Crypto Arbitrage Platform: How It Works and What You Need to Know

When you use a crypto arbitrage platform, a tool that automatically finds and exploits price differences for the same cryptocurrency across different exchanges. Also known as arbitrage trading bot, it doesn’t create value—it just moves money from where it’s cheaper to where it’s more expensive, pocketing the spread. This isn’t magic. It’s math. And it only works if you move fast, pay low fees, and avoid exchanges that freeze withdrawals.

Most people think arbitrage is easy money. It’s not. The price gap between Binance and KuCoin for ETH might be 0.5%—but after withdrawal fees, network costs, and slippage, you’re left with 0.1%. That’s why successful traders use crypto exchange differences, variations in liquidity, trading volume, and withdrawal speeds across platforms to their advantage. Some exchanges have deep order books but slow withdrawals. Others move fast but charge high trading fees. A good arbitrage platform, a system designed to detect and execute trades across multiple exchanges automatically balances all this. It doesn’t just spot the gap—it calculates whether the trade is even worth making after costs.

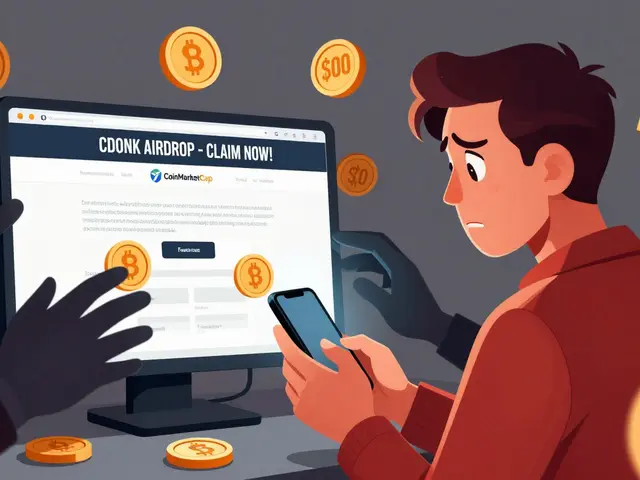

You’ll find plenty of tools promising 10% daily returns. They’re either scams or backtested fantasies. Real arbitrage happens in milliseconds. It requires direct API access, low-latency servers, and coins with enough volume to move without crushing the price. That’s why most of the posts here focus on the real stuff: exchange reviews that reveal hidden fees, blockchain liquidity issues that slow down trades, and security risks in cross-chain transfers that can wipe out your profit before you even cash out. You won’t find a single post here that sells you a "guaranteed arbitrage bot." Instead, you’ll see how THORChain enables native swaps without wraps, why MochiSwap is too risky to trust, and how Binance’s ban in India created arbitrage opportunities for those who moved fast.

There’s no silver bullet. But if you understand how exchanges operate, where liquidity pools are thin, and which chains have real trading volume, you can spot opportunities others miss. The best arbitrage isn’t automated—it’s informed. And that’s what this collection is for: cutting through the hype to show you what actually works, what blows up, and why.

Arbidex Crypto Exchange Review: Does This Arbitrage Platform Still Work in 2025?

Arbidex promised automated crypto arbitrage across exchanges in 2018, but it required users to surrender custody of funds. Today, the platform is inactive, its ARX token is nearly worthless, and the model has been rendered obsolete by decentralized alternatives.

Categories

Popular Articles