10. That’s why so many new tokens launch here — it’s easier for small projects to get traction without burning through funds just to deploy a contract.

BNB Chain runs on a proof-of-staked-authority consensus, which means it’s faster than Bitcoin or Ethereum but less decentralized. It’s not a public, permissionless network like Ethereum — it’s managed by a smaller group of validators, mostly tied to Binance. This gives it speed and stability, but it also means it’s more vulnerable to centralization risks. Still, for everyday users who want to swap tokens, stake, or join airdrops without paying a fortune, BNB Chain is often the go-to. It supports EVM, Ethereum Virtual Machine, the software environment that runs smart contracts on Ethereum and compatible chains, so tools like MetaMask work the same way. You can use the same wallet, same interfaces, same tutorials — it just costs less and moves faster.

Many of the projects linked here — like Aerodrome Finance, a leading decentralized exchange on Base Chain, or THORChain, a cross-chain swap protocol that works on BEP20 — rely on BNB Chain’s infrastructure. Even when they’re built on other chains, they often use BNB as a bridge token or liquidity anchor. That’s why you’ll see BNB mentioned in nearly every DeFi guide, exchange review, or airdrop checklist on this site. It’s not just a coin — it’s the fuel for a whole ecosystem.

But don’t assume all BNB Chain projects are safe. The same low barriers that help startups also attract scams. Many tokens here have no team, no audits, and vanish after a week. That’s why posts like the ones on MochiSwap, Libre Swap, and Arbidex exist — they’re warnings disguised as reviews. The BNB Chain isn’t risky by design, but the lack of gatekeeping makes it a wild west for unvetted tokens. If you’re trading here, know what you’re holding. Check liquidity, verify contracts, and never assume popularity equals legitimacy.

What you’ll find below isn’t just a list of articles — it’s a practical map. You’ll see how BNB Chain connects to real-world use cases like cross-chain swaps, insurance automation, and supply chain tracking. You’ll find guides on avoiding bridge hacks, spotting fake airdrops, and understanding governance tokens built on it. Whether you’re new to crypto or just trying to make sense of why so many tokens live on BNB Chain, these posts cut through the noise and show you what actually matters — not the hype, but the mechanics, risks, and real outcomes.

Biswap v2 Crypto Exchange Review: Fees, Features, and Real Performance in 2025

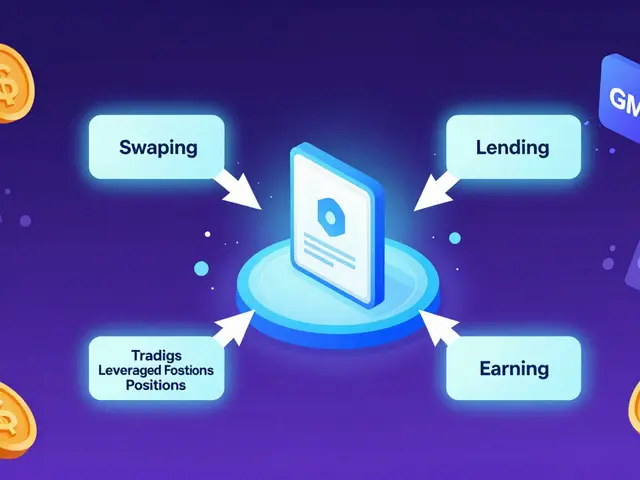

Biswap v2 is a low-fee decentralized exchange on BNB Chain offering swaps, staking, yield farming, and 100x leverage. With a deflationary BSW token and no KYC, it's ideal for experienced DeFi users seeking high rewards - but carries significant risk.

What is Venus BNB (vBNB) Crypto Coin? A Simple Breakdown of How It Works

Venus BNB (vBNB) is a token you receive when you deposit BNB into the Venus Protocol on BNB Chain. It earns interest over time and can be used as collateral to borrow other crypto assets. Learn how it works, its risks, and who it’s really for.