Stablecoin UK: What You Need to Know About Stablecoins in the UK

When you hear stablecoin, a cryptocurrency designed to hold a steady value, usually tied to a fiat currency like the British pound or US dollar. Also known as pegged coin, it lets you trade crypto without riding wild price swings. In the UK, stablecoins aren’t just for speculators—they’re used for everyday payments, remittances, and as a bridge between traditional banking and DeFi. If you’re holding or trading crypto here, you’re likely already using one, even if you didn’t realize it.

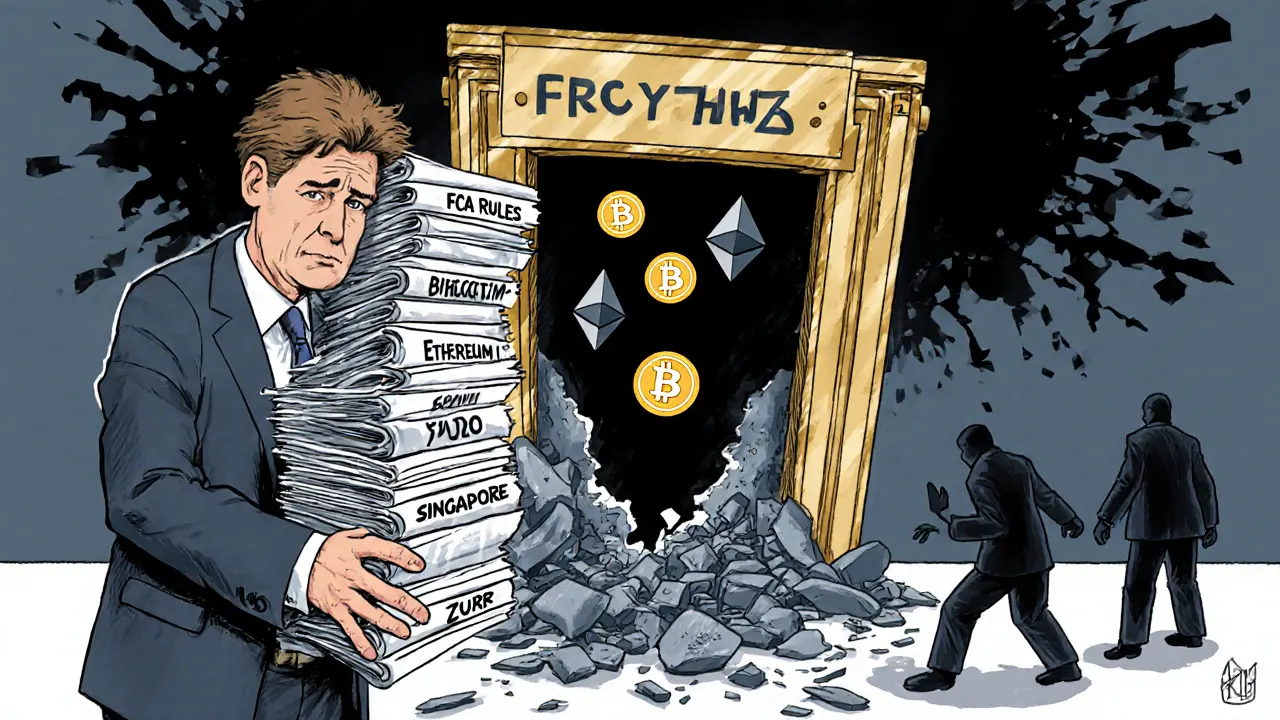

The UK doesn’t ban stablecoins, but it’s getting serious about who can issue them. The Financial Conduct Authority (FCA) now requires stablecoin issuers to be authorized, meaning only those meeting strict reserve and audit rules can operate legally. That’s why GBP stablecoin, a stablecoin pegged directly to the British pound is gaining traction—users want digital money that’s as reliable as cash in their wallet. Meanwhile, USDT UK, the UK version of Tether, the world’s largest stablecoin is still widely used, but it’s under more scrutiny than ever. Not all stablecoins are equal. Some claim to be backed 1:1 with cash, but their audits are hidden or outdated. Others are backed by risky assets like commercial paper. In the UK, you need to know the difference before you deposit.

Stablecoin exchanges in the UK are also changing. Platforms like CoinDCX and WazirX now offer GBP deposits and withdrawals, making it easier to move money in and out of crypto without high fees or delays. But if you’re using a non-UK exchange, you might be risking your funds. The FCA has warned users against unregistered platforms that don’t follow anti-money laundering rules. And while some people use stablecoins to bypass banking restrictions, that’s not always safe—your wallet could get frozen, or worse, your coins could vanish if the platform collapses.

There’s also the question of taxes. HMRC treats stablecoins like any other crypto asset. Selling, trading, or even spending them can trigger a taxable event. If you bought USDT with GBP and later used it to buy Bitcoin, you might owe capital gains tax. Keeping clear records isn’t optional—it’s required.

What you’ll find below isn’t a list of the best stablecoins. It’s a collection of real stories, warnings, and breakdowns from people who’ve been burned, confused, or misled. You’ll see how one UK trader lost money on a fake GBP-backed stablecoin. You’ll learn why a popular DeFi platform got flagged by regulators. You’ll find out which exchanges are actually licensed to operate here—and which ones you should avoid. This isn’t theory. These are the mistakes real people made in the UK crypto space, and how you can avoid them.

UK Crypto Hub Ambitions: Regulations, Restrictions, and Realities in 2025

The UK aims to be a global crypto hub with strict regulations to protect consumers, but political shifts and slow implementation are undermining its ambitions. Learn what's allowed, what's banned, and where the UK stands in 2025.