DeFi Explained: What It Is, How It Works, and What You Need to Know

When you hear DeFi, short for decentralized finance, it means financial services built on public blockchains without banks or middlemen. Also known as open finance, it lets you lend, borrow, trade, and earn interest—all through code, not a customer service rep. This isn’t theory. People use it daily to swap tokens, lock up crypto for rewards, or vote on protocol changes—all without handing over their keys to a company.

At the heart of DeFi are smart contracts, self-executing programs on blockchains that automatically run when conditions are met. These are what make things like automated lending pools or instant swaps possible. Without them, DeFi wouldn’t exist. Then there’s governance tokens, crypto assets that give holders voting power over how a protocol evolves. Tokens like AERO or MKR don’t just have value because people trade them—they have value because people decide the rules. And let’s not forget cross-chain tools, like THORChain, a system that lets you swap Bitcoin for Ethereum without wrapping or trusting a third party. These aren’t gimmicks—they’re the plumbing behind the scenes that make DeFi actually work across different networks.

But DeFi isn’t all high yields and smooth swaps. Many platforms, like Libre Swap or MochiSwap, have no team, no audits, and zero real usage. Others, like Arbidex, promised automation but asked users to give up control of their funds—and then vanished. The same goes for governance tokens that look powerful on paper but are controlled by just a few wallets. Real DeFi isn’t about chasing the next 1000% gain. It’s about understanding who controls the code, whether the smart contracts have been checked by experts, and if the protocol actually solves a problem—or just pretends to.

What you’ll find here isn’t hype. It’s the real stories: how cross-chain bridges get hacked, why some tokens are dead before launch, how insurance claims are now processed in minutes using blockchain, and which exchanges actually work on Base or Ethereum. You’ll see what works, what’s a scam, and what’s just noise. No fluff. No promises. Just what’s happening in DeFi right now—and what you should actually pay attention to.

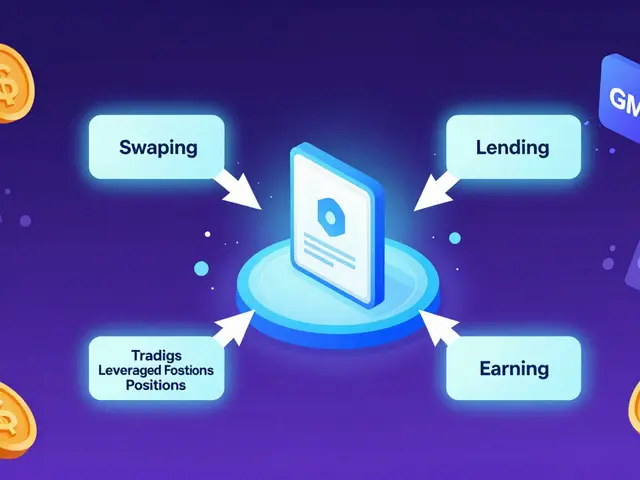

SmarDex Crypto Exchange Review: The Rise of the Everything Protocol

SmarDex is transforming from a simple AMM into the Everything Protocol-a unified DeFi platform combining swaps, lending, and leveraged trading. This review breaks down its tech, risks, and potential to reshape decentralized finance.

What is Venus BNB (vBNB) Crypto Coin? A Simple Breakdown of How It Works

Venus BNB (vBNB) is a token you receive when you deposit BNB into the Venus Protocol on BNB Chain. It earns interest over time and can be used as collateral to borrow other crypto assets. Learn how it works, its risks, and who it’s really for.