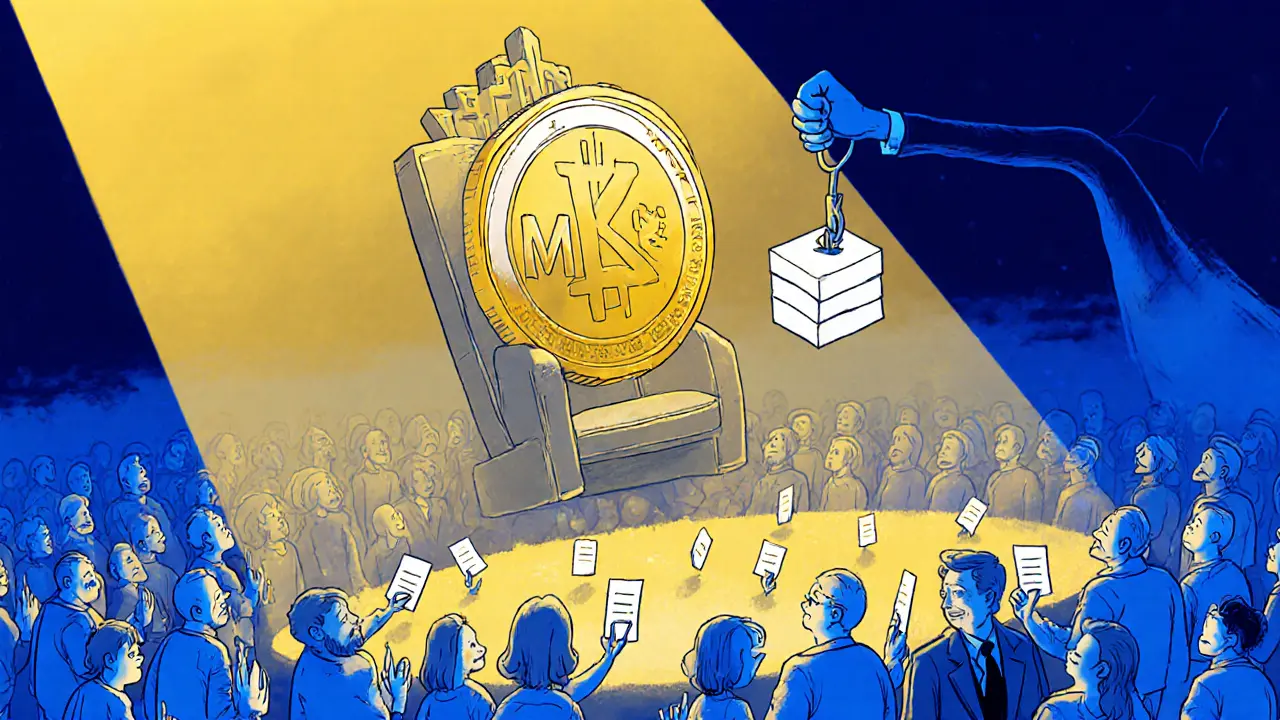

DAO Voting: How Decentralized Governance Works and Why It Matters

When you hold tokens in a DAO, a decentralized autonomous organization where decisions are made by token holders, not CEOs or boards. Also known as blockchain governance, it lets people vote on everything from treasury spending to protocol upgrades using their tokens as votes. This isn’t theory—it’s happening right now in DeFi, NFT communities, and even public infrastructure projects. But most people don’t understand how it actually works, or why some DAOs succeed while others collapse after a single vote.

DAO voting relies on smart contracts, self-executing code that automatically enforces rules without human interference. These contracts define who can vote, how many tokens are needed, and what happens when a proposal passes or fails. If a proposal gets enough support, the code executes it—like releasing funds, changing fees, or updating the protocol. No middleman. No delays. But this also means bad proposals can’t be stopped once they’re live. That’s why voting participation matters more than you think. A DAO with 5% turnout is just as vulnerable to manipulation as a centralized company.

Real DAOs like MakerDAO, Uniswap, and Aragon have shown that crypto voting, the process of casting votes using digital tokens on a blockchain. It’s not just about owning tokens—it’s about showing up. When users don’t vote, whales and bots fill the gap. We’ve seen DAOs get hijacked by single wallets holding 10% of tokens. Others collapsed because voters didn’t understand the consequences of their choices. That’s why reading proposals isn’t optional—it’s survival. You’re not just voting on code. You’re voting on who gets paid, what features get built, and whether your tokens keep value.

The posts below show you exactly how DAO voting plays out in the wild. You’ll see real examples of successful votes, failed proposals, and outright scams disguised as governance. Some posts dig into how voting power is distributed across wallets. Others break down why certain DAOs require lock-ups or delegation to prevent manipulation. You’ll also find cases where voting didn’t happen at all—and what that meant for users. This isn’t about theory. It’s about protecting your assets in a system where your vote is your only shield.

Understanding Governance Token Value in Decentralized Finance

Governance tokens let holders vote on blockchain protocol decisions, but their value is often speculative. Learn how they work, who controls them, and how to turn voting power into real influence.

Categories

Popular Articles