DLT Explained: What It Is, How It's Used, and Why It Matters in Crypto

When you hear DLT, Distributed Ledger Technology is a system where data is stored across multiple computers instead of one central server, making it tamper-resistant and transparent. Also known as blockchain, it’s the backbone of Bitcoin, DeFi apps, and even insurance platforms that cut claim times from weeks to minutes. But DLT isn’t just blockchain — it’s the broader category that includes any network where transactions are recorded and verified by multiple parties without a middleman.

DLT enables decentralized systems, networks that operate without a single controlling entity, relying instead on consensus among participants to validate changes. That’s why platforms like THORChain can swap BTC for ETH without wrapping tokens — they use DLT to let users trade native assets directly. It’s also why companies like insurance firms are using DLT to lock in claim details on an immutable ledger, reducing fraud and speeding up payouts. And when exchanges like Binance get blocked in India, it’s because regulators are trying to control systems that don’t answer to any single government or bank.

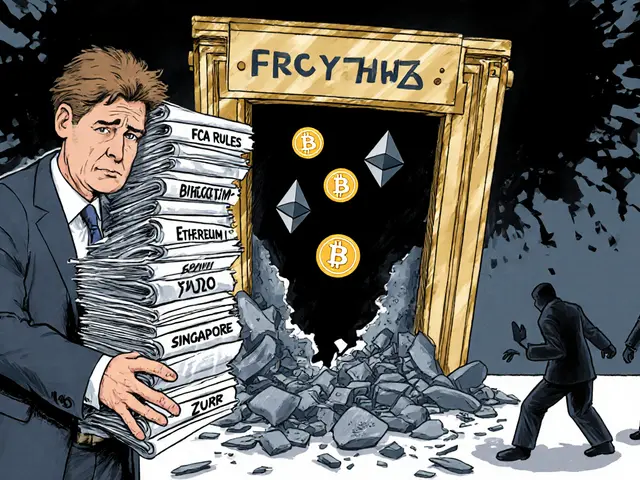

DLT doesn’t just store data — it changes how trust works. In traditional finance, you trust a bank to keep your records straight. With DLT, you trust the code, the network, and the math. That’s why crypto regulation, the set of rules governments apply to digital asset platforms to prevent money laundering, tax evasion, and fraud is so tricky. You can’t regulate a system that has no headquarters, no CEO, and no central server. That’s why the UAE’s removal from the FATF grey list mattered — it wasn’t about banning crypto, it was about forcing DLT projects to meet global compliance standards while still staying decentralized.

Some DLT projects, like Taraxa, are built for real business use — tracking supply chains and handshake deals with speed and low cost. Others, like Arbidex or Libre Swap, promised automated trading but failed because they didn’t solve real problems or left users in control of their funds. And then there are governance tokens, where voting power on a DLT network is tied to token ownership — turning users into stakeholders, not just customers.

DLT is everywhere in crypto — from the peer-to-peer network running Bitcoin to the smart contracts powering Venus BNB. But not all DLT is equal. Some are open, public, and permissionless. Others are private, controlled, and barely used. The difference matters if you’re trading, investing, or just trying to protect your money from hacks and scams.

Below, you’ll find real-world breakdowns of DLT in action — from how North Korea steals crypto using decentralized networks, to why a dead token like LifeTime (LFT) still teaches us something about trust in crypto. You’ll see which exchanges use DLT properly, which ones don’t, and how compliance, security, and innovation clash in the real world of blockchain.

How Distributed Ledger Technology is Transforming Supply Chain Management

Distributed Ledger Technology is revolutionizing supply chains by enabling real-time traceability, reducing fraud, and cutting administrative costs. From pharmaceuticals to food, companies are using DLT to build transparent, secure, and efficient global networks.