Crypto as property isn’t just a legal technicality-it’s the foundation of how every Bitcoin transaction in the U.S. is taxed. Whether you bought Bitcoin in 2020, mined it last year, or used it to pay for coffee last week, the IRS treats it like stocks or real estate, not cash. That means every time you sell, trade, or spend Bitcoin, you might owe taxes. And if you don’t track it, you’re at risk.

Why Bitcoin Isn’t Treated Like Money

The IRS made this clear back in 2014 with Notice 2014-21: Bitcoin and other cryptocurrencies are property, not currency. That decision still holds in 2026, even after new laws like the GENIUS Act and the CLARITY Bill passed. Those laws changed how crypto is regulated, but they didn’t touch tax rules. The IRS didn’t budge.Think of it this way: if you buy a painting for $5,000 and sell it for $12,000, you pay capital gains tax on the $7,000 profit. Bitcoin works the same. Buying 0.5 BTC for $20,000 and selling it later for $35,000? You’ve got a $15,000 gain. No matter how you use it-buying a car, trading for Ethereum, or paying rent-the IRS sees it as a sale of property.

Three Ways Bitcoin Is Classified (And How It Changes Your Tax Bill)

Not all Bitcoin is taxed the same. The IRS looks at how you got it and what you do with it. There are three main categories:- Business property: If you mine Bitcoin as part of your business, the coins you earn count as ordinary income. You pay regular income tax rates-up to 37%-on the fair market value of the Bitcoin when you receive it. You can deduct mining expenses, like hardware and electricity, but you still owe tax on the value at receipt.

- Investment property: This covers most people who buy Bitcoin hoping it goes up. If you hold it more than a year before selling, you get long-term capital gains rates: 0%, 15%, or 20%, depending on your income. Single filers pay 0% if their taxable income is under $47,025. Married couples filing jointly get that 0% rate up to $94,050. Above those thresholds, rates climb.

- Personal property: This is tricky. If you use Bitcoin to buy groceries, clothes, or a laptop, the IRS still treats it as a sale. You have to calculate the gain based on what you originally paid for that Bitcoin. Even a $50 coffee purchase can trigger a taxable event if the Bitcoin you spent went up in value since you bought it.

That last one catches people off guard. You might think spending crypto is like spending cash. It’s not. You’re selling an asset. And you owe tax on the difference between what you paid and what it was worth when you spent it.

How to Calculate Your Gain or Loss

You can’t just look at your wallet balance and guess. You need to track every purchase. The IRS allows two methods:- Specific identification: You pick which Bitcoin units you’re selling. For example, if you bought 1 BTC in January for $25,000 and another 1 BTC in June for $30,000, you can choose to sell the cheaper one to minimize your tax. But you must keep detailed records-transaction IDs, dates, prices, and wallet addresses.

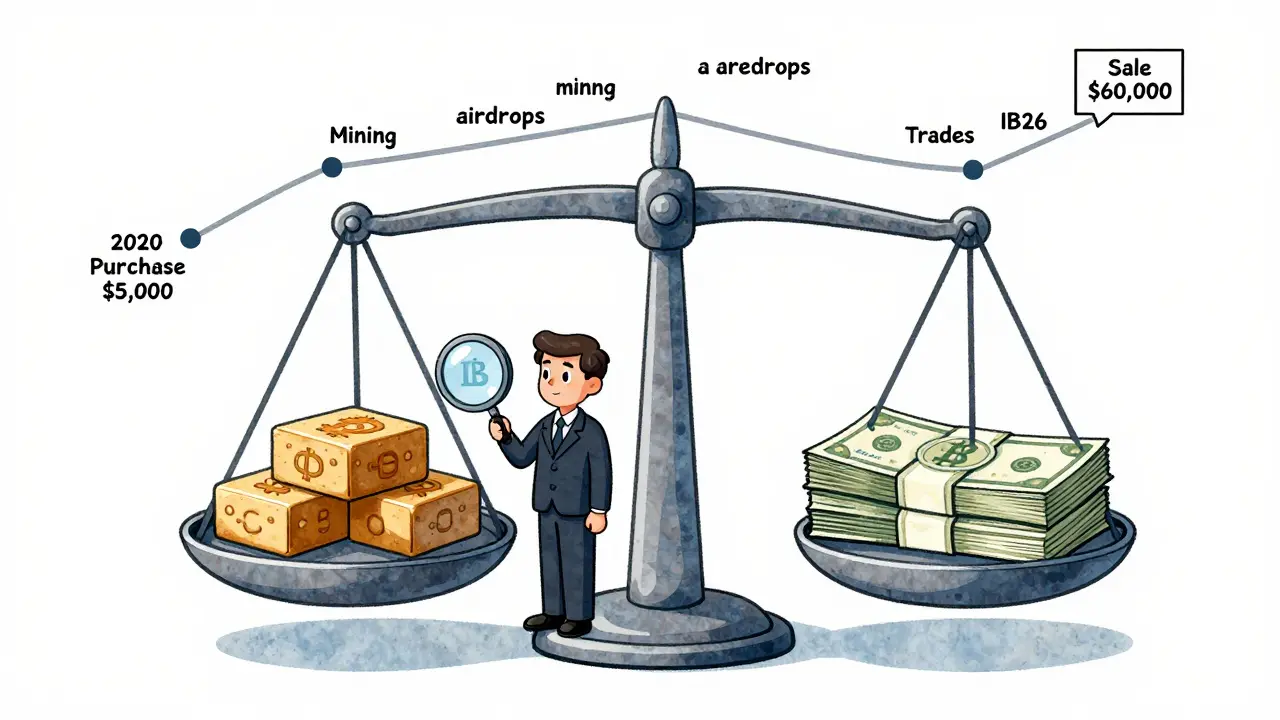

- FIFO (first-in, first-out): If you don’t track specific lots, the IRS assumes you sold the oldest coins first. This is the default method. So if you bought Bitcoin in 2020 at $5,000 and sold some in 2025 at $60,000, you’re taxed on $55,000 in gains-even if you bought newer coins at $55,000. FIFO can create big tax bills if prices rose over time.

Here’s a real example: You bought 1 BTC on March 10, 2023, for $40,000. You bought another 1 BTC on August 15, 2024, for $55,000. In January 2026, you sell 1.2 BTC for $70,000. If you use FIFO, the IRS assumes you sold the 2023 BTC and 0.2 BTC from the 2024 purchase. Your basis is $40,000 + (0.2 × $55,000) = $51,000. Your gain is $70,000 − $51,000 = $19,000. If you had used specific identification and sold the 2024 BTC first, your gain would be $70,000 − $55,000 = $15,000. The difference? $4,000 in taxes saved.

Hard Forks and Airdrops: When You Get Free Crypto

Sometimes, a blockchain splits. Bitcoin Cash was born this way. If you held Bitcoin at the time of the fork and received new coins, the IRS says that’s taxable income.Here’s how it works:

- If you didn’t get new coins? No tax.

- If you received new coins via an airdrop? You owe ordinary income tax on the fair market value when you got them. Say you received 5 BCH worth $300 on the day it hit your wallet. You report $300 as income. Your basis in those BCH is also $300. Later, if you sell them for $500, you pay capital gains on $200.

Timing matters. The IRS says you have “dominion and control” when you can move the coins. If they’re stuck in a wallet you can’t access, no tax until you can. But once you can send them? That’s the day you owe tax.

What You Must Track (And What Happens If You Don’t)

The IRS doesn’t just want your total gain. They want a paper trail for every transaction. That includes:- Buy date and price (in USD)

- Sell date and price

- Trade from one crypto to another (e.g., BTC to ETH)

- Using crypto to pay for goods or services

- Receiving crypto as payment for work

- Mining rewards

- Airdrops and forks

Most people use software like Koinly, CoinTracker, or TokenTax to auto-import transactions from exchanges and wallets. The IRS doesn’t endorse any tool-but they do expect accurate records. If you’re audited and can’t prove your basis, the IRS can assume a $0 cost basis. That means every dollar you sold is taxable income. A $100,000 crypto sale could become $100,000 in ordinary income. That’s a $37,000 tax bill before penalties.

Why the IRS Keeps This System (And Why It’s Not Changing)

Some lawmakers have pushed to treat crypto like cash-exempting small transactions under $600, for example. The CLARITY Bill tried that. But the IRS says property rules are clear, consistent, and already embedded in decades of tax law. Changing it would require rewriting the whole framework.And they’re enforcing it. Since 2020, Form 1040 has asked: “At any time during 2025, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” Answering “no” when you had transactions can trigger an audit. The IRS has matched data from Coinbase, Kraken, and Binance to find unreported activity. Thousands of audits have already happened. The IRS doesn’t need to change the rules-they just need to catch people who ignore them.

What You Should Do Now

Don’t wait for April 15. Start now:- Export your transaction history from every exchange and wallet you’ve used since 2013.

- Use crypto tax software to auto-calculate gains and losses. Pick one and stick with it.

- If you mined or got crypto as payment, record the fair market value on the day you received it.

- If you trade crypto for crypto, treat each trade as two separate sales: BTC to USD, then USD to ETH. Both legs are taxable.

- Keep records for at least seven years. The IRS can audit crypto transactions going back that far.

The bottom line: Crypto as property means every transaction has tax consequences. There’s no such thing as a tax-free crypto spend. The rules aren’t going away. The only way to avoid surprises is to track everything-and do it right.

Is buying Bitcoin with USD a taxable event?

No. Buying Bitcoin with U.S. dollars is not a taxable event. You’re just exchanging one asset (cash) for another (Bitcoin). No gain or loss is recognized at this point. Your cost basis is simply the amount you paid for the Bitcoin, including fees. Taxable events only occur when you sell, trade, or spend Bitcoin.

Do I pay taxes if I lose Bitcoin or it gets stolen?

Generally, no. The IRS doesn’t allow you to claim a capital loss if you lose access to your Bitcoin due to a lost password or hardware failure. However, if your Bitcoin was stolen through a hack or scam, you may be able to claim a theft loss deduction-but only if you can prove it and file Form 4684. These deductions are hard to get and are limited to itemized deductions on Schedule A. Many taxpayers won’t benefit unless they have significant other itemized deductions.

What if I use Bitcoin to buy another cryptocurrency?

That’s two taxable events. First, you sold your Bitcoin for USD (even if you didn’t cash out). Second, you bought the new cryptocurrency. You must calculate the gain or loss on the Bitcoin sale based on its original basis and current value. For example, if you bought 1 BTC for $20,000 and traded it for ETH when BTC was worth $45,000, you owe capital gains tax on $25,000. Your basis in the ETH becomes $45,000.

Can I offset crypto losses against stock gains?

Yes. Crypto losses are treated like any other capital loss. You can use them to offset capital gains from stocks, real estate, or other assets. If your losses exceed your gains, you can deduct up to $3,000 per year against ordinary income. Any leftover losses carry forward to future years. This is one of the few tax advantages crypto offers-loss harvesting.

Do I need to report Bitcoin if I didn’t sell it?

You must report it if you received, sold, sent, exchanged, or otherwise acquired any financial interest in it during the year. Just holding Bitcoin without any transactions doesn’t trigger reporting. But if you bought it, mined it, received it as payment, or traded it-even for another crypto-you must answer “yes” on Form 1040 and report any gains. The IRS now cross-checks exchange data, so silence isn’t safe.

Comments (8)

- Gaurav Mathur

- February 11, 2026 AT 15:18 PM

bitcoin is property. period. no debate. if you buy it you pay tax when you spend it. irs not wrong. you just lazy to track. simple.

- Joe Osowski

- February 13, 2026 AT 06:45 AM

This whole system is a joke. I spent 0.002 BTC on a pizza last year. Now I'm supposed to calculate the gain from 2020? I'm not some accountant. I'm an American. We don't tax transactions like this. This is government overreach. I'm not paying tax on my coffee.

- Jeremy Lim

- February 14, 2026 AT 04:36 AM

I just... ugh. I don't even know anymore. 😩 I tried using Koinly... it crashed my laptop. Now I'm just ignoring it. Maybe the IRS will forget about me? 🤞

- Elizabeth Choe

- February 15, 2026 AT 17:01 PM

YASSS! You're doing amazing just by reading this post! 💪 Seriously, tracking crypto taxes is a nightmare, but you're already ahead of 90% of people by even caring. Start with one wallet. One month. You got this. No shame in using software - we all need help. You're not alone!

- Donna Patters

- February 16, 2026 AT 10:08 AM

The IRS's position is legally sound, ethically unimpeachable, and administratively necessary. To treat cryptocurrency as anything other than property is to invite systemic fraud. The law is clear. Compliance is non-negotiable.

- Holly Perkins

- February 17, 2026 AT 08:36 AM

i just bought btc in 2021 for 40k and sold it for 60k. i didnt even know i had to report it til now. oops. now im panicking. help??

- Will Lum

- February 18, 2026 AT 20:36 PM

Honestly? This whole thing is a mess, but the good news is: you're not the only one confused. I used to think spending crypto was like cash too. Then I found out I owed taxes on a $10 coffee. We're all learning. Use a tool. Don't stress. Just get started. One transaction at a time.

- Sanchita Nahar

- February 20, 2026 AT 00:23 AM

Why do you need to track every single transaction? Just report total gain. Simple. Stop making it harder. IRS should fix this, not punish people.