Leverage Management in Crypto: How to Avoid Liquidation and Protect Your Trades

When you trade crypto with leverage, a tool that lets you control a larger position using borrowed funds. Also known as margin trading, it can turn small price moves into big profits—but it’s also the fastest way to lose everything if you don’t know what you’re doing. Most beginners think leverage is a shortcut to wealth. It’s not. It’s a double-edged sword that cuts both ways, and the edge that cuts you is often sharper than the one that cuts the market.

Liquidation risk, the moment your position is automatically closed because your collateral dropped too low isn’t some rare glitch—it’s built into every leveraged trade. On platforms like Binance, Bybit, or even DeFi protocols like Aave, you can get liquidated in seconds if the market moves just 5% against you. And it’s not just about the size of your trade. It’s about how you manage your position, where you set your stop-loss, and whether you’re trading on a 10x or 50x leverage. The difference between surviving and getting wiped out isn’t luck—it’s discipline.

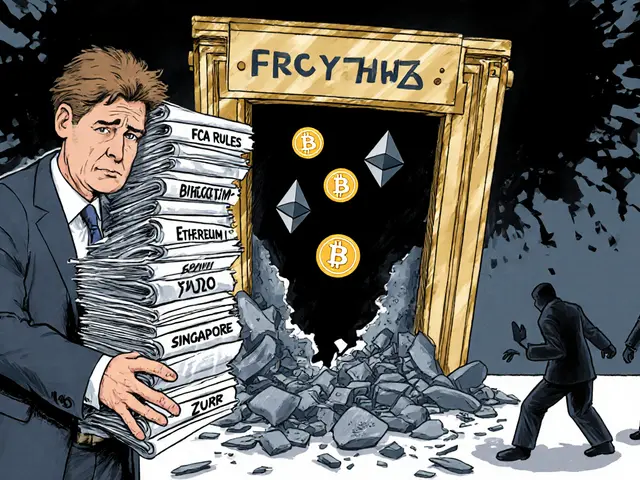

DeFi leverage, lending protocols that let you borrow crypto to amplify your position without a central exchange adds another layer of complexity. No customer support. No warning. No second chances. If your collateral falls below the threshold, your position vanishes. And unlike centralized exchanges, you can’t call someone to ask for help. You have to know the math, the fees, and the liquidation triggers before you even click "open position."

What you’ll find in these posts isn’t theory. It’s real-world examples of traders who used leverage the right way—and those who lost everything because they ignored basic rules. You’ll see how cross-chain bridges became targets for hackers because traders over-leveraged their positions. You’ll learn why some DeFi tokens like vBNB and RUNE are used as collateral, and why that matters when markets crash. You’ll understand how North Korean hackers used leverage to amplify stolen funds, and how compliance tools help exchanges prevent reckless trading. This isn’t about getting rich quick. It’s about staying in the game long enough to make smart moves.

Levers amplify everything—your wins, your losses, your mistakes. The goal isn’t to use the highest leverage possible. It’s to use the least amount needed to reach your goal. That’s leverage management. And if you’re trading crypto without it, you’re not trading—you’re gambling with someone else’s money.

Managing Leverage Effectively in Blockchain and Business

Managing leverage effectively means using borrowed capital, automation, and strategic strengths to amplify results-without risking everything. Learn how blockchain projects, traders, and founders can use leverage safely and sustainably.