There’s no such thing as an LFJ exchange on Binance Smart Chain (BSC). At least, not one that’s real, verified, or safe to use. If you’ve seen ads, social media posts, or YouTube videos pushing "LFJ (BSC)" as a new DeFi platform, you’re being misled. The name "LFJ" is being used to trick people into connecting wallets to fake or malicious smart contracts. What you’re actually seeing is a scam dressed up to look like Trader Joe - a legitimate decentralized exchange on Avalanche - but with a fake name and a fake blockchain.

Let’s be clear: Trader Joe is a real, audited DEX on Avalanche. It supports over 170 tokens and 260 trading pairs. It’s been around since 2021. It’s been audited by HashEX and Paladin. It’s used by tens of thousands of people. But none of that applies to "LFJ (BSC)." There’s no official website, no GitHub repo, no team behind it, no documentation. Just a contract address floating around Telegram groups and TikTok ads.

Why "LFJ (BSC)" Doesn’t Exist

Binance Smart Chain (BSC) is a blockchain built to be fast and cheap. It’s home to thousands of DeFi apps - PancakeSwap, Venus, BakerySwap. But if you search any official BSC explorer - like BscScan - for "LFJ," you won’t find a verified contract with that name. You’ll find dozens of unverified contracts with similar-sounding names: LfjToken, LFJFinance, LfjSwap. These aren’t platforms. They’re honeypots.A honeypot is a smart contract designed to look like a legitimate DeFi app. It might show fake APYs, fake trading volumes, or even fake user balances. But once you connect your wallet and approve a transaction, the contract drains your funds. No refund. No appeal. No way back. In 2023, over $2.38 billion was stolen from crypto users through these kinds of scams. Most of them used names like "LFJ" to ride the coattails of real projects.

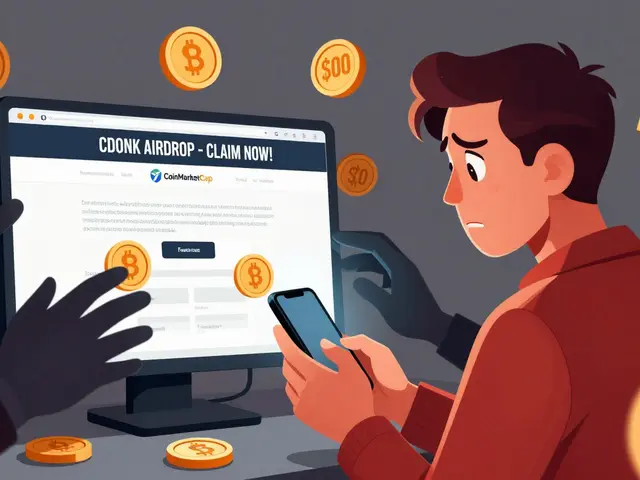

How the Scam Works

Here’s how it plays out:- You see an ad: "Earn 500% APY on LFJ (BSC) tokens!"

- You click the link. It takes you to a website that looks like Trader Joe - same colors, same layout, same logo.

- You connect your MetaMask wallet.

- You’re asked to approve a transaction to "deposit" or "stake" your tokens.

- You approve it. The contract gets full access to your wallet.

- Within seconds, all your ETH, BNB, and tokens vanish.

This isn’t a glitch. It’s not a bug. It’s intentional. The contract code is written to steal everything the moment you approve it. No one is running a real exchange. No one is paying out rewards. The "liquidity pool" you see? It’s fake. The "token"? It’s worthless. The "team"? Doesn’t exist.

What Real BSC Exchanges Look Like

If you want to trade on BSC, stick to platforms that have been around for years and have public track records:- PancakeSwap - The biggest DEX on BSC. Over $1 billion in daily volume. Audited by CertiK and PeckShield.

- BakerySwap - Operated by the Binance ecosystem. Has been live since 2020.

- Venus - A lending and borrowing platform built on BSC. Used by millions.

All of these have:

- Public team members with LinkedIn profiles

- Open-source code on GitHub

- Regular security audits published online

- Community forums and official Discord channels

- Verified contracts on BscScan with green checkmarks

LFJ has none of these. Not even one.

How to Spot a Fake Exchange

You don’t need to be a coder to avoid getting scammed. Here’s what to check before you connect your wallet:- Check the contract address - Go to BscScan.com. Paste the contract address. Is it verified? Is there a whitepaper or documentation linked? If it says "Unverified Contract," walk away.

- Look for audits - Real projects publish audit reports from firms like CertiK, Hacken, or PeckShield. If you can’t find one, it’s not safe.

- Search for the name - Google "LFJ crypto exchange" or "LFJ BSC". If the top results are YouTube videos, Telegram groups, or Reddit threads with no links to official sites, it’s a scam.

- Check the token - If the token has no market cap, no trading volume, and no listing on CoinGecko or CoinMarketCap, it’s garbage.

- Ask yourself: Why is this so good? - "Earn 500% APY?" That’s not a feature. That’s a red flag.

What Happens If You Get Hacked

If you’ve already connected your wallet to an LFJ scam site, here’s what to do immediately:- Disconnect your wallet from all dApps - Use WalletConnect or MetaMask’s "Connected Sites" feature to revoke permissions.

- Transfer any remaining funds to a new wallet - Don’t reuse the same seed phrase.

- Report the contract - Submit the address to BscScan and to the Binance Security team.

- Don’t panic - but don’t expect your money back. Once it’s gone, it’s gone.

Exchanges - even real ones - won’t refund you if you got scammed by a fake site. You’re responsible for your own security. That’s why you need to be smarter than the scammer.

Real Security Tips for BSC Users

If you’re trading on BSC, follow these rules:- Never approve a token without checking the contract.

- Use a hardware wallet like Ledger or Trezor for anything over $500.

- Enable 2FA on your exchange accounts - even if they’re DeFi.

- Use a separate wallet for DeFi trading - keep your main funds offline.

- Never click on links from DMs, tweets, or YouTube comments.

There’s no shortcut to safety. No app will ever be worth your life savings if you don’t verify it first.

Final Warning

"LFJ (BSC)" is not a crypto exchange. It’s a trap. Every dollar you send to it is gone for good. The people behind it are not developers. They’re criminals. And they’re counting on you to be impatient, greedy, or confused.If you’re looking for a real DeFi experience on BSC, use PancakeSwap. It’s free. It’s open. It’s safe. And it’s been around long enough to prove it.

Don’t chase fake returns. Don’t trust names that sound familiar. Don’t let a logo fool you. In crypto, if it sounds too good to be true - it’s not just a scam. It’s a robbery.

Comments (10)

- Charlotte Parker

- January 5, 2026 AT 12:29 PM

So let me get this straight - we’re supposed to trust PancakeSwap because it’s been around since 2020? Bro, that’s like trusting a 1998 Nokia because it still turns on. DeFi is a wild west, and if you think longevity equals safety, you’ve never seen a rug pull that took 3 years to execute. This isn’t a warning - it’s a pep talk for the complacent.

- Valencia Adell

- January 6, 2026 AT 18:30 PM

Everyone’s screaming about scams but nobody talks about the real problem: the people who *want* to get scammed. They don’t care about audits or GitHub. They want 500% APY. They want to be rich by Tuesday. The scammer isn’t the criminal - the victim is the enabler. You don’t get robbed by a fake contract. You get robbed by your own greed. And now you’re mad because the mirror showed you the truth.

- Meenakshi Singh

- January 6, 2026 AT 20:43 PM

LOL this is why I use hardware wallets. 🛡️ Even if I click a scam link, at least my seed phrase is locked in a metal box. Also, if you're still using MetaMask for more than $100, you're basically leaving your front door open with a sign that says 'ROB ME'.

- Denise Paiva

- January 8, 2026 AT 18:53 PM

One must consider the epistemological framework of trust in decentralized systems wherein the absence of verification does not equate to malevolence but rather to ontological ambiguity. The very notion of a 'verified contract' is a relic of centralized epistemic authority. LFJ may not be audited by CertiK, but neither was Bitcoin in 2009. The market will eventually prune the inefficiencies. To condemn without waiting for emergent consensus is to impose fiat logic upon organic innovation.

Moreover, the conflation of 'legitimacy' with 'popularity' is a fallacy. PancakeSwap dominates because of Binance's marketing budget, not because of superior code. The real question is not whether LFJ is safe, but whether the ecosystem is capable of distinguishing between novelty and fraud without bureaucratic gatekeepers.

Perhaps the real scam is the illusion that safety can be outsourced to auditors and whitepapers. In truth, every token is a bet on belief. And belief, as we know, is not measured in lines of code but in the courage to stake one's capital without guarantees.

I do not endorse LFJ. I merely question the dogma that equates institutional validation with moral righteousness. The crypto revolution was never meant to be policed by auditors in suits. It was meant to be anarchic. And if you're scared of the chaos, you should have stayed in banking.

That said, I still wouldn't connect my wallet. But not because I fear theft. Because I fear conformity.

- Michael Richardson

- January 9, 2026 AT 13:06 PM

USA made this mess. Now you wanna blame some guy in India for making a fake site? Get real. If you can't tell a scam from a real DEX, you shouldn't be allowed near a crypto wallet. America taught the world to gamble. Now you're mad the casino won?

- Paul Johnson

- January 10, 2026 AT 17:53 PM

Bro why are you even reading this if you dont know what bsc is like do you even own a wallet or are you just here for the memes cause if you dont know the difference between pancake and some fake site then you should just buy btc and shut up

- Calen Adams

- January 12, 2026 AT 02:15 AM

Let’s level with everyone - this isn’t about LFJ. This is about the systemic collapse of due diligence in DeFi. We’ve normalized clicking ‘approve’ without reading the contract. We’ve turned wallet security into an afterthought. And now we’re shocked when people lose everything? Wake up. The market doesn’t care if you’re ‘new’ or ‘excited.’ It eats optimism for breakfast. If you’re not auditing every single transaction, you’re not trading - you’re gambling with your life savings. Stop blaming scammers. Start taking ownership. Your wallet is your responsibility. No one else’s.

And if you’re still using MetaMask on your phone? That’s not a wallet. That’s a suicide note with a QR code.

- Sabbra Ziro

- January 13, 2026 AT 21:19 PM

I appreciate this breakdown so much - thank you for taking the time to lay this out clearly. So many people are terrified of crypto because of scams like this, and it’s not fair to them. You’ve given them real tools to protect themselves, not just fear. Let’s keep spreading awareness like this. Maybe one day, we’ll have a culture where safety isn’t an afterthought - it’s the default. ❤️

- Sarbjit Nahl

- January 14, 2026 AT 07:45 AM

Scam or not the market will decide. You cannot prevent ignorance by writing long posts. The people who fall for LFJ will fall for LFJ2 or LFJ3. The real issue is not the scam but the lack of financial literacy. Educate the masses or stop complaining. This post is preaching to the choir

- Kelley Ramsey

- January 15, 2026 AT 23:06 PM

Wait - so if I connect my wallet to a fake site and my funds get drained… is there *any* way to recover them? Like, ever? Or is it truly 100% gone? I just want to understand the finality of it all… because if it’s truly irreversible, then this isn’t just a warning - it’s a death sentence for anyone who makes one mistake. And that’s terrifying.