MOCHI price prediction: What drives its value and where it might go next

When people ask about MOCHI, a meme-inspired cryptocurrency token with no official team or whitepaper. It’s not a project built for utility—it’s a community-driven experiment in speculation, social momentum, and viral trading. Unlike Bitcoin or Ethereum, MOCHI doesn’t solve a problem or power a network. It exists because people believe in it—sometimes for fun, sometimes for profit, rarely for logic. That makes its price movements unpredictable, but not random. What you see in charts isn’t just noise—it’s the echo of Discord chatter, TikTok trends, and whale wallets moving in sync.

MOCHI’s value doesn’t come from revenue, partnerships, or tech upgrades. It comes from meme coin trends, the pattern where tokens gain traction through online culture rather than fundamentals. Think Dogecoin in 2021 or Shiba Inu in 2022. When a token goes viral, its price can spike 500% in a day—and drop 80% the next. MOCHI follows that same playbook. Its supply, distribution, and trading volume are public, but none of that matters as much as what’s trending on Twitter or Reddit right now. The crypto price forecast, the attempt to predict future token values using historical data and sentiment for MOCHI is mostly guesswork. Analysts use technical indicators, but those work best on assets with real usage. For MOCHI, the only reliable signal is community energy.

Most MOCHI price predictions you find online are either recycled hype or AI-generated fluff. Real traders don’t rely on them. They watch wallet activity: are big holders dumping? Is new liquidity being added? Is there a coordinated push on social media? The token’s history shows spikes after influencer mentions or when it gets listed on smaller exchanges with low trading barriers. But those gains rarely last. If you’re looking at MOCHI as a long-term investment, you’re betting on luck, not logic. If you’re trading it, you’re playing a game of timing and nerves.

What you’ll find in the posts below aren’t magical forecasts. They’re real examples of how tokens like MOCHI behave—when they rise, when they crash, and why most people lose money chasing them. You’ll see case studies of similar meme coins, breakdowns of fake hype cycles, and warnings about scams disguised as "next big thing" tokens. No one can tell you exactly where MOCHI will be in 30 days. But you can learn how to spot the signs before it’s too late.

MochiSwap Crypto Exchange Review: What You Need to Know Before Trading MOCHI

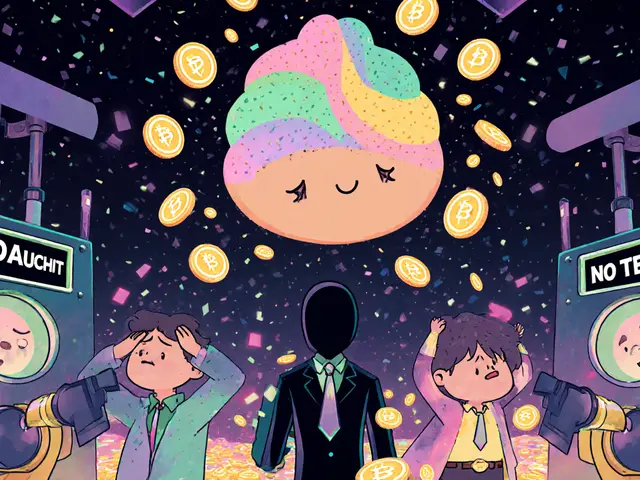

MochiSwap isn't a traditional crypto exchange-it's a speculative DeFi token with no team, no audits, and wild price swings. Learn where to trade MOCHI, why experts disagree on its future, and safer alternatives.