Base Network: What It Is, Why It Matters, and What’s Happening on It

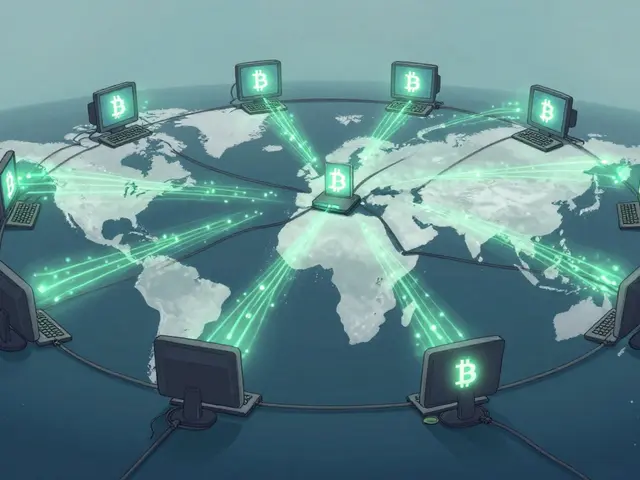

When people talk about Base network, a low-fee Ethereum layer-2 blockchain backed by Coinbase. Also known as Base chain, it was built to make crypto trading and DeFi simple, cheap, and fast—without sacrificing security. Unlike other chains that chase hype, Base focuses on real usage: people swapping tokens, earning yield, and using apps without paying $50 in gas fees. It’s not just another L2—it’s one of the few that actually got adoption because it works for everyday users, not just speculators.

What makes Base different? It’s not flashy, but it’s reliable. It uses Ethereum’s security while cutting costs by batching transactions off-chain. That’s why Aerodrome Finance, the leading decentralized exchange on Base thrives here—traders get low slippage and high liquidity without the chaos of other chains. And the AERO token, the governance and reward token for Aerodrome isn’t just a speculative gamble—it’s tied directly to trading volume and user activity on Base. This isn’t theory. It’s real incentives driving real behavior.

Base doesn’t have a hundred useless tokens. It has tools people actually use. You’ll find DeFi protocols that pay real yields, bridges that work without constant hacks, and wallets that connect smoothly. It’s not the biggest chain, but it’s one of the cleanest. And that’s why traders who’ve been burned by broken L2s are quietly moving here. If you’ve ever waited 10 minutes for a swap to confirm or lost money to a failed bridge, Base is the quiet alternative you’ve been ignoring.

Below, you’ll find honest reviews, deep dives, and real-world breakdowns of what’s working—and what’s not—on Base. No fluff. No promises of moonshots. Just what’s happening on the chain, who’s using it, and why it’s becoming the quiet powerhouse of DeFi.

Uniswap v2 on Base: A Simple, Reliable Crypto Exchange for Everyday Traders

Uniswap v2 on Base offers a simple, low-cost way to trade crypto without intermediaries. With low fees, wide token support, and no KYC, it’s ideal for self-custody traders - but requires crypto knowledge and carries risks.

Categories

Popular Articles