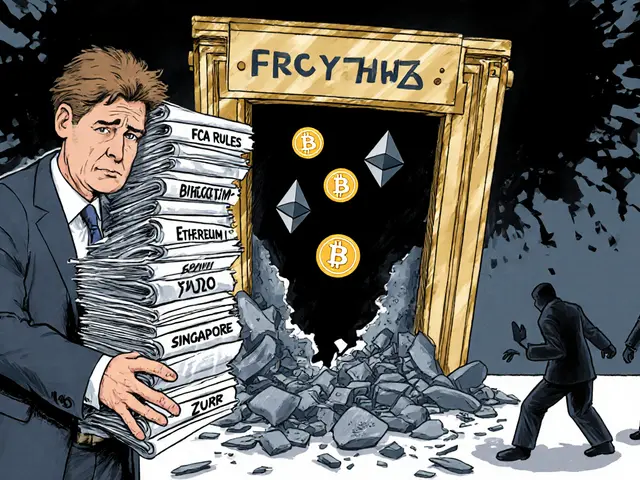

Iran’s cryptocurrency scene isn’t what you’d expect. While the government bans people from buying crypto with Iranian rials, it still lets mining operations run full throttle. Why? Because it’s not about stopping crypto-it’s about controlling it. And the rules have gotten tighter than ever in 2025 and early 2026.

Trading Crypto with Rials Is Now Illegal

Since December 27, 2024, you can’t use Iranian rials to buy or sell cryptocurrency on any local exchange. The Central Bank of Iran shut down every payment gateway that linked rial accounts to crypto platforms. That means no bank transfers, no mobile wallets, no peer-to-peer payments in rials for Bitcoin, Ethereum, or USDT. If you try, the system blocks it. The only way to trade now is through government-approved platforms that hand over your full transaction history-name, ID, IP address, timestamps, everything.Stablecoin Limits Are Strictly Enforced

Stablecoins like USDT are the lifeline for Iranians trying to protect their savings from hyperinflation. The rial lost over 90% of its value against the dollar since 2020. So people turn to USDT, even if it’s risky. But on September 27, 2025, the Central Bank dropped a new rule: you can only buy $5,000 worth of stablecoins per year. And you can’t hold more than $10,000 total. If you had $15,000 in USDT, you had one month to sell the extra $5,000-or risk having your account flagged.That’s not a suggestion. It’s a legal limit. The government has access to exchange data, and they’re cross-checking wallet addresses. People who ignored the cap started seeing their accounts frozen or locked. Some were even summoned for questioning.

Advertising Crypto Is Now a Crime

In February 2025, Iran banned all cryptocurrency advertising. No more YouTube videos telling you how to buy Bitcoin. No more billboards for Nobitex or Digifinex. No Instagram influencers promoting USDT as a hedge. Even Iranian companies promoting crypto abroad got shut down. The government called it a move to “protect citizens from financial speculation.” But the real goal? To reduce public interest and make crypto feel dangerous, not profitable.Why Mining Is Still Allowed

Here’s the twist: while you can’t trade crypto with rials, you can mine it. Iran has one of the largest Bitcoin mining operations in the world-responsible for nearly 4.5% of global hash power. Why? Because mining uses cheap electricity, and the government profits from it. They sell the mined Bitcoin on international markets, bypassing sanctions. The state even built special mining zones with subsidized power for state-linked entities.But even mining isn’t free. The government now caps electricity use for miners. Some large operations have been shut down for exceeding limits. And all mining rigs must be registered with the Ministry of Industry. Unlicensed miners risk fines or confiscation.

Tether’s Big Freeze Changed Everything

On July 2, 2025, Tether froze over $100 million in Iranian-linked USDT across 42 wallet addresses. More than half of those wallets were tied to Nobitex, Iran’s biggest exchange. Some were also linked to addresses flagged by Israeli intelligence as connected to the IRGC. The freeze sent shockwaves through Iran’s crypto community.Within days, Iranian users were told to dump USDT and switch to DAI on the Polygon network. Why Polygon? Because it’s faster, cheaper, and harder for Tether to track. Exchanges started promoting DAI as the “safe stablecoin.” It wasn’t about trust-it was about survival. If you held USDT after July 2025, you were gambling with your money.

Iran’s Own Digital Currency Is Still a Pilot

The Central Bank launched a digital version of the rial called “Rial Currency.” It’s not Bitcoin. It’s not decentralized. It’s just electronic rials-fully controlled by the government. You can’t mine it. You can’t send it internationally without approval. The pilot runs on Kish Island, a free-trade zone meant to reduce dollar dependency.But nobody uses it. Why? Because it’s tied to the same failing rial. People don’t want digital rials-they want digital dollars. So the digital rial is mostly used for government payroll and state transactions. Regular Iranians still prefer crypto.

Crypto Is Now Taxable

In August 2025, Iran passed its first cryptocurrency tax law. Profits from trading Bitcoin, Ethereum, or stablecoins are now taxed as speculative income-same as gold or real estate. The tax rate isn’t public, but it’s estimated between 15% and 25%. The law is being rolled out slowly. First, exchanges report transactions. Then, the tax agency sends notices. Some traders have already received bills.This isn’t about fairness. It’s about revenue. The government wants a cut of the crypto economy without legalizing it. They’re turning a black market into a taxable one.

What Happens If You Break the Rules?

Violating the stablecoin limits or trading rials for crypto can lead to fines, account freezes, or even criminal charges. There are reports of people being summoned by financial intelligence units for holding over $10,000 in USDT. Some were forced to sign statements promising to reduce their holdings. Others had their bank accounts frozen for months.But enforcement is uneven. People with connections, or those who trade through offshore exchanges, still find ways around the rules. The system isn’t perfect. But the risk is higher than ever.

Why Iranians Still Use Crypto

Despite all the restrictions, Iranians still trade crypto daily. Why? Because the rial keeps falling. Inflation is over 50%. Salaries are worth less every month. People don’t trust banks. They don’t trust the government. Crypto isn’t a choice-it’s a necessity.Even with $5,000 annual limits, people find ways. They use family members’ IDs. They split holdings across wallets. They trade on decentralized platforms outside Iran. They use VPNs. They rely on trusted friends to move funds. The system is broken, but the need isn’t.

What’s Next for Iran’s Crypto Market?

The government’s goal is clear: control the flow of money without losing the benefits of crypto. They want mining revenue. They want tax income. They want to stop capital flight. But they don’t want people to escape the rial.As of early 2026, the rules are still changing. More exchanges are being forced to integrate government APIs. More wallets are being monitored. More users are switching to privacy-focused coins like Monero or Zcash-though those are harder to trade.

One thing’s certain: Iran’s crypto landscape is a paradox. The state bans you from using it, but profits from it. It punishes you for holding it, but depends on it to survive sanctions. And ordinary Iranians? They’re caught in the middle, trying to keep their savings alive in a currency that’s losing value by the hour.

Comments (10)

- Jerry Ogah

- February 1, 2026 AT 02:59 AM

This is the most messed-up thing I’ve ever seen. The government bans people from using crypto to save their money, but mines it themselves and profits? That’s not policy-that’s theft with a badge. People are starving while the state hoards Bitcoin like it’s gold in a vault. Absolute hypocrisy.

And don’t even get me started on Tether freezing $100M. That’s not regulation, that’s a global financial coup. Who even gave them that power? The UN? The IMF? No. Some private company in New York decided Iranians don’t deserve to keep their savings. And now we’re supposed to cheer for DAI like it’s a hero?

It’s not crypto they hate. It’s freedom. And they’re terrified of it.

- Andrea Demontis

- February 1, 2026 AT 14:44 PM

What’s fascinating here isn’t just the irony-it’s the deeper epistemological crisis embedded in the state’s behavior. The Iranian government operates under a paradoxical ontology: it simultaneously denies the legitimacy of decentralized value while depending on its material output to sustain national solvency. This isn’t merely economic policy; it’s a performative contradiction where the state must outlaw the very mechanism that preserves its own fiscal viability.

By restricting rial-to-crypto transactions, they attempt to maintain the illusion of monetary sovereignty. But in doing so, they amplify the collapse of that sovereignty. The rial is already a ghost currency. Crypto isn’t an alternative-it’s the only remaining language of economic survival. And yet, the state refuses to learn the grammar.

Their tax law? A desperate attempt to extract rent from a system they’ve rendered illegal. It’s like taxing air while banning oxygen tanks. The people aren’t breaking rules-they’re rewriting the rules of survival in real time. And the state? They’re just trying to keep the script from changing.

- Edward Drawde

- February 1, 2026 AT 22:42 PM

bro the government mines bitcoin but you cant buy it?? lmao. they wanna be rich but you gotta be poor. classic. 😭

- Richard Kemp

- February 3, 2026 AT 00:24 AM

kinda wild how the same people who shut down rial trading are the ones running the mining farms. i mean, if you're gonna ban it, ban it all. but nah, they'll take the crypto and leave you with a worthless rial. guess that's just how it is now.

hope folks find a way. it's rough out there.

- Meenal Sharma

- February 3, 2026 AT 18:32 PM

It is evident that the Western financial hegemony, through entities such as Tether, has weaponized financial infrastructure to exert coercive control over sovereign nations. The freezing of Iranian-linked USDT addresses is not a technical measure-it is an act of economic warfare, orchestrated in collusion with intelligence agencies to destabilize Iran’s economic resilience. The imposition of arbitrary stablecoin caps, coupled with state surveillance of wallet addresses, reveals a pattern of digital colonialism.

Furthermore, the promotion of DAI as a ‘safe’ alternative is a deceptive narrative. It is merely a rebranding of the same centralized paradigm, now repackaged under the guise of decentralization. The Iranian populace is being manipulated into exchanging one form of dependency for another.

The so-called ‘digital rial’ is a transparent tool of surveillance and control, designed to replace the rial with a more efficient, trackable, and oppressive variant. The government’s actions are not irrational-they are meticulously calculated to preserve power, not prosperity.

- Freddy Wiryadi

- February 4, 2026 AT 11:58 AM

man this whole thing is like watching a dad throw away the video game console but still play it in his room when no one’s looking 😅

people are just trying to survive and the state’s out here mining btc like it’s a side hustle while telling you ‘nope, can’t buy it’

and now we’re supposed to use polygon dais? 🤔 i get it, it’s the only thing left-but still feels like trading one broken system for another

still, respect to the Iranians keeping it going. they’re the real crypto OGs.

🙏🫡

- Wayne mutunga

- February 5, 2026 AT 11:04 AM

It’s sad how the most vulnerable people are forced to become financial hackers just to keep from losing everything. I don’t know if I could do it. The stress of constantly watching your holdings, splitting them across wallets, using VPNs, trusting strangers-it’s exhausting. And the government doesn’t even see that. They just see transactions, not people.

I hope someone finds a way to help them without making it worse.

- Moray Wallace

- February 6, 2026 AT 07:59 AM

Interesting how the state’s strategy mirrors that of other authoritarian regimes: prohibit access to tools of resistance while monetizing them. The mining operations are essentially a sanctioned black market-legal for the state, illegal for the citizen.

The fact that people are switching to DAI on Polygon speaks volumes. It’s not about preference-it’s about evasion. The system is rigged, and the only way to win is to play outside it.

Still, the human cost is staggering. I wonder how many have lost everything trying to hold onto something stable.

- Dahlia Nurcahya

- February 7, 2026 AT 12:50 PM

I just want to say how brave these people are. Imagine waking up every day knowing your currency is collapsing, your government doesn’t trust you with crypto, and your savings could vanish because of a Tether freeze-but you still find a way to keep going.

They’re not traders. They’re survivors. And they’re doing it with family IDs, split wallets, and whispers over encrypted apps.

Don’t underestimate them. They’re building a new kind of economy-one the state can’t fully control.

Stay strong, Iran. You’re not alone.

- Jeremy Dayde

- February 8, 2026 AT 12:07 PM

the thing that kills me is that the government is literally profiting off the same thing they're punishing people for

they make money from mining but if you try to buy a little usdt to protect your salary you get flagged

and then they tax your profits like you're some rich guy trading on coinbase

no one's asking for a handout they just want to keep their money from turning into worthless paper

and now they're pushing this digital rial like it's the future

it's not the future it's just the same old trap with a new name

the people are out here building a parallel economy with nothing but grit and vpn

and the state just sits there counting btc