CELT Distribution: What It Is, How It Works, and Why It Matters

When you hear CELT distribution, the way the CELT token is allocated across wallets, teams, and public sales. It's not just about who gets tokens—it's about how those tokens move, who controls them, and whether the system stays fair over time. Many crypto projects fail because their token distribution is lopsided, giving too much to insiders or early investors. CELT distribution tries to avoid that trap by spreading tokens across users, liquidity providers, and long-term stakeholders. Without a balanced approach, even the best tech can collapse under pressure from whales dumping their holdings.

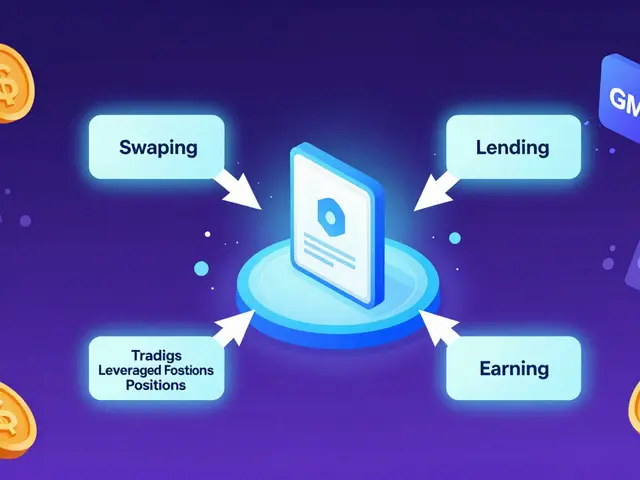

CELT distribution relates directly to tokenomics, the economic design behind a crypto asset, including supply limits, unlocking schedules, and reward structures. If 40% of CELT is locked for two years and only 10% goes to public airdrops, that tells you the project values patience over hype. Compare that to projects where 70% of tokens are released at launch—those often crash fast. You’ll also see blockchain distribution, how tokens are spread across different chains or networks to increase accessibility and reduce centralization risks in posts below. Some projects tie CELT to Ethereum, others to BNB Chain or Solana. Where it lives affects who can use it and how easily.

CELT distribution doesn’t happen in a vacuum. It’s shaped by airdrop eligibility, the rules that determine who qualifies for free tokens based on past activity, wallet holdings, or community participation. If you held a certain token in 2023, or staked on a specific platform, you might have qualified for CELT. That’s not random—it’s a strategy to reward early supporters and build a loyal user base. But scams copy this pattern. Real airdrops never ask for your private key. You’ll find real examples in the posts below, showing who got CELT, how they earned it, and what happened after.

What you’ll find here isn’t theory. These are real cases: projects that got distribution right, ones that failed, and others that turned token allocation into a tool for growth. You’ll see how CELT compares to TARA, MOCHI, and other tokens with similar goals. You’ll learn how to check if a distribution is fair—or if it’s just a front for insiders to cash out. No fluff. No promises. Just what’s real, what’s risky, and what you should watch for next.

CELT Airdrop Details: What Really Happened with Celestial Token Distribution

Celestial (CELT) never had a public airdrop. Tokens went only to private investors, and the project collapsed after launch. Learn what really happened to CELT and why you should avoid it.