THORChain BEP20: What It Is, How It Works, and Why It Matters

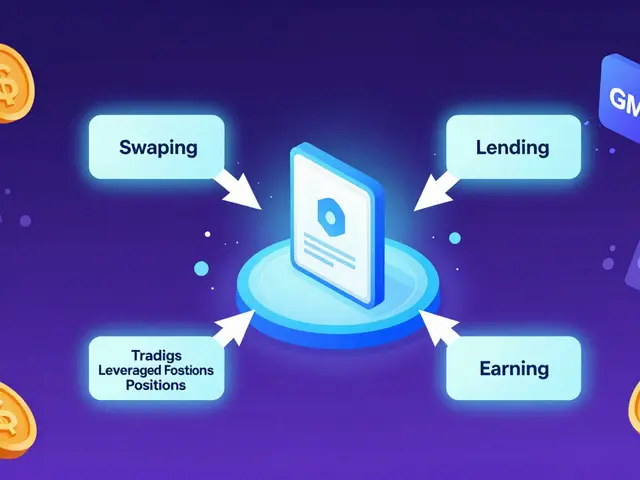

When you trade THORChain BEP20, a native asset on the BNB Chain that connects directly to the THORChain decentralized exchange network. It's not just another token—it's a live pipeline between Bitcoin, Ethereum, and BNB Chain without needing wrapped tokens or trusted bridges. Unlike most cross-chain solutions that lock your crypto in smart contracts, THORChain uses a network of validators called ThorNodes to swap assets directly, keeping your funds under your control the whole time.

This matters because cross-chain swaps, the process of moving crypto from one blockchain to another without intermediaries are broken in most places. Bridges like Multichain or Synapse have been hacked for over $2 billion since 2020. THORChain avoids that risk by not holding your assets at all—it just coordinates the swap using cryptographic proofs. That’s why users who care about security, not just yield, turn to THORChain BEP20 when moving BNB, BTC, or ETH between chains. It’s also the only major protocol that lets you trade Bitcoin directly on a non-Bitcoin chain without using a wrapped version like WBTC.

Behind the scenes, DeFi liquidity, the pool of tradable assets that keeps decentralized exchanges running on THORChain is built differently too. Liquidity providers don’t just earn fees—they get paid in RUNE, the native token that secures the whole network. That creates a feedback loop: more liquidity means more security, which attracts more users, which brings in more liquidity. It’s a rare design where incentives align perfectly. That’s why even in bear markets, THORChain keeps growing its liquidity—unlike other chains that lose volume when prices drop.

But here’s the catch: THORChain BEP20 isn’t for everyone. If you’re used to swapping tokens on Uniswap or PancakeSwap with one click, this feels clunky. You need to understand gas fees, liquidity pools, and how to read a THORChain address. It’s not a mobile app—it’s a tool for people who want control, not convenience. That’s why you’ll find more experienced traders and DeFi builders using it, not beginners looking for quick gains.

The posts below dig into real cases: how THORChain BEP20 fits into cross-chain security, what happens when liquidity dries up, and why some users still prefer it over newer protocols. You’ll also see how it compares to other chains, what went wrong in past swaps, and how to avoid losing funds when using it. No fluff. No hype. Just what works—and what doesn’t—in the real world of decentralized swaps.

THORChain (BEP20) Crypto Exchange Review: Native Cross-Chain Swaps Without Wraps

THORChain (BEP20) lets you swap native crypto like BTC and ETH without wrapping or trusting intermediaries. Learn how it works, why RUNE matters, and whether it's safe and worth using in 2025.