Swiss Franc Stablecoin: What It Is, Why It Matters, and Where to Find Real Info

When you hear Swiss Franc stablecoin, a digital currency pegged to the value of the Swiss franc (CHF) to maintain price stability. Also known as CHF stablecoin, it’s designed to give crypto users the reliability of one of the world’s most trusted fiat currencies without leaving the blockchain. Unlike volatile coins like Bitcoin or Dogecoin, a Swiss Franc stablecoin doesn’t swing wildly—it holds its value close to 1 CHF, making it useful for trading, saving, or sending money across borders with minimal risk.

Why does this matter? Because when markets crash, people look for safe anchors. The Swiss franc has spent decades being a global safe-haven currency, backed by Switzerland’s strong economy, low debt, and political neutrality. A stablecoin tied to it brings that same trust into crypto. You can hold it in a wallet, use it in DeFi protocols, or send it instantly to someone in another country—all while knowing your balance won’t drop 30% overnight. This isn’t just theory. Real projects like CHF Coin, a regulated, tokenized representation of Swiss francs issued by Swiss financial institutions and others have launched with full transparency, audits, and reserve proofs. These aren’t speculative tokens—they’re digital cash equivalents.

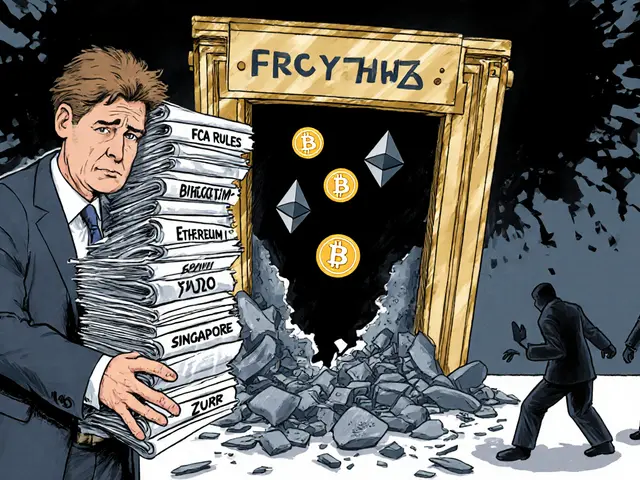

But not every coin calling itself a "Swiss Franc stablecoin" is real. Some are scams pretending to be backed by CHF while holding nothing. Others are poorly managed and lose their peg. That’s why you need to know what to look for: proof of reserves, regulatory oversight, and clear issuer details. Switzerland’s strict financial rules make it harder for shady projects to operate there, so look for issuers based in Zurich or Geneva with clear compliance. This is also why crypto regulation, the growing global framework governing digital assets, including stablecoin issuance and reserve requirements matters so much—especially with MiCA in Europe and similar laws emerging elsewhere.

What you’ll find below isn’t a list of hype-driven tokens. It’s a collection of real, verified posts about stablecoins tied to the Swiss franc, how they’re used, who issues them, and the risks you might not see on a marketing page. You’ll see how they compare to USDT or USDC, why some traders prefer them for cross-border payments, and how regulators are watching them closely. No fluff. No fake airdrops. Just clear, practical info to help you decide if a Swiss Franc stablecoin fits your needs—or if you should walk away.

What is Frankencoin (ZCHF) Crypto Coin? The Swiss Franc-Pegged Stablecoin Explained

Frankencoin (ZCHF) is a decentralized, Swiss franc-pegged stablecoin built on Ethereum. Backed by crypto collateral and governed by token holders, it offers a non-USD alternative for DeFi users seeking stable value without banks.