MKR Token: What It Is, How It Works, and Why It Matters in DeFi

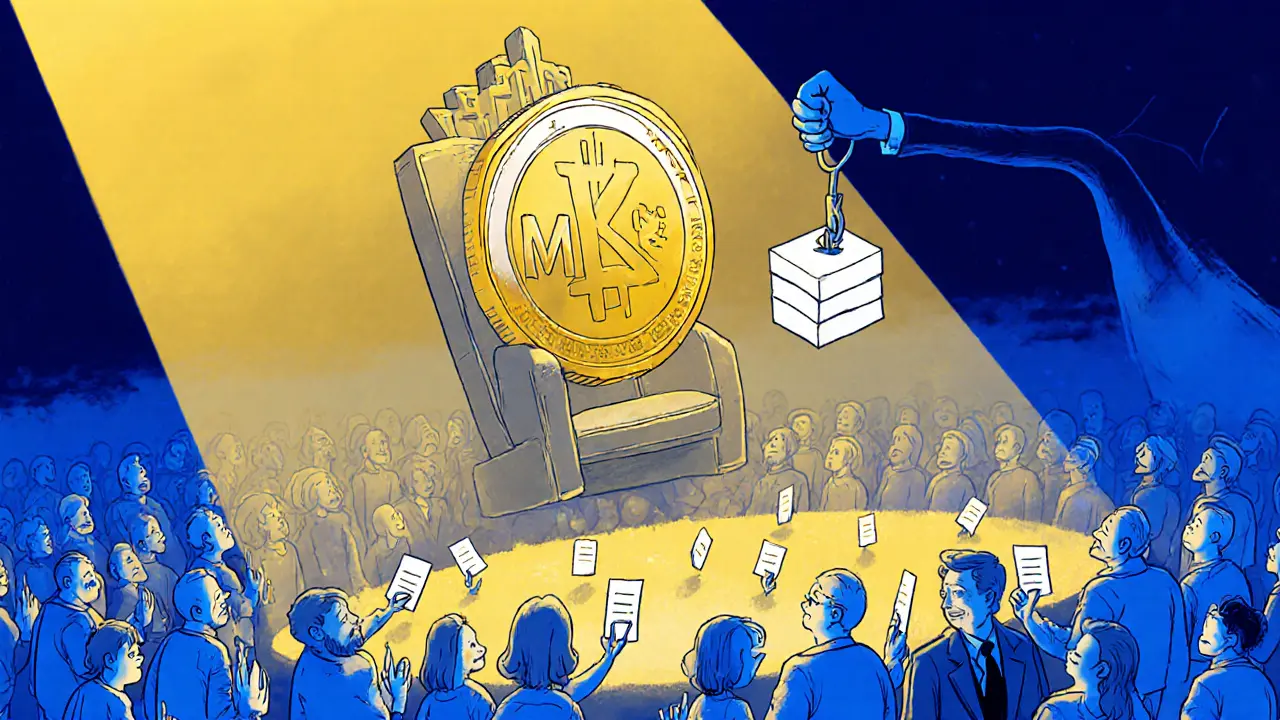

When you hear about MKR token, the governance token of MakerDAO, the decentralized system that issues the Dai stablecoin. Also known as Maker token, it doesn’t store value like Bitcoin—it gives holders the power to vote on changes to the entire Dai ecosystem. Unlike most crypto projects, MakerDAO doesn’t have a CEO or a team making decisions behind closed doors. Instead, anyone who holds MKR can propose and vote on upgrades, risk settings, and fee adjustments. This makes MKR one of the earliest and most real-world examples of blockchain-based democracy in action.

Behind MKR is Dai, a decentralized stablecoin pegged to the US dollar. Unlike centralized stablecoins like USDT or USDC, Dai isn’t backed by a bank—it’s created when users lock up crypto like ETH as collateral in smart contracts called Collateralized Debt Positions (CDPs). If the value of that collateral drops too low, the system automatically sells it off to keep Dai stable. MKR token holders are the ones who decide what types of assets can be used as collateral, how much collateral is needed, and what interest rates borrowers pay. They’re essentially the engineers of a financial system that runs without banks. This system has survived multiple crypto crashes, including the 2020 Black Thursday crash and the 2022 Terra collapse, because MKR holders adjusted parameters in real time to protect Dai’s peg. That’s why Dai is still one of the most trusted stablecoins in DeFi, even after more than seven years.

But MKR isn’t just about stability—it’s about control. If you own MKR, you’re not just a holder—you’re a participant in a global financial experiment. You can vote to add new collateral types like real estate tokens, change the stability fee, or even shut down the entire system if something goes wrong. That’s powerful. And it’s why MKR is often grouped with other DeFi governance tokens, tokens that give users voting rights over decentralized protocols, like AAVE or COMP. But MKR is different. It’s older. It’s battle-tested. And it’s still running.

There’s no hype around MKR like there is with new memecoins. No influencers pushing it. No flashy ads. That’s because its value isn’t in speculation—it’s in utility. The token’s price moves based on how well the MakerDAO system is performing. If more people use Dai, if the system stays stable, if governance works smoothly, MKR becomes more valuable. If things break, MKR holders absorb the losses by burning their own tokens to cover deficits. That’s the design. That’s the risk. And that’s why it still matters.

Below, you’ll find real-world breakdowns of how MKR fits into DeFi, how it compares to other governance models, and what happens when things go wrong. You’ll see how it connects to other systems like cross-chain bridges, stablecoin risks, and DeFi security flaws—all things that affect MKR’s ecosystem. This isn’t a theory page. It’s a practical look at the token that helped build the foundation of decentralized finance—and still holds it together today.

Understanding Governance Token Value in Decentralized Finance

Governance tokens let holders vote on blockchain protocol decisions, but their value is often speculative. Learn how they work, who controls them, and how to turn voting power into real influence.