OFAC Sanctions and Crypto: What You Need to Know About Compliance and Blacklisted Assets

When you hear OFAC sanctions, U.S. government restrictions that block transactions with specific individuals, entities, or countries to protect national security and foreign policy interests. Also known as Office of Foreign Assets Control restrictions, these rules apply to crypto just like traditional finance—whether you realize it or not. If you’re trading, holding, or launching a token, OFAC sanctions can freeze your wallet, block your exchange access, or make your project legally risky overnight.

It’s not just about North Korea or Iran. North Korea’s Lazarus Group, a state-backed hacking team that steals crypto to fund weapons programs and evade global financial controls has been linked to over $3 billion in crypto thefts since 2017. That’s why exchanges like Binance and KuCoin got blocked in India—not because crypto is illegal, but because they didn’t screen users against the OFAC crypto list, the official database of sanctioned wallets, addresses, and entities that U.S.-linked platforms must check in real time. Even if you’re not in the U.S., if your exchange uses American banking services or servers, you’re subject to these rules.

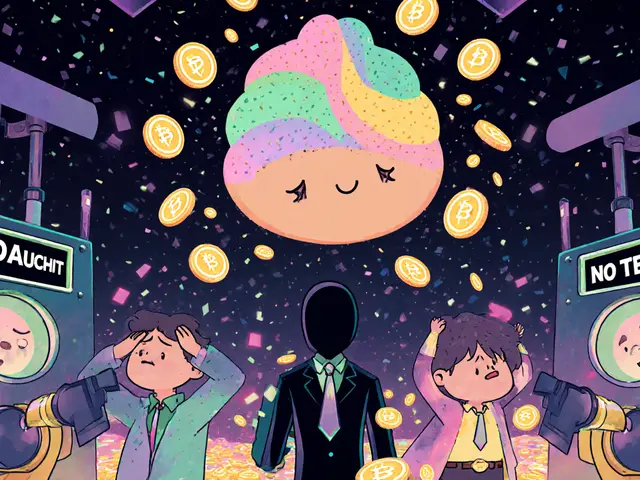

And it’s not just exchanges. Crypto airdrops, free token distributions meant to build community or launch new protocols can get shut down if even one participant is on the OFAC list. Projects like Juicebox and LifeTime didn’t fail because of bad tech—they failed because they couldn’t comply. No one wants to be the next target. That’s why compliance checklists now include OFAC screening as a non-negotiable step for any crypto business in 2025.

You might think, "I’m just a regular user," but if you hold a token tied to a sanctioned address—even by accident—you could lose access. That’s why tools like cross-chain bridges and decentralized exchanges can’t ignore OFAC. THORChain and Aerodrome Finance might let you swap tokens without a middleman, but if your wallet flag gets flagged, those swaps vanish. The same goes for stablecoins: if a stablecoin issuer doesn’t screen users, regulators shut them down fast.

And here’s the thing: OFAC doesn’t just target criminals. It can freeze wallets of people who unknowingly received tokens from a hacked address. It can ban a token because its founder once lived in a sanctioned country. It can block a DAO because one of its early contributors is listed. There’s no warning. No appeal process. Just silence—and a frozen balance.

That’s why the posts below matter. You’ll find real cases—like how Bolivia lifted its crypto ban while others tightened controls, or why ZappyPay isn’t an exchange but still got caught in the crosshairs. You’ll see how the EQ Equilibrium airdrop worked, who qualified, and why some wallets got excluded. You’ll learn how to spot fake airdrops like KCAKE and CSS that prey on people who don’t understand compliance. And you’ll see why MochiSwap and Libre Swap aren’t just risky—they’re legally dangerous if they don’t screen users.

Whether you’re trading, building, or just holding crypto, OFAC sanctions aren’t a footnote. They’re the invisible line between staying in the game and getting locked out. This collection gives you the facts—not the hype—to stay safe, legal, and in control.

OFAC Sanctions on North Korean Crypto Networks: How the U.S. Is Stopping $2.1 Billion in Cyber Theft

In 2025, OFAC crushed North Korean crypto theft networks that stole over $2.1 billion, targeting fake IT workers embedded in U.S. startups. Here's how the scheme works and what companies must do to stay safe.