Crypto Payment Processor: How They Work and Which Ones Actually Matter

When you hear crypto payment processor, a service that lets businesses accept cryptocurrency as payment by converting it to fiat or holding it on-chain. Also known as a crypto merchant gateway, it acts like a digital cash register for Bitcoin, Ethereum, and other coins—no bank needed. It’s not magic. It’s software that connects your store to a blockchain, handles wallet addresses, locks in prices at checkout, and either pays you in dollars or keeps the crypto. Simple. But most people don’t realize how many of these services have vanished—or how few still work reliably in 2025.

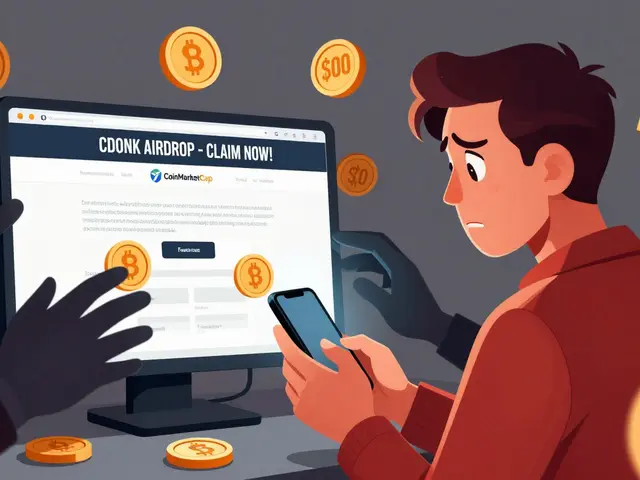

Behind every working crypto payment gateway, a system that enables merchants to receive and manage cryptocurrency payments securely is a real team, real audits, and real liquidity. Many so-called processors from 2021-2022 are dead. Their websites are gone. Their tokens are worthless. You can’t trust a processor that doesn’t name its founders, hasn’t been audited, or asks you to send funds to a wallet they control. The good ones? They don’t hold your money. They just facilitate the swap. Think of them like a toll booth for crypto: they let it pass, but they don’t keep it.

Real blockchain payments, transactions settled directly on a public ledger without intermediaries need speed, low fees, and clear settlement rules. That’s why some processors use Layer 2 networks like Lightning or Base—because waiting 10 minutes for a Bitcoin confirmation kills sales. Others integrate with stablecoins like USDC so merchants don’t get wrecked by price swings. And yes, compliance matters. If you’re a business, you need to know if the processor follows AML/KYC rules in your country. In the U.S., that means registering with FinCEN. In Europe, it means following MiCA. Skip this, and you’re not just risking fines—you’re risking your entire operation.

What you’ll find below isn’t a list of hype. It’s a collection of real cases—some working, some failed, some outright scams. You’ll see how Juicebox tried to fund crypto projects but collapsed. How Arbidex promised arbitrage but vanished. How MochiSwap and Libre Swap looked like exchanges but had no volume, no team, and no future. These aren’t random stories. They’re warnings. Every crypto payment processor that disappeared left merchants holding bags of worthless tokens or frozen funds. The ones still standing? They’re the ones that kept it simple: secure, transparent, and focused on actual use—not speculation.

Whether you’re a small shop owner, a freelancer, or running an online store, accepting crypto shouldn’t mean gambling with your cash flow. The right processor gives you control. It doesn’t lock your funds. It doesn’t promise 500% returns. It just makes payments work. Below, you’ll find deep dives into exactly what went wrong—and what still works—in the messy, fast-moving world of crypto payments. No fluff. Just facts. And the tools you can actually trust in 2025.

Zappy Crypto Exchange Review: Why It Doesn't Exist and What ZappyPay Actually Is

There is no such thing as Zappy crypto exchange. ZappyPay is a payment processor, not a trading platform. Learn the difference, avoid scams, and find real exchanges to trade crypto safely in 2025.