Crypto Restrictions UK: What’s Banned, What’s Legal, and How to Stay Compliant

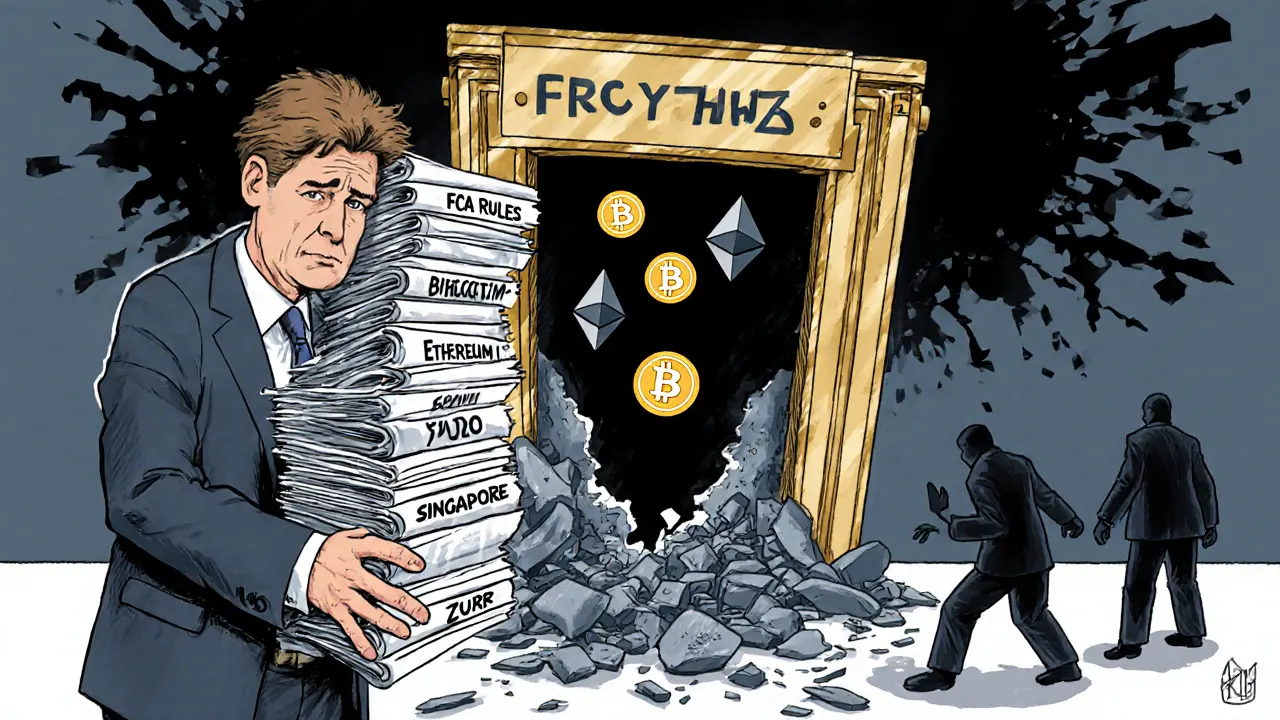

When it comes to crypto restrictions UK, the rules set by the UK Financial Conduct Authority that limit how crypto can be marketed, traded, and used by consumers. Also known as UK crypto regulations, these rules don’t outlaw cryptocurrency—but they do shut down shady players and force platforms to play by strict new standards. If you’re trading, investing, or just holding crypto in the UK, you need to know where the line is. The FCA doesn’t want you to lose money to scams, pump-and-dumps, or unlicensed platforms. That’s why they’ve banned crypto derivatives for retail investors, blocked unregistered exchanges from advertising, and forced firms to register under AML rules. It’s not about stopping crypto—it’s about stopping bad actors.

Related to this are FCA crypto rules, the specific guidelines issued by the UK’s financial watchdog that require crypto businesses to verify users, report suspicious activity, and keep clear records. These rules apply to any company offering crypto services to UK residents, whether it’s an exchange, wallet provider, or staking platform. Then there’s crypto exchanges UK, the platforms that operate legally under FCA oversight, like Coinbase, Kraken, and Bitstamp. These are the only ones you can trust to follow KYC, protect your funds, and report taxes correctly. On the flip side, platforms like Binance (before its UK license) and KuCoin were blocked from marketing to UK users because they refused to comply. If you’re using a platform that doesn’t mention the FCA, you’re likely in the gray—or red—zone.

And let’s not forget crypto tax UK, the requirement that every crypto trade, sale, or even gift must be reported to HMRC. Whether you swapped ETH for SOL, sold BTC for pounds, or earned interest on a DeFi platform, you owe tax on the gain. HMRC doesn’t care if you used a no-KYC exchange—if you made a profit, it’s taxable. Many people get tripped up thinking crypto is anonymous, but the FCA and HMRC now share data with exchanges, and they’re getting better at tracing on-chain activity. Ignoring this isn’t clever—it’s risky.

These rules aren’t going away. The UK is moving toward a clearer legal framework, not away from it. What you’ll find in the posts below are real examples of what happens when people ignore these boundaries: exchanges that collapsed because they weren’t licensed, airdrops that turned out to be scams targeting UK wallets, and DeFi platforms that got flagged for operating without proper compliance. You’ll also see how traders in the UK are adapting—using P2P platforms, sticking to FCA-approved exchanges, and keeping detailed records to avoid tax trouble. This isn’t about fear. It’s about staying in control. The crypto world doesn’t need you to break the rules to win. It just needs you to know them.

UK Crypto Hub Ambitions: Regulations, Restrictions, and Realities in 2025

The UK aims to be a global crypto hub with strict regulations to protect consumers, but political shifts and slow implementation are undermining its ambitions. Learn what's allowed, what's banned, and where the UK stands in 2025.