Crypto Governance: How Decisions Are Made in Blockchain Networks

When you hear crypto governance, the system by which blockchain communities make collective decisions without central authorities. Also known as blockchain governance, it’s what keeps networks like Bitcoin and Ethereum alive when they face upgrades, security threats, or funding debates. Unlike banks or corporations, no CEO makes the call. Instead, it’s developers, node operators, miners, and token holders—often thousands of strangers—who vote on changes using code, not meetings.

This isn’t just theory. It’s happening right now. DAOs, decentralized autonomous organizations that run on smart contracts and token-based voting. Also known as decentralized organizations, they’re the engines behind crypto governance. Projects like Arbidex and Libre Swap failed because they had no real governance—no one could agree on next steps, so they just died. Meanwhile, THORChain and Aerodrome Finance survive because their token holders actively vote on fee structures, treasury spending, and even which chains to support. Your $BUSD airdrop eligibility? That’s governed too—by rules written into code and approved by the community.

Token voting is the most common tool, but it’s not perfect. Big holders can dominate votes, and most people don’t even bother showing up. That’s why some chains, like Taraxa, are testing hybrid models: on-chain votes for technical changes, off-chain forums for big-picture direction. And when things go wrong—like cross-chain bridge hacks or stolen funds—the governance system has to decide: do we hard fork? Do we refund victims? Do we punish the devs? These aren’t hypotheticals. They’ve happened. North Korea’s Lazarus Group stole billions because they exploited weak governance in poorly monitored bridges. Meanwhile, the UAE’s removal from the FATF grey list happened because its regulators forced crypto projects to adopt clear governance rules before they could operate legally.

What you’ll find below isn’t a textbook. It’s real cases. Posts about how MochiSwap collapsed without any community oversight, how FTX Turkey ignored governance entirely and got shut down, and why LifeTime and BIZZCOIN are dead tokens with no one left to vote on their fate. You’ll see how crypto compliance checklists now include governance frameworks, how UK regulators demand transparent voting logs, and why even airdrops like KCAKE and CELT are scams when there’s no governance to back them up. This is the hidden system that decides whether your crypto lives or dies. Know how it works—or get left behind.

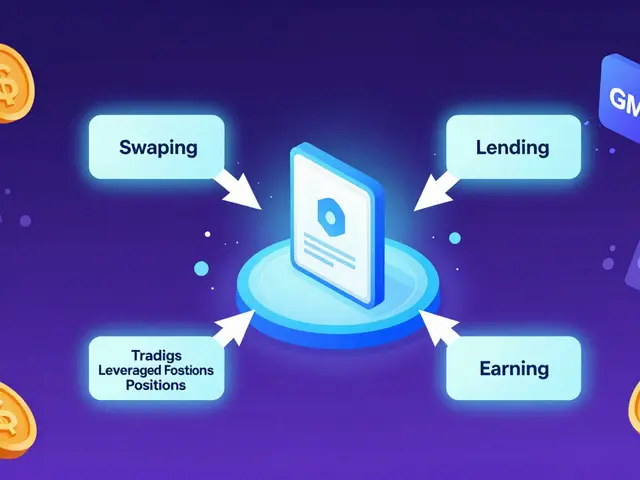

Understanding Governance Token Value in Decentralized Finance

Governance tokens let holders vote on blockchain protocol decisions, but their value is often speculative. Learn how they work, who controls them, and how to turn voting power into real influence.